Montgomery County treasurer outlines prepayment and delinquency programs at Huber Heights council meeting

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

County Treasurer John McManus briefed Huber Heights council on property tax prepayment plans, the Board of Revision appeal window, delinquency payment contracts and common credits such as the homestead and owner-occupancy credits.

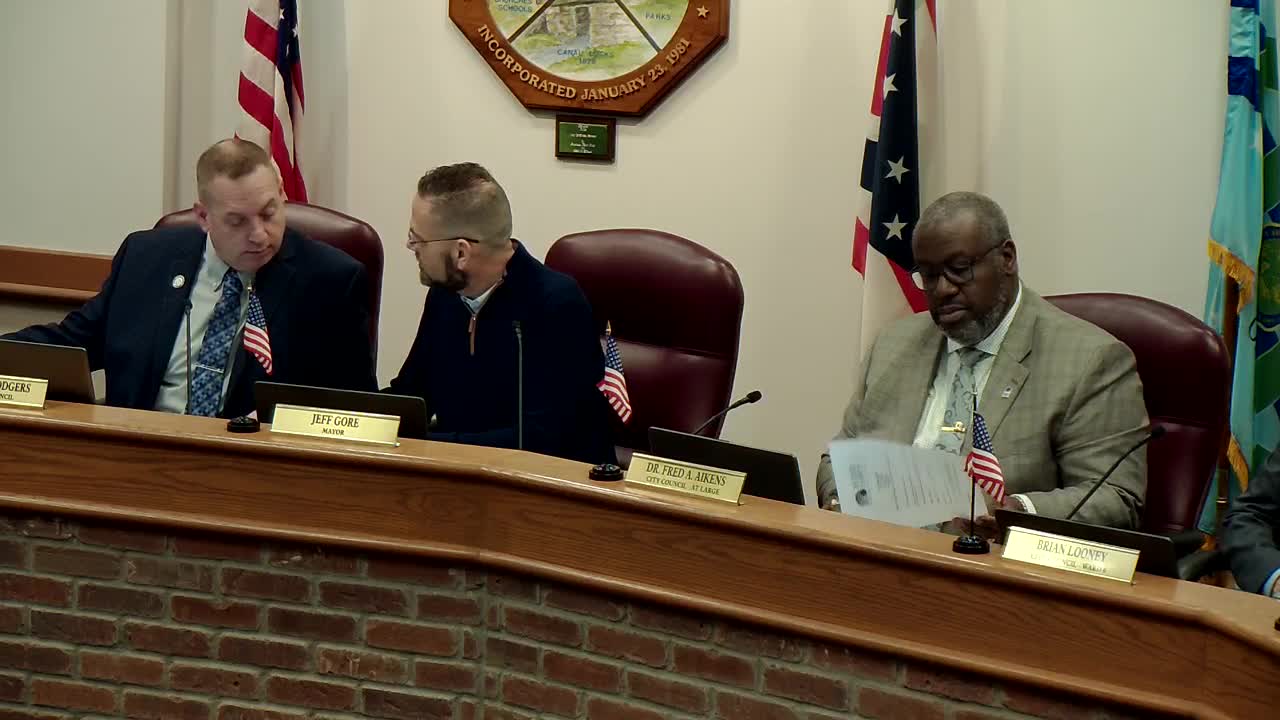

John McManus, Montgomery County Treasurer, spoke to the Huber Heights City Council on Jan. 27 about services his office offers to help property owners manage annual tax bills and delinquencies.

"I'm John McManus. I'm the county treasurer," he said, explaining the treasurer's role as the county's banker, investment officer and property tax collector. McManus described a popular prepayment plan that allows property owners to split their property tax payment into monthly payments; he said the program has grown and that his office recently signed up more than 100 new families in a week.

McManus reviewed the Board of Revision process for contesting property valuations and said the filing window for appeals is open from the beginning of January until the end of March. He also described a delinquency payment contract, a statutory arrangement that requires a 20% down payment and monthly installments; he noted that a property enrolled in such a contract cannot be foreclosed upon or have a tax lien sold by the treasurer while the owner is complying with the schedule.

He reminded the council and residents about common credits and exemptions that can reduce bills, including the owner-occupancy credit (a 2.5% reduction for primary residences) and the homestead tax credit for eligible homeowners. McManus encouraged councilmembers to refer constituents to the treasurer's office and said the office is prepared to assist with enrollment and questions.

Councilmembers thanked McManus; Councilmember Campbell praised his staff's professionalism and responsiveness.

Ending: McManus left materials for the council, noted the treasurer's office can be a resource during tax season, and encouraged residents to check county online tools for parcel and bill details.