Norwood finance commission reviews FY26 budget materials and explains free cash and stabilization funds

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The town's finance commission briefed town meeting members on the FY26 budget approach, the size of the school appropriation, the town's certified free cash and how free cash is allocated by town meeting.

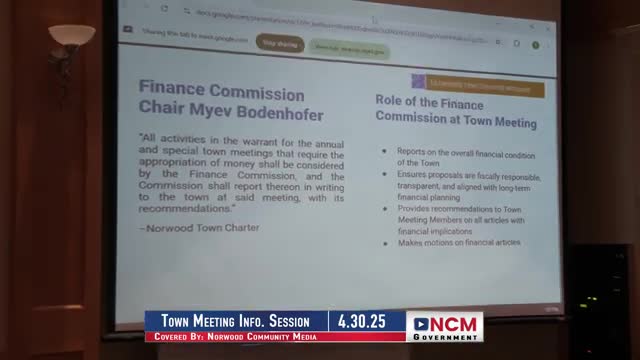

Maya Bodenhofer, chair of the Town of Norwood Finance Commission, reviewed the FY26 budget materials that town meeting members should study in advance of the annual meeting and explained how free cash is certified and allocated.

Bodenhofer said the budget book contains FY22-FY24 actuals, the FY25 current budget and the FY26 requests; she emphasized town meeting will vote on the FY26 operating budget, which becomes effective July 1. She said the town appropriation to the schools is approximately $65,000,000 for the coming year and noted that schools also receive state and federal grants such as the special education circuit breaker and Title I and Title III funds.

On free cash, Bodenhofer said the town's most recent certified free cash was $29,800,000 and explained the certification process: unspent appropriations and surplus revenues at fiscal year-end are submitted to the state for certification, typically in October. She said that once certified, free cash may be appropriated only by town meeting following a board of selectmen warrant placement and a finance commission motion; the town previously has used free cash for specific purposes when the school committee pledged to return unused funds.

Bodenhofer identified an estimated fiscal impact tied to two proposed optional veteran property tax exemptions (HERO Act clauses) at about $75,000 per year that would not be reimbursed by the state.

Why it matters: town meeting will vote on FY26 appropriations and any special town meeting articles that allocate free cash. Understanding how free cash is certified and allocated helps members evaluate requests and potential impacts on reserves and stabilization funds.

Details: Bodhenhofer and town staff noted that department-level requests, shared costs (health insurance, pensions), and capital or special-article requests are all described in the budget book. Finance commission makes the motion for financial articles at town meeting and issues recommendations on special town meeting articles that affect the budget.