State economist says income-tax receipts exceeded expectations; corporate collections flagged as volatile

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

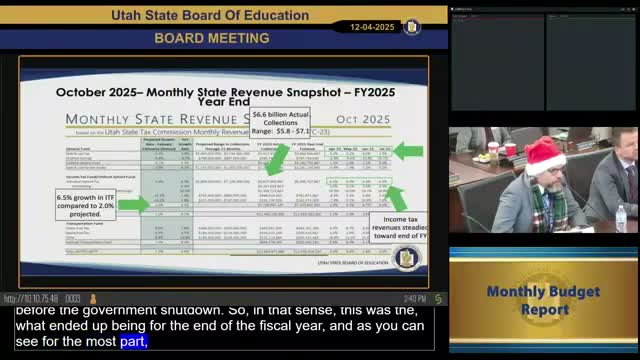

Economist Nestor Rodriguez told the board that income-tax receipts grew about 6.5% versus a 2% projection and that corporate-tax collections fell sharply in early fiscal-year reports; he recommended follow-up with the tax commission as federal reporting disruptions persist.

Nestor Rodriguez, state economist, told the Financial Operations board during agenda item 13 that most revenue indicators were steady and that income-tax receipts came in above projections.

Rodriguez said the TC '23 revenue summary showed the income tax fund collected about 6,600,000,000 and recorded roughly 6.5% growth compared with a 2% projection. He described corporate taxes as more volatile and warned that corporate collections dropped early in the new fiscal year, recommending the board follow up with the tax commission to understand drivers of the decline.

Rodriguez read highlights from the TC '23 summary saying corporate collections ‘‘shrunk by 56.2%’’ for the same comparison period and suggested part of that change may reflect recent federal tax-policy changes (he referenced HR1 in his summary) and the inherent volatility in corporate filings. He cautioned that first-release revenue snapshots can change and are not necessarily predictive of the remainder of the fiscal year.

On broader economic indicators, Rodriguez said second-quarter GDP estimates were revised upward in the latest release but noted those releases preceded the federal government shutdown, which has delayed some data. He also described mixed labor-market signals: a private payroll report showed a loss while another report showed 119,000 jobs added and a decline in jobless claims.

Rodriguez said more comprehensive data will be available in January — including additional TC '23 releases and the state economic council forecasts — and offered to return with updated analysis after staff digest the governor’s recently released budget. ‘‘We’re seeing steady income-tax revenues, but corporate collections are an item to watch,’’ he said.

The board had a brief exchange with Member Davis, who joked about Rodriguez ‘‘wearing a Santa hat’’ because of relatively good news; Rodriguez reiterated caution and noted uncertainty tied to federal tax-policy changes. No formal action or vote followed the update.