Supervisor of assessments previews homestead exemption portal, tentatively flat equalization factor from state

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The supervisor of assessments told the Public Service Committee the county launched a taxpayer portal for homestead exemptions on June 1, has received roughly 1,000 applications through the portal, and expects fillable PDFs to be removed on Jan. 1 ahead of ADA-driven website changes; the state returned a tentative equalization factor of 1.0.

The Supervisor of Assessments told the Kane County Public Service Committee that the office launched an online taxpayer portal for homestead exemptions on June 1 and has already received about 1,000 applications through the portal.

“We opened on June 1, a taxpayer portal for homestead exemptions. By placing it on the website, we've already gotten a thousand exemption applications,” the supervisor told the committee. He said the portal was intentionally rolled out quietly to ensure it worked before broader promotion.

The supervisor said the county is making broader website changes to comply with new interpretations of the Americans with Disabilities Act for online content. He warned that the fillable PDF forms used previously will not be lawful after April and that paper forms will remain available for residents who prefer them.

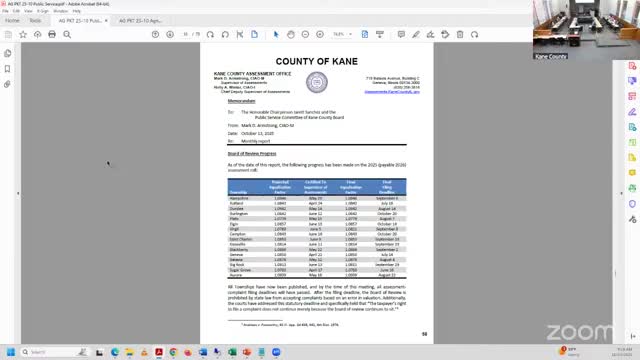

He told the committee the state returned a tentative equalization factor of 1.0 for the county — indicating no macro-level assessment changes this year — and that a public hearing on the factor will be held Nov. 4 in Springfield.

The supervisor also reviewed postmark rules: documents mailed and postmarked by the due date are considered filed as of the postmark date, which he described as state law. He noted the office has seen some mail arriving long after the postmark date, which he attributes to postal delays outside county control.

Costs and outreach: the supervisor discussed outreach options to increase uptake of exemptions and estimated that a countywide registered-mail campaign would cost about $1,000,000 in postage alone, plus handling and records costs. He said the office has instead used a short notice on the annual tax bill and is studying targeted outreach using USPS-format addresses and parcel matching.

Committee members asked for future reports showing the number of eligible parcels and how many currently receive exemptions; the supervisor offered to provide more granular counts in a subsequent report.