Senate considers bill to allow state tax deduction for tithes and offerings

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

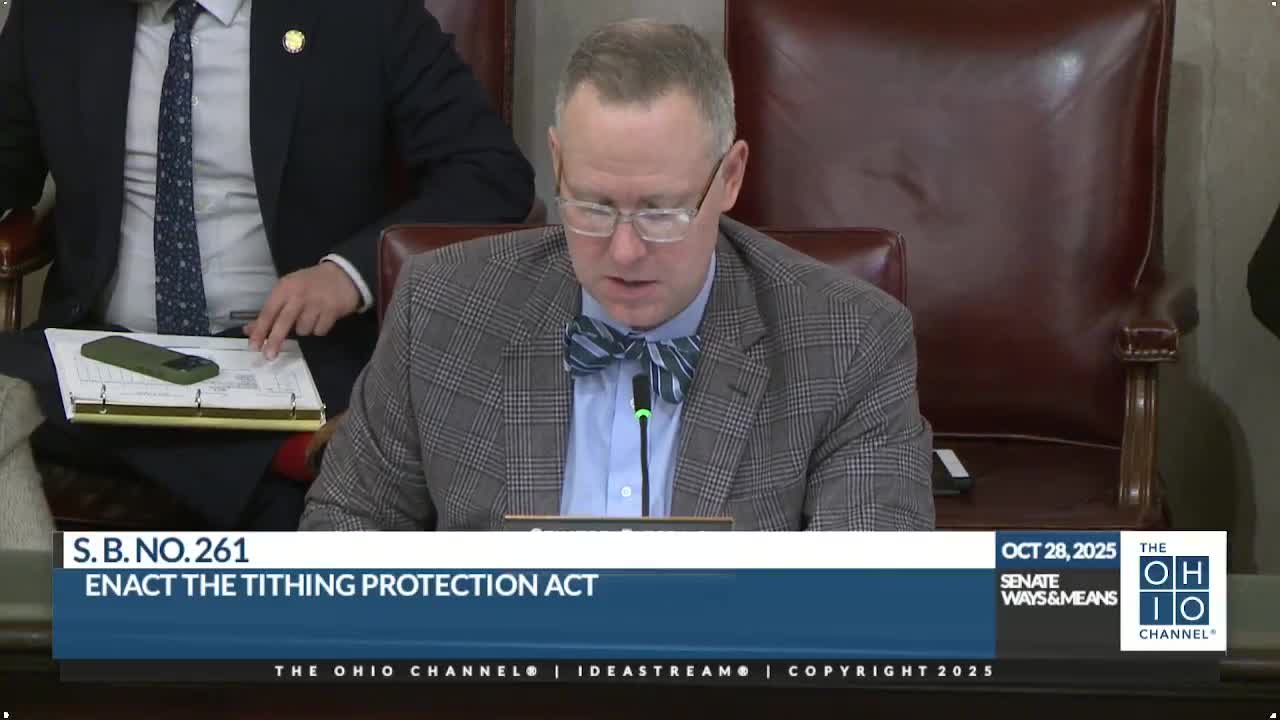

Sen. Reynolds presented sponsor testimony for the Tithing Protection Act (SB 261), which would allow taxpayers who itemize to deduct verified tithes and offerings on Ohio state returns, aligning state treatment with federal practice; sponsor said churches provide written giving statements and a fiscal estimate is pending from LSC.

Senator Reynolds presented sponsor testimony on Senate Bill 261, the Tithing Protection Act, which would allow Ohio taxpayers who itemize to deduct verified tithes and offerings on their state income tax returns.

Reynolds said the measure aligns Ohio policy with the federal tax code by letting taxpayers subtract verified charitable contributions to houses of worship when calculating state taxable income. She noted that 29 other states already permit some form of state deduction or credit for charitable giving and that Ohio is among the minority that do not.

Committee members asked how the state would verify amounts given to houses of worship and what the fiscal cost would be. Reynolds said congregations commonly provide donors with giving statements that include the nonprofit's 501(c)(3) tax ID and that the sponsor would ask the Legislative Services Commission for a fiscal analysis. Sen. Roegner expressed support for the concept; no fiscal estimate was presented at the hearing.

No committee action was taken; sponsor testimony concluded.