Task force examines investing local government reserves in-state; report due Nov. 30

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

A state task force led by the state treasurer is studying whether funds held by local governments could be invested more in Utah institutions to benefit the state's economy. A University of Chicago study is expected Nov. 3 and the task force final report is due Nov. 30, League representatives said.

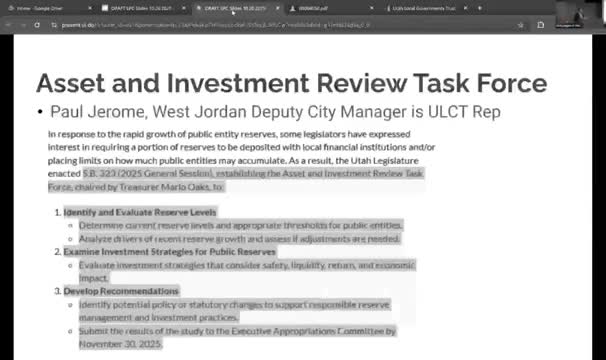

Paul (local government representative on the Asset Investment Review Task Force) updated LPC members on a task force convened by the state treasurer to examine whether local-government-held reserves are increasingly staying in nonlocal investments and whether greater in-state investment would yield broader state benefits.

Why it matters: The task force’s recommendations could lead to policies that encourage or require a greater share of local government reserve investments to be placed with in-state banks or funds, affecting investment earnings and banking relationships.

Key points

- Study and timeline: The University of Chicago is producing a study with findings due Nov. 3; the task force’s final report to the state is due Nov. 30. Task-force membership includes state auditors, school districts, counties, banking professionals and local-government representatives.

- Local-government perspective: Paul said many reserves are not idle — they are committed to capital projects, maintenance-of-effort obligations and other near-term needs — and urged the task force to account for legitimate local cash-flow and project-planning reasons money appears to be held in reserve.

- Survey response: A voluntary survey to finance staff produced roughly 25–30 municipal responses; task-force members encouraged municipal finance officers to review public materials and offer feedback.

Ending

Paul urged members to review task-force meetings on the state treasurer’s website and to submit questions or concerns about how reserve balances are counted and used by local governments.