House passes bill allowing Michigan deduction for out-of-state 529 contributions

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

House Bill 4747 passed the Michigan House 72-32 to let Michigan taxpayers deduct contributions to qualified education and special needs accounts regardless of where the 529 plan is domiciled.

The Michigan House on a recorded vote of 72-32 passed House Bill 4747 to amend the Income Tax Act of 1967 so Michigan taxpayers may deduct contributions to qualified education and special needs accounts (commonly known as 529 plans) regardless of where the program is located.

Representative Joseph Tisdale, sponsor of the bill, said the change "simply allows Michigan residents that are actively saving for qualified education and special needs expenses to deduct those contributions regardless of where the IRS certified 529 program is located." He argued the change would stop Michiganders from being penalized when they choose out-of-state plans that better meet their needs.

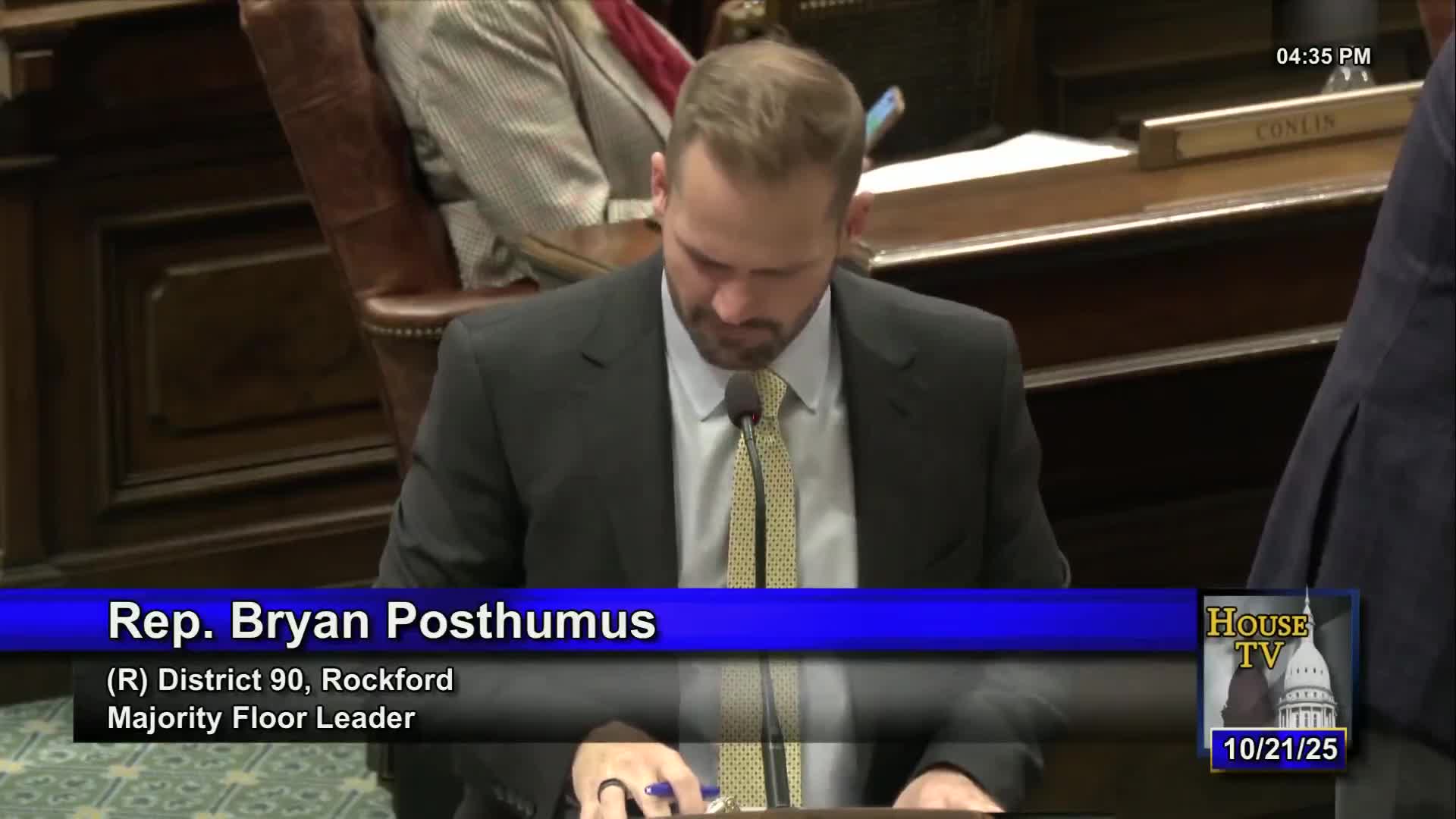

Earlier on second reading the House adopted a floor substitute (H-1) offered by Representative Tisdale. On third reading, with no further amendments stated on the record, the clerk opened the board and announced 72 aye votes and 32 nay votes. A majority voted in favor and the bill passed. The House then ordered immediate effect after a motion by the majority floor leader; members rose and immediate effect was recorded.

Action and next steps: The bill passed the House and immediate effect was ordered. The transcript does not record a fiscal note, nor does it record Senate consideration or gubernatorial action.