House passes bill exempting trade-ins of portable electronics from use tax

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The Michigan House passed House Bill 4375 on a 71-33 vote to amend the Use Tax Act to remove tax on trade-ins of portable electronic devices and ordered immediate effect.

The Michigan House on a 71-33 roll call vote approved House Bill 4375, a measure amending the Use Tax Act to remove use tax on trade-ins of portable electronic devices and ordered the bill to take immediate effect.

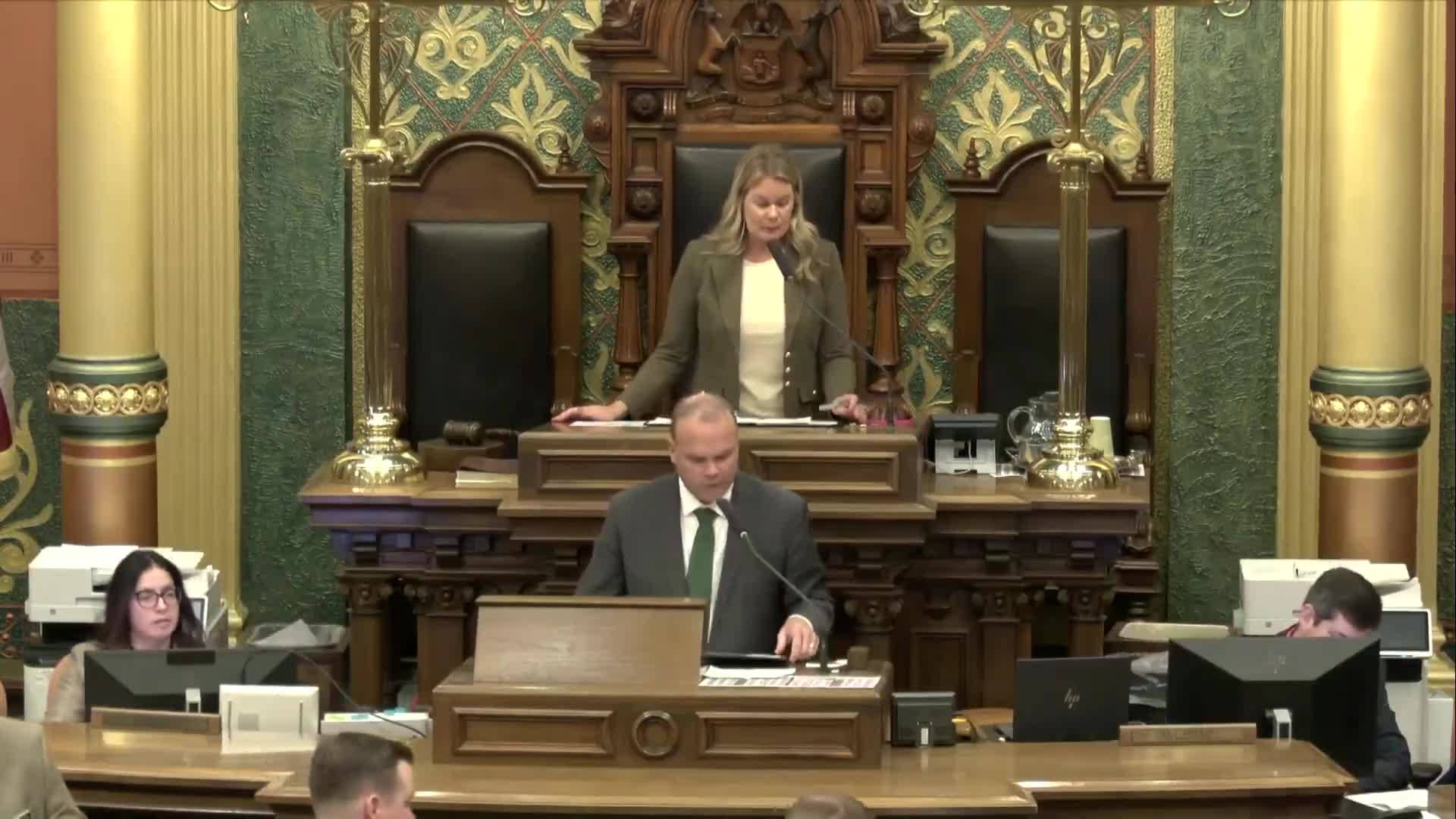

Sponsor Representative Ann Frisbie told colleagues the measure would align Michigan with about 30 other states and estimated the change would provide roughly $42 in relief for someone trading in a cell phone. "It doesn't sound like much until you're a family of 4 doing them all at once," Frisbie said as she urged support for the bill.

The bill had a series of floor amendments. Representative Frisbie offered Amendment 1, which was adopted. Representative Weiss offered Amendment 2; the clerk recorded that the amendment was not adopted. Representative Bridal offered Amendment 3; the clerk recorded that the amendment was not adopted. After the final tally the clerk announced 71 aye votes and 33 nay votes; a majority of members elected and serving having voted in favor, the bill passed. The majority floor leader then moved for immediate effect; members rose and immediate effect was ordered.

The sponsor said the bill "protects Michigan consumers" by removing the sales/use tax on trade-ins of portable devices and estimated the per-device relief at $42.

Action and next steps: The bill passed the House and the House ordered immediate effect. The transcript does not state subsequent Senate or gubernatorial actions or effective date beyond the House ordering immediate effect.