Committee hears bills to reduce school‑bond approval threshold to 55%; supporters urge voter access, opponents cite tax concerns

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

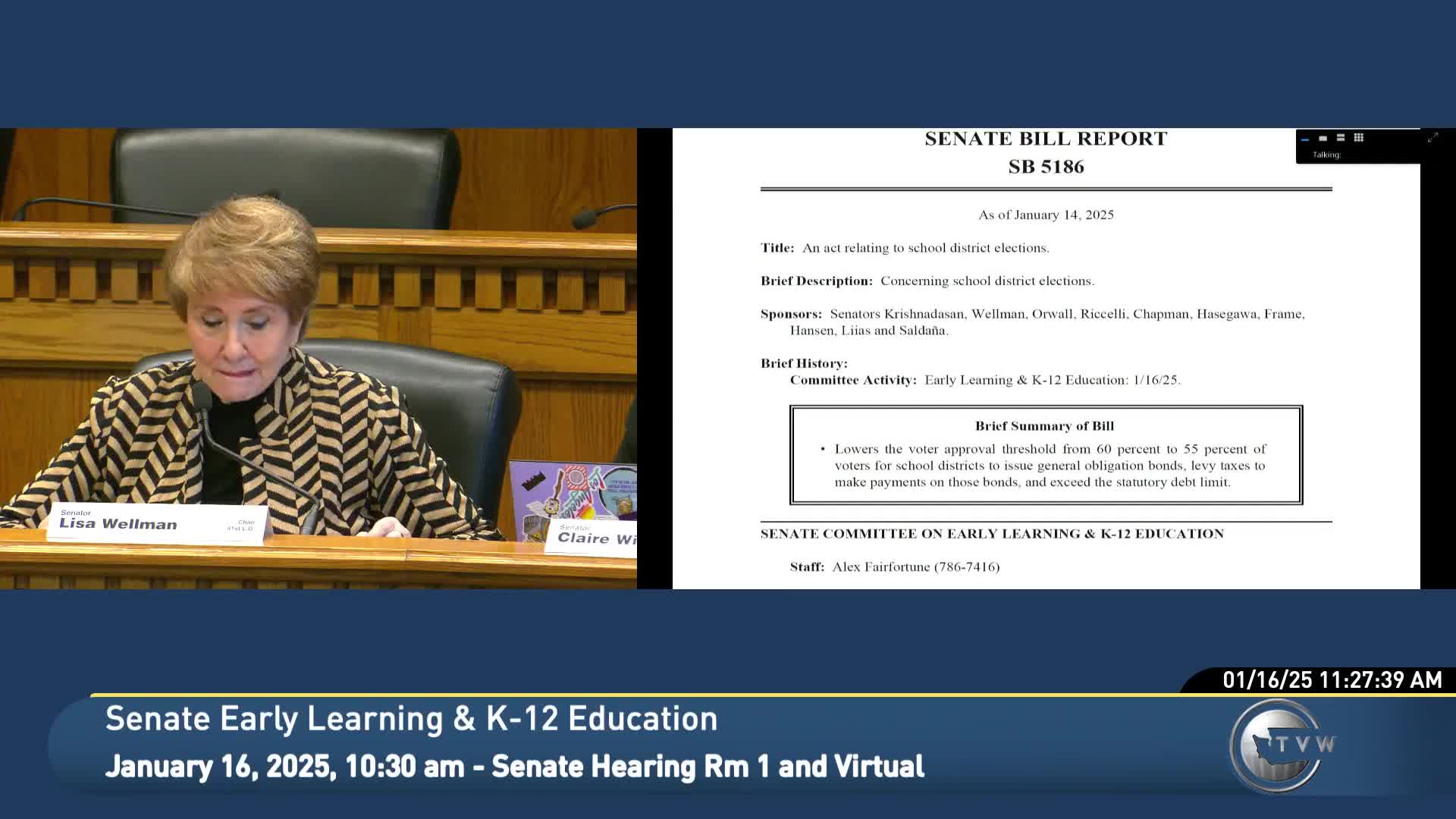

Senate Bill 5186 and Senate Joint Resolution 8200 would lower the supermajority needed to approve school bonds from 60% to 55%. Sponsors and a broad coalition of school districts, parents and education groups testified in favor; some witnesses urged 50% (simple majority) while opponents warned of increased property‑tax pressure.

The Senate Early Learning & K‑12 Education Committee took testimony on Senate Bill 5186 and the linked constitutional amendment, Senate Joint Resolution 8200, which would lower the voter approval threshold for school general obligation bonds from 60% to 55%.

Senator Debra Kirshadossen (for the record identified herself) framed the proposals as a response to repeated bond failures that leave districts unable to address overcrowding, safety and aging facilities. She said the 60% requirement ‘‘has been in place for nearly 80 years’’ and described the change to 55% as ‘‘a thoughtful compromise’’ that would better reflect community will while protecting taxpayers.

Senator Cortez — who described herself as an educator — introduced the constitutional amendment portion (SJR 8200) and said lowering the threshold is about local control and equity: ‘‘This is about giving local control to communities to decide whether they should move forward and build schools,’’ Cortez said.

A wide range of witnesses testified in favor, including district leaders from Peninsula, Lake Washington, Issaquah, Wenatchee, Bethel, Orting, and others; parent and student advocates; the Washington State PTA; the Washington Education Association; and business and facilities advocates. Several presenters urged going further to a simple majority (50%). Lake Washington witnesses and Issaquah officials said many local bond measures that the community supported failed under the 60% rule and that the current threshold forces repeated campaigns and higher costs.

Jennifer Butler, a Peninsula School Board member and architect, said a 55% threshold enjoys bipartisan support and would have allowed many more bonds to pass in recent cycles. OSPI staff presented election data showing that, in a recent November cycle, four of 14 bond measures passed under the 60% rule but nine would have passed at 55% and 12 would have passed with a simple majority.

Opponents urged caution. Tim Iman of Bellevue said voters are concerned about rising property taxes and called for making it harder, not easier, to raise taxes. Loretta Barnes and a few other individual residents said they opposed lowering the threshold and raised concerns about transparency and bond spending practices in some districts.

Several witnesses—district finance officers and school board members—urged the legislature to consider 50% instead of 55%, arguing a simple majority would align bond passage with levy rules and mirror the majority of states. Others framed 55% as a politically achievable compromise to advance reform.

No committee vote was recorded at the hearing. Committee members asked for further consideration and debate on the measure and its threshold.