Barnstable County officials warn of fiscal 'cliff' within decade after 10-year budget projections

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

County finance staff presented a 10-year revenue and expenditure projection showing a small FY2027 surplus followed by growing deficits and a possible debt-service ceiling breach by 2030 unless revenues or spending change. Commissioners discussed using reserves, restructuring services and seeking new municipal agreements.

Barnstable County finance staff told commissioners Oct. 22 that a 10-year projection of revenues and expenditures shows a small surplus in fiscal 2027 but growing structural deficits afterward and an elevated debt outlook that could breach the county's 10% debt-service cap by about 2030 unless the county finds additional revenue or reduces operating costs.

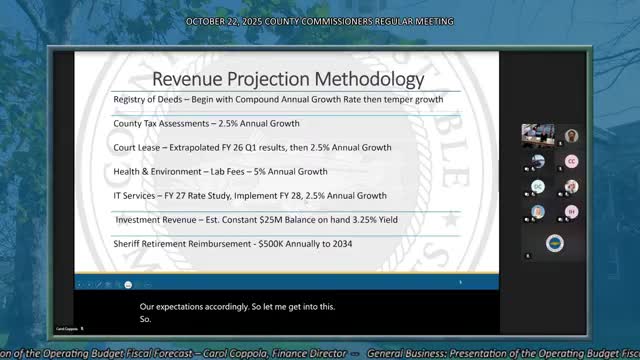

The projection, prepared by county finance staff, used a conservative, weighted-average approach for each revenue stream rather than a long-run compounded growth rate. "We cut that projection in half to 2.18%" when modeling registry of deeds revenue after excluding COVID-era distortions, the finance presentation said. Registry receipts, courthouse lease income and the county assessment were identified as the major revenue sources. The presentation assumed a 3.25% investment yield on a hypothetical constant $25 million balance and included a sheriff retirement reimbursement currently scheduled at $500,000 per year through 2034.

Why it matters: the county faces simultaneous, sustained upward pressure on personnel and insurance costs—salary growth in the model averaged about 6% annually—with limited ability to raise assessments (the county noted a 2.5% cap on the municipal assessment/ excise increases). At the same time, the county has large capital and deferred-maintenance liabilities, including an early estimate of about $60 million related to PFAS cleanup and treatment needs. The county has authorized $11 million in borrowing and included an additional $45 million in the debt outlook to cover PFAS work; staff said $4 million of that cost has been paid from ARPA funds.

Finance staff said they used different methods across expense categories: regression analysis for retirement costs, a 12.25% blended near-term increase scenario for retiree group insurance (with an alternate stress scenario peaking higher then easing to 7%), and a 2.5% trend for less-reliable operating categories. For IT services, staff proposed a rate study in 2027 with new rates implemented in 2028 to better align internal billing with costs.

Commissioners responded with a mix of concern and questions about options. One commissioner warned the group was "coming close to the cliff, and we have to make some tough decisions about what stays and what goes," and urged staff to lay out specific options for service reductions, timing and potential percentage reductions in department budgets. Several commissioners emphasized that existing county reserves (undesignated/unreserved fund balance and stabilization funds) can smooth short-term needs but are a one-time resource, not a sustainable fix.

Discussion highlighted structural constraints: the county said municipal assessments can rise only 2.5% annually absent an override, and towns face similar limits; commissioners noted that many services the county provides developed as state and federal programs were reduced. Several speakers urged stronger regional agreements with towns to fund shared services—IT and dredging were discussed as examples where regionalization could yield efficiencies if financing and assessment rules permit.

On borrowing and debt service, staff said the debt outlook includes authorized but not yet issued debt and the added PFAS borrowing; the first repayment on that modeled borrowing was shown beginning in 2030. The board was shown a gray reference line at an estimated 10% of the county budget as a cautionary ceiling for annual debt service; under the projection that line would be exceeded around 2030 without additional revenue or reductions.

A handful of other points in the meeting: staff noted deferred maintenance across the county complex in the order of roughly $70 million (some already appropriated but not spent), the county is pursuing a capital budget policy and planned a November 5 discussion of process changes, and staff said they will provide commissioners with consolidated overall annual revenue-growth and expenditure-growth percentages to match against the projection.

The meeting produced one recorded formal action: approval of the commissioner's consent agenda (items 8a–8i). The motion was moved and seconded and recorded as "Aye" by commissioners on the audio record. The finance briefing and the commissioners' direction means the county will present more refined options to close the projected gap and a proposed capital policy during upcoming meetings.

The county scheduled a capital budget presentation and possible approval for Dec. 3 and said it will return to the board with more detailed revenue-percentage figures and options for addressing the projected shortfalls.