DLS fiscal briefing: Governor's FY26 plan narrows a shortfall but leaves structural gap, proposes broad tax changes and education cuts

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

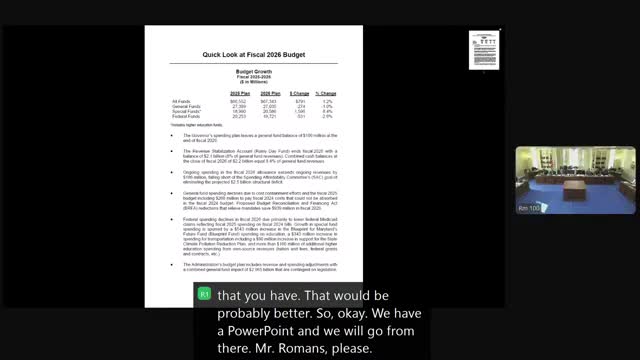

David Romans, an analyst with the Maryland Department of Legislative Services, told the House Judiciary Committee on Jan. 28, 2025, that the governor’s proposed $67 billion budget balances on a cash basis for fiscal 2026 but leaves a structural deficit of about $186 million and relies on nearly $3 billion of statutory changes in the Budget Reconciliation and Financing Act (HB 352).

David Romans, an analyst with the Maryland Department of Legislative Services, told the House Judiciary Committee on Jan. 28, 2025, that the governor’s proposed $67 billion budget is balanced on a cash basis for fiscal 2026 but still leaves a structural deficit of about $186 million and depends on nearly $3 billion of statutory changes contained in the Budget Reconciliation and Financing Act (HB 352).

Romans said the administration’s plan shows $791,000,000 of overall budget growth over the prior year and a 1.0 percent decline in state general fund revenues — a drop of about $274,000,000 to just over $27,000,000,000 — driven in part by the governor’s cost‑containment measures. On a cash basis, he said, the budget leaves a $106,000,000 balance in the general fund and keeps more than $2,000,000,000 in the rainy‑day fund (about 8 percent of general fund revenues), exceeding the Spending Affordability Committee’s 7.5 percent target.

“The governor’s budget fails to” achieve structural balance, Romans said, noting that achieving the committee’s structural goal would require additional revenues or spending reductions (or a mix of both) to close the $186,000,000 gap.

Why it matters: the proposal mixes revenue changes, transfers and cuts to close an immediate cash shortfall but shifts persistent costs into local governments or future years. Romans flagged risks not reflected in the forecast, including possible federal grant reductions and economic volatility tied to capital gains revenue and federal workforce changes.

Major revenue and tax proposals

Romans described roughly $1.4 billion in new revenue in fiscal 2026 from a package of tax and fee changes. Highlights he cited include personal income tax reform estimated to raise about $691,000,000; a temporary (four‑year) 1 percentage point capital‑gains surcharge on filers with taxable income of $350,000 or more (estimated at about $128,000,000); elimination of Maryland itemized deductions in favor of an expanded standard deduction (individuals $5,600, joint $11,200); two new top personal income tax brackets for very high incomes; and a retail delivery fee of $0.75 per taxable order.

Other proposals Roman identified: raising the sports wagering tax from 15 percent to 30 percent and table‑game tax from 20 percent to 25 percent (effective in the current fiscal year), a corporate combined reporting change and a slight reduction of the corporate rate (from 8.25% to 7.99% over two years), and a change to inheritance/estate taxes — eliminating the inheritance tax while lowering the estate tax exemption from $5,000,000 to $2,000,000 (administration projects the package to be roughly revenue neutral across those two changes).

Spending changes, transfers and targeted reductions

Romans said the Budget Reconciliation and Financing Act includes nearly $1,000,000,000 of spending reductions and roughly $634,000,000 of transfers to the general fund (the largest transfer, about $230,000,000, comes from the local income tax reserve fund). The governor’s proposal would also reduce the reinvestment payment to pensions by about $43,600,000 and increase a hospital assessment used for Medicaid funding (Romans said the assessment would bring total hospital assessments to about $394,000,000).

Key program impacts raised in the briefing

- Childcare scholarship program: The governor would cap enrollment at about 42,000 children (Romans said current enrollment is “almost 42,000”), which legislative services had projected would grow to more than 50,000 in fiscal 2026; that cap is a principal source of claimed savings.

- Public higher education: The University System of Maryland faces about $106,000,000 less in fiscal 2026 compared with fiscal 2025, Romans said, meaning institutions may need to cut programs or raise tuition and fees.

- Developmental Disabilities Administration (DDA): The state discovered a substantial underfunding in the current year; Romans said unfunded costs were “like $450,000,000 on a $1,000,000,000 program.” The governor provided a current‑year deficiency and proposes cost‑containment measures estimated at roughly $97,000,000 in the current year and $235,000,000 in fiscal 2026. Romans also said the administration proposes ending an enhanced regional payment for eight jurisdictions (including Montgomery and Prince George’s counties). Committee members pressed for detail on geographic impacts.

- K–12 / Blueprint Fund: The governor proposes a 551,000,000 increase overall for K–12 in fiscal 2026 but would scale back several statutory expansions tied to the Blueprint for Maryland’s Future. Most notably, the behavioral‑health portion that statute would have set at roughly $130,000,000 is left at the current $40,000,000 under the proposal (Romans described that as a permanent change). The administration also proposes pausing growth in the concentration‑of‑poverty grants for two years (Romans said the pause saves about $70,000,000 in the first year and about $193,000,000 in the second year) and delaying the planned phase‑in of additional collaborative teacher time from fiscal 2026 to 2030.

Local impacts and cost shifts

Romans said the governor would shift about $144,000,000 of costs to local governments in fiscal 2026. One example: a change to teachers’ retirement funding would require local governments (including counties and Baltimore City) to cover half of the growth in the state’s normal cost increase for teacher retirement this year — roughly a $90,000,000 recurring local cost shift in Romans’ description.

Other notes and risks

- Child Victims Act: Romans said the Child Victims Act (statute) has produced a large set of claims; he noted outside counsel is advising the Attorney General’s Office and that some advocacy parties hope for a settlement before the end of session. He said there is no money in the budget specifically reserved for any settlement payment and both the governor and General Assembly would need to find funds if an initial payment were required in fiscal 2025 or 2026.

- Volatility and audits: Romans warned the budget increases reliance on capital‑gains and other volatile revenue and said legislative services does not assume additional federal grant reductions in the forecast. He also said the Office of Legislative Audits conducts regular audits of state agencies but that Maryland does not run an especially large program of performance audits.

Committee response and next steps

Members across the dais asked detailed follow‑ups about distributional impacts, regional effects for DDA and schools, the phase‑in and pause mechanics for concentration‑of‑poverty grants, and whether taxes on high‑income filers drive out‑migration. Romans answered technical questions about timing, savings estimates, and program mechanics; he repeated that closing the structural gap would require new revenue, further cuts, or both. The committee recessed and scheduled bill hearings for 1:15 p.m.

Ending note: The briefing provided the committee with the administration’s fiscal assumptions and the statutory changes (HB 352) that enable much of the governor’s plan; legislative committees will now examine the revenue and expenditure proposals in detail in forthcoming hearings and markups.