Ocala CRA reports 18% rise in tax increment revenue, suspends new-construction incentive during budget review

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

CRA staff reported an 18% year-over-year increase in tax increment revenue and told the advisory committee they will suspend new-construction incentive grant applications for downtown while the CRA budget and potential incentive packages for several large projects are evaluated.

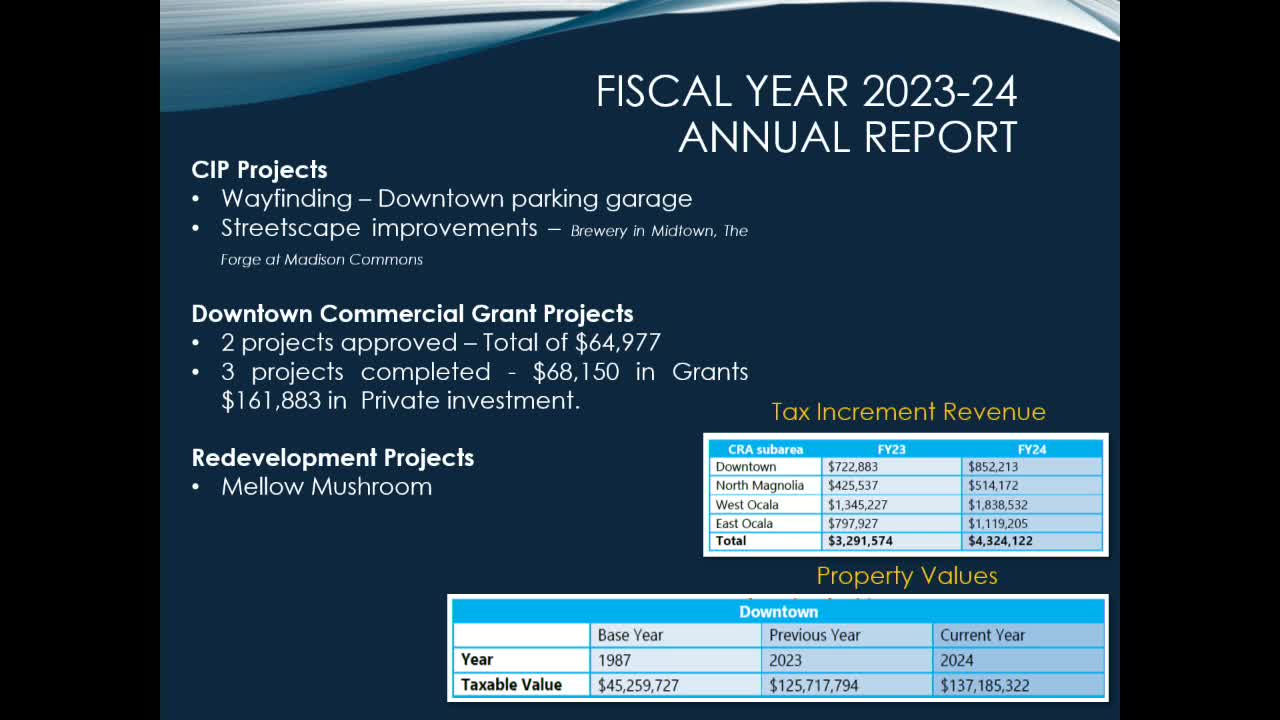

CRA staff presented the Downtown Community Redevelopment Area annual report and budget priorities to the advisory committee on April 16 and said tax increment revenue increased approximately 18% year over year.

The staff presentation said tax increment revenue rose from $722,883 in the prior year to $852,230 in the most recent accounting period. The packet also listed $68,150 in reimbursements awarded across three completed projects and $161,833 in capital investment reported from property owners for completed projects.

As part of the budget review, staff said the downtown CRA has suspended applications for the new-construction incentive grant (downtown CRA only) while it evaluates funding priorities and possible incentive packages for several large proposed developments, including Lincoln Square and other developer inquiries the city is discussing with private partners. "At the position that the downtown CRA is in, our best incentive is going to be a TIF reimbursement," a staff member said, adding the CRA is not cash heavy and will evaluate packages within available funding.

Staff listed current developer commitments that will continue to be funded from CRA funds under existing agreements: the Forge (Rising Commons), the Hilton Garden Inn, District Bar & Kitchen, Mellow Mushroom and Brick City projects. Committee members asked for clarity about outstanding commitments and the time horizon for payments; staff said some agreements include long-term payment schedules. In one example staff described as part of a downtown motel agreement, payments are structured for roughly 10 years and run close to 2038; staff described the payment formula as tied to 70% of certain annual tax receipts under the developer agreement.

Committee members also asked why operating expenses rose from FY 2023 to FY 2024; staff attributed most of the increase to added staff time devoted to projects, a new staff hire and higher operating costs such as dues, training and project promotion.

Staff told the committee the CRA has approximately 13 years remaining for the downtown CRA term and that the advisory body is positioning funds for land acquisition and streetscape projects to maximize benefits over that period. Staff noted funds are already committed to the named developer agreements and that future incentives would have to be sized to the CRA's projected revenues and reserves.

"Those projects will continue...and then if there are all the CIPs that we need to focus on, we'll take those on each year as well," a staff member said during the meeting.