Agency details HR 1 SNAP changes: higher state administrative costs, work rules and utility deductions reshaped benefits

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Agency officials described how HR 1 (enacted July 4, 2025) changed SNAP administration: states will bear a larger share of administrative costs, payment-error rates now carry greater financial liability, exemptions and work requirements were altered, and utility allowances were revised, affecting benefit amounts for some households.

State human services officials briefed the House Human Services Committee on policy changes required by HR 1 that affect Supplemental Nutrition Assistance Program administration and household benefits.

Miranda Gray, deputy commissioner for the Economic Services Division, and Leslie Wisdom, food and nutrition program director, said HR 1 imposes significant operational changes and budgetary consequences. "As a state, we've really been trying to make sure that we're complying with the federal law because it has such significant impacts to those that are on SNAP," Gray said.

Key changes described to the committee include:

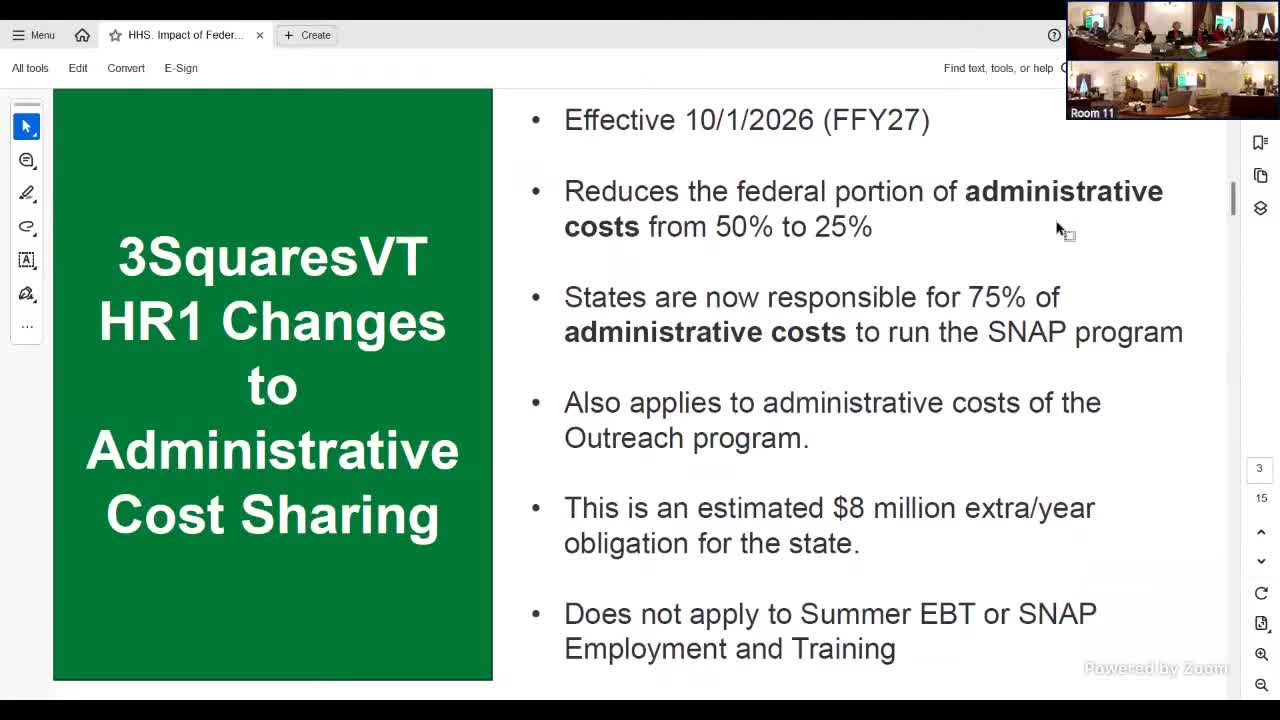

- Administrative match: The federal/state administrative match for several SNAP administrative functions shifts so that the federal share is reduced and the state share increases (described as moving to roughly 25% federal/75% state for some costs). Agency staff estimated the additional state cost could be approximately $8,000,000 annually for administrative expenses.

- Payment error rate: Vermont reported a 5.13% payment-error rate for federal fiscal 2024 and a cumulative 5.93% through May of the current federal fiscal year. Agency staff said staying below a 6% error rate is important because rates above 6% can increase state liability in subsequent years.

- Exemptions and work requirements: HR 1 removed or narrowed several exemptions (including limits on child-in-home exemptions to children under 14 and changes to the age ranges subject to work rules). The state used a bank of discretionary exemptions through Sept. 30 to prevent immediate benefit closures; officials said roughly 4,000 households were contacted because the agency lacked data showing other exemptions or work compliance.

- Utility allowance changes: Federal 'heat-and-eat' policy that previously allowed many households to receive maximum utility deductions was limited to households with an elderly or disabled member. The agency recalculated benefits for the caseload and reported about 2,600 households experienced benefit decreases, and 36 households were no longer eligible after the recalculation; staff said those closures can result from multiple combined factors.

- Noncitizen eligibility: HR 1 narrowed eligible noncitizen categories; the agency reported 119 households were affected statewide, with 33 households receiving partial reductions and 86 households closing. Officials said the number of Afghan refugees with special immigrant visas among those closed cases was small but not zero.

The agency also noted a pass-through called the SNAP Education Funders Group, roughly just under $500,000 annually, that supports community partners. Officials asked legislators to consider the new administrative cost burden in upcoming budget discussions.

Leslie Wisdom described operational steps the agency has taken, including staff trainings, outreach to providers, and system programming. "We have many working families who receive these cards," Wisdom said; she described using the SNAP Employment and Training network and community partners to help households meet work requirements or identify appropriate exemptions.

Committee members asked for additional budget detail and for continued coordination with community partners as the state implements the changes.