Klarna and fintech group back bill clarifying Ohio Small Loan Act to preserve bank-issued buy-now-pay-later

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Proponents including Klarna and the Financial Technology Association supported Senate Bill 269, saying it would codify long-standing interpretations of the Ohio Small Loan Act and exempt bank-issued small-dollar, short-term loans (commonly used in buy-now-pay-later products) from licensing that would otherwise restrict such lending.

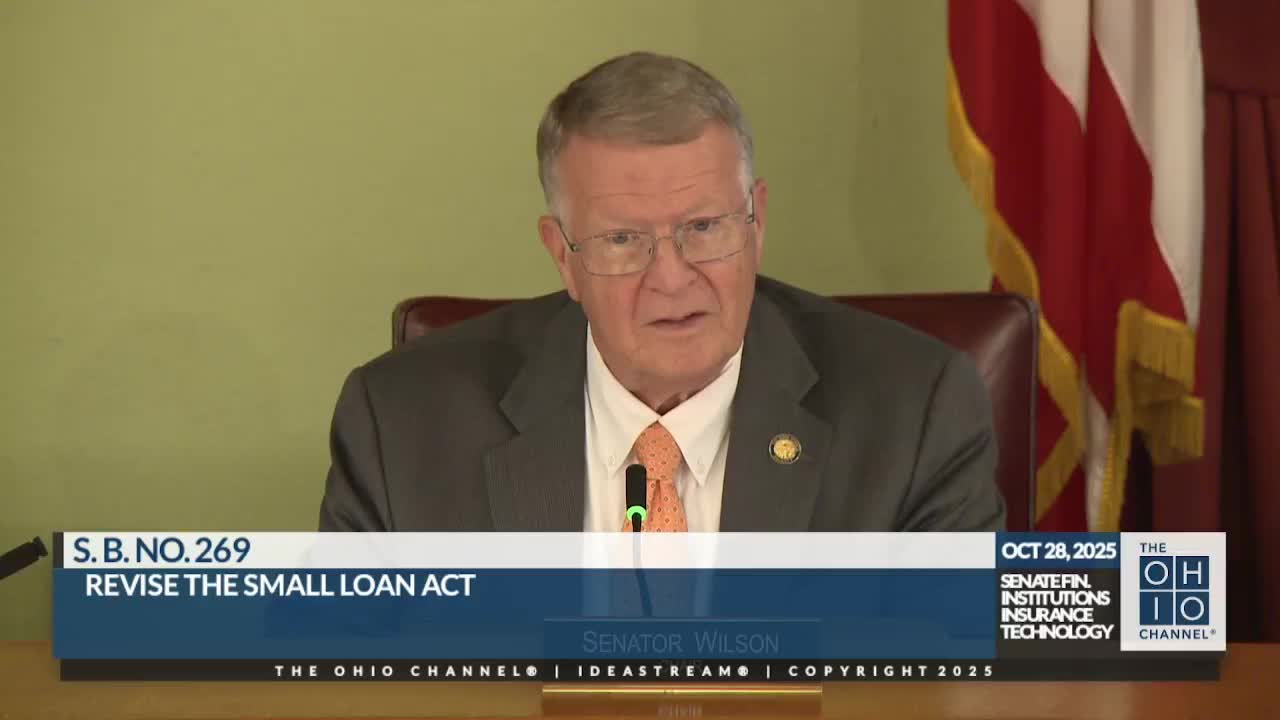

At a second hearing on Senate Bill 269, proponents from industry and trade groups told the Financial Institutions Insurance Technology Committee the bill would clarify that bank-issued small-dollar loans offered through fintech platforms are exempt from licensing under the Ohio Small Loan Act.

Jeff Anderson, head of U.S. policy at Klarna, said the bill "simply codifies what's long been understood, that licensed banks and their service providers can offer small dollar short term loans." Anderson described consumer use of Klarna's flexible-payments products and offered several usage statistics: the average Klarna balance is $87, over 765,000 Ohioans used Klarna in the past year and more than 27 million Americans are customers. Anderson said 99% of Klarna customers repay their balances and estimated Ohioans spent about $600 million on Klarna in the last year.

Anderson and other proponents warned a recent Ohio Division of Financial Institutions interpretation would, in their view, require licensing for nonbank entities that arrange bank loans under $5,000 and could bar loans under $1,000 or under one year. Angelina Bradfield, head of policy at the Financial Technology Association, testified that the ODFI alert "runs counter to established legal interpretations of the SLA" and that enforcement of that interpretation could restrict consumer access to lower-cost credit, particularly bank-partnered buy-now-pay-later loans.

Senator Blessing said he had concerns about consumer protection and suggested the bill may need stronger enforcement or "teeth." Proponents replied that SB 269 is narrowly focused on restoring prior understanding of exemptions for bank-issued loans and that regulators and federal banking supervision remain involved in oversight.

The committee conducted a second hearing on SB 269; no vote was taken and no amendments were recorded.