Kane County finance committee adopts package of tax levies, postpones three budget adjustments

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

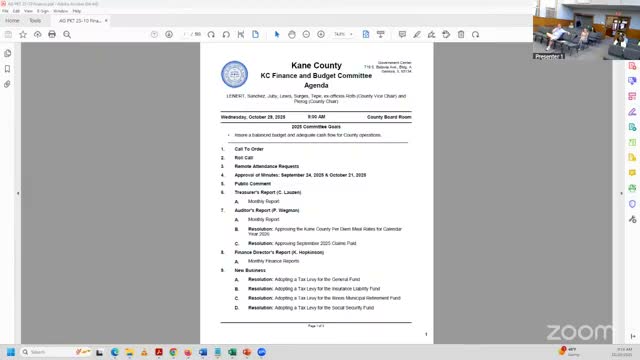

The Kane County Finance & Budget Committee on Oct. 29 approved 19 tax-levy resolutions — including a $37.6 million general-fund levy — and multiple special-service-area assessments, accepted routine claims and benefit changes, and postponed three departmental budget-adjustment requests until the next finance meeting.

At its Oct. 29 meeting, the Kane County Finance & Budget Committee approved a package of tax-levy resolutions that together allocate property-tax levy amounts across the general fund and many special funds and service areas. The committee also postponed three budget-adjustment requests to the next finance meeting and approved routine items such as claims paid and the EyeMed vision plan for 2026.

The committee adopted a general-fund levy of $37,623,175. Finance staff and commissioners discussed the difference between the levy (a dollar amount the county submits) and the subsequent tax extension process, which converts levies to rates using assessed valuations. Finance Director Miss Hopkinson explained the levy is a legal dollar appropriation; the state and county clerk later compute the tax rates when equalized assessed values are finalized.

Why it matters: Levy adoption is a key step in the county budget cycle. The levies set the dollar amounts the county will request from property taxpayers for specific funds; the final per-property tax rates are set later when valuations are extended. Commissioners pressed staff for clarity on downward adjustments and the routine small-dollar rounding differences that can occur when the extension is calculated.

Votes at a glance (selected resolution outcomes): - General fund levy — $37,623,175. Motion moved and seconded; roll call approved (record shows a single "no" vote by Commissioner Sergis/Surges; remainder in favor). - Insurance liability fund levy — $6,411,918. Approved by roll call. - Social Security fund levy — $4,694,843. Approved by roll call. - County Highway fund levy — $5,010,909. Approved by roll call. - County Highway Matching fund levy — $65,125. Approved by roll call. - Health fund levy — $1,972,455. Approved by roll call. - Veterans Commission fund levy — $568,728. Approved by roll call. - Multiple special-service-area levies (Shirewood Farms, Mill Creek, Wildwood West, Plank Road Estates, Exposition View, Tamara Dippman, Church Monitor, 45 W 185 Plank Road SSA, Boyer Road SSA, Crane Road Estates SSA, and others) were presented, moved, seconded and approved by roll call; amounts ranged from $110 (Shirewood Farms SSA) to $1,039,034 (Mill Creek SSA).

Postponed items: Three budget-adjustment resolutions (Public Defender, Court Services, Judiciary) were moved to the next finance committee meeting to be considered after the full county board adopts the fiscal-year budget (targeted for the Nov. 10 full board meeting). Committee members clarified the postponements are intended so adjustments happen after a formally adopted county budget.

Other administrative actions: The committee approved the claims-paid report for September ($18,000,911.79) and a 2026 per-diem resolution following staff confirmation that the county uses GSA/IRS locality per-diem rates. EyeMed was approved as the county vision plan for 2026.

What remained unresolved: Commissioners asked staff to review the standard language concerning whether the levy may be adjusted up or down at extension time; staff indicated the form used is consistent with prior years and can be revisited if needed.

Provenance: Transcript excerpts used for this article begin with the committee’s discussion of the levy process and run through the roll-call votes on the general-fund levy and subsequent levies (topic intro: 00:48:34; topic finish: 01:44:44).