Committee approves amendment to Sawyer County tax ordinance, sets fees and shorter timeline for tax-title process

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The committee approved an amendment to Sawyer County's taxation ordinance (Chapter 24) to align with recent state acts, set administrative fees for tax-deed processing and shorten the county's timeline to acquire tax title. The committee also reviewed a list of 37 parcels proposed for sale under the revised process.

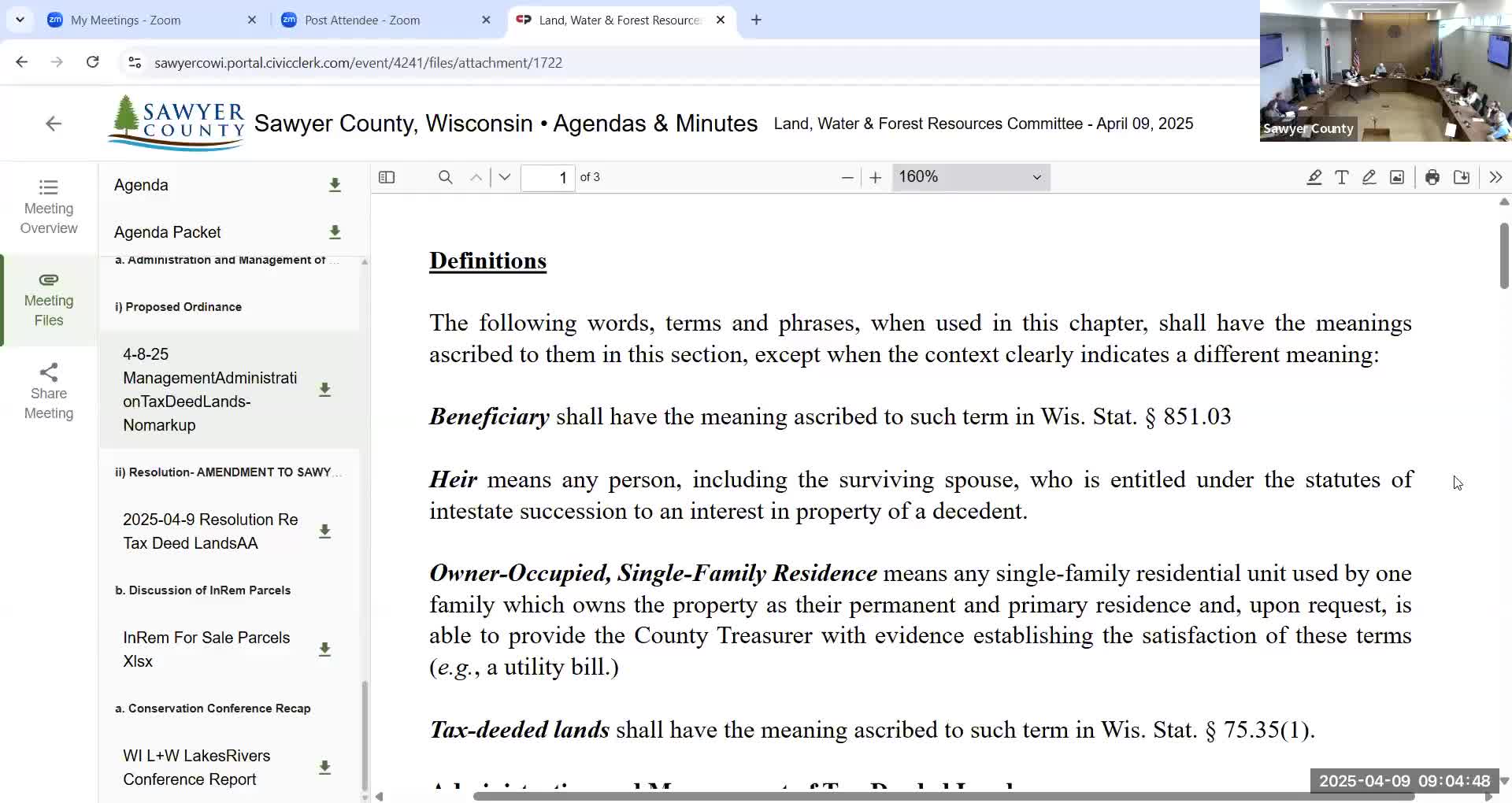

The Sawyer County Land, Water and Forest Resources Committee on a voice vote approved an amendment to the county's taxation ordinance, Chapter 24, that shortens the county's internal timeline for acquiring tax title, sets new administrative fees and implements state changes under recent acts.

The amendment directs the county treasurer and the committee to "act as expeditiously as allowed under Wisconsin law to proceed to acquire tax title to tax delinquent properties, but in no event longer than 3 years from the date of tax certificate issued unless a longer period is required by applicable law." Committee members also approved administrative fees of $300 for the tax certificate process and $1,800 when a property is put up for sale, plus recovery of itemized costs, the committee was told.

Committee members said the change implements state Acts 206 and 207, which alter how proceeds from tax-deed sales are handled and require counties to return excess sale proceeds to prior owners in many cases. The change follows state-level litigation and statute updates, the committee was told: "a lot of states are changing their tax deed process," and counties statewide are adjusting to those legal changes.

The treasurer presented a list of 37 parcels the county wants to offer for sale and recommended using assessed fair-market values as the minimum bid amounts for initial sale listings. Presenters warned some parcels are likely unsalable at those minimums because they are unbuildable or inaccessible; the treasurer said the county's goal is to recover costs where possible but acknowledged returns to the county will be limited by the new state rules.

Committee members discussed practical steps the treasurer will take if properties do not sell at the minimum amount: they can be relisted, offered via realtor, or reduced in price. The committee noted that some counties face lawsuits seeking return of past sale proceeds to prior owners following the Minnesota case Tyler v. Hennepin; Sawyer County staff said that litigation has resulted in a class-action-type process in Wisconsin and the county's insurers are involved in its defense.

The committee also discussed operational details required by the new process: certified checks to prior owners when contact information exists; placement of unclaimed funds if checks are not cashed; and the suggestion to hold returned funds in a separate account while the county awaits any legal claims.

The committee approved the ordinance amendment and the supporting resolution by voice vote; individual vote tallies were not recorded in the meeting transcript. The treasurer will return next month with a finalized parcel list and the recommended minimum amounts for each property.

Why it matters: The amendment brings Sawyer County's tax-deed process into alignment with recent state law changes, alters how sale proceeds are allocated, and introduces explicit administrative fees intended to reimburse the county for processing costs. It also changes the county's internal timetable for acquiring tax title from a longer practice to a three-year maximum in ordinary cases.

What's next: The treasurer will email the parcel list in advance of the May meeting for committee review; the committee will consider the minimum bid amounts and move to advertise properties for sale under the revised ordinance.