South Dakota Retirement System remains fully funded; July COLA set at 1.71%

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

SDRS officials told the Joint Appropriations Committee the system is fully funded, pays about $750 million annually in benefits with 87% of benefit dollars staying in the state, and that July's cost‑of‑living adjustment is capped at 1.71% under the system's funding test.

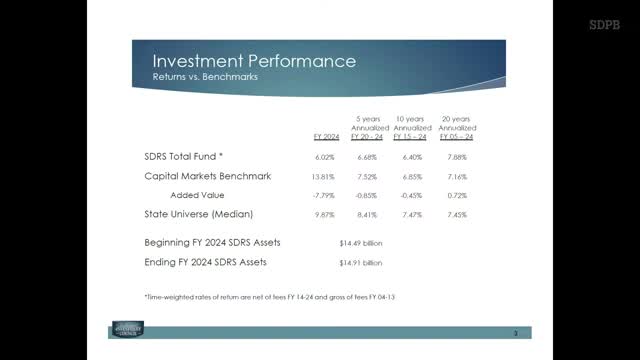

South Dakota Retirement System Executive Director Travis Hallman briefed the Joint Appropriations Committee on SDRS's funding status, benefits and member services on Jan. 16, reporting the system remains fully funded and that benefit payments continue to support local economies.

Funding and scale: Hallman said SDRS paid about $750,000,000 in benefits annually and serves roughly 34,000 benefit recipients; he said roughly 87% of those payments remain in South Dakota. Hallman emphasized SDRS's funding model: South Dakota uses a fixed‑contribution, variable‑benefit design in which contribution rates are set and benefits (not employer contribution levels) are the primary variable when markets or demographics change.

COLA mechanics and July 2025 adjustment: Hallman explained that SDRS calculates a baseline funding test and then determines the maximum distributable COLA (cost‑of‑living adjustment) consistent with maintaining a fully funded status. He said SDRS's actuarial calculation this year produces a restricted maximum COLA of 1.71%. Hallman described the process in detail: if the plan's baseline calculation shows a funded status that permits the full statutory COLA range (0–3.5%), the CPI‑W would be paid up to that ceiling; if the baseline calculation does not support the statutory top end, the actuary computes a restricted maximum. For the coming July 1 adjustment, the CPI‑W was higher than that restricted maximum (CPI‑W ~2.49%), so retirees will receive the 1.71% maximum supported by the actuarial test.

Supplemental (457) plan: Hallman reviewed the supplemental retirement (457) plan that SDRS administers for public employees. The plan had roughly $722,000,000 in assets at the end of fiscal 2024 and about 15,000 participants; Hallman said it is a low‑cost voluntary vehicle with Roth and pre‑tax options, age‑based funds and a guaranteed‑interest account currently yielding about 3%.

Administrative costs and operations: Hallman said SDRS operates with 35 FTE and that administrative costs are charged to the trust funds; statute limits administrative spending to no more than 3% of annual contributions and SDRS has an internal target of 2%. He said the system uses outside benchmarking (CEM) and that SDRS's adjusted administrative cost per member is about 36% less than peer averages while delivering high service levels.

Why it matters: SDRS funds retirement incomes for public employees statewide; the system's funding, benefit determination (COLA) and administrative costs affect public employees, budget forecasts and long‑term fiscal health. Hallman told lawmakers the board watches COLA and funding closely and that the system's contingency planning prioritizes benefit sustainability.

Next steps and follow‑up: SDRS said it will continue outreach and education for members, provide requested materials and return for deeper briefings if specific legislative questions arise.