Committee hears broader bill to exempt diapers and essential childcare products from sales tax

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

House Bill 1307 would exempt child and adult diapers and a list of essential childcare products from sales-and-use tax starting Jan. 1, 2026. Staff briefed the committee on eligibility, DOR implementation responsibilities and fiscal estimates; Representative Michelle Caldier sponsored the bill and emphasized family relief.

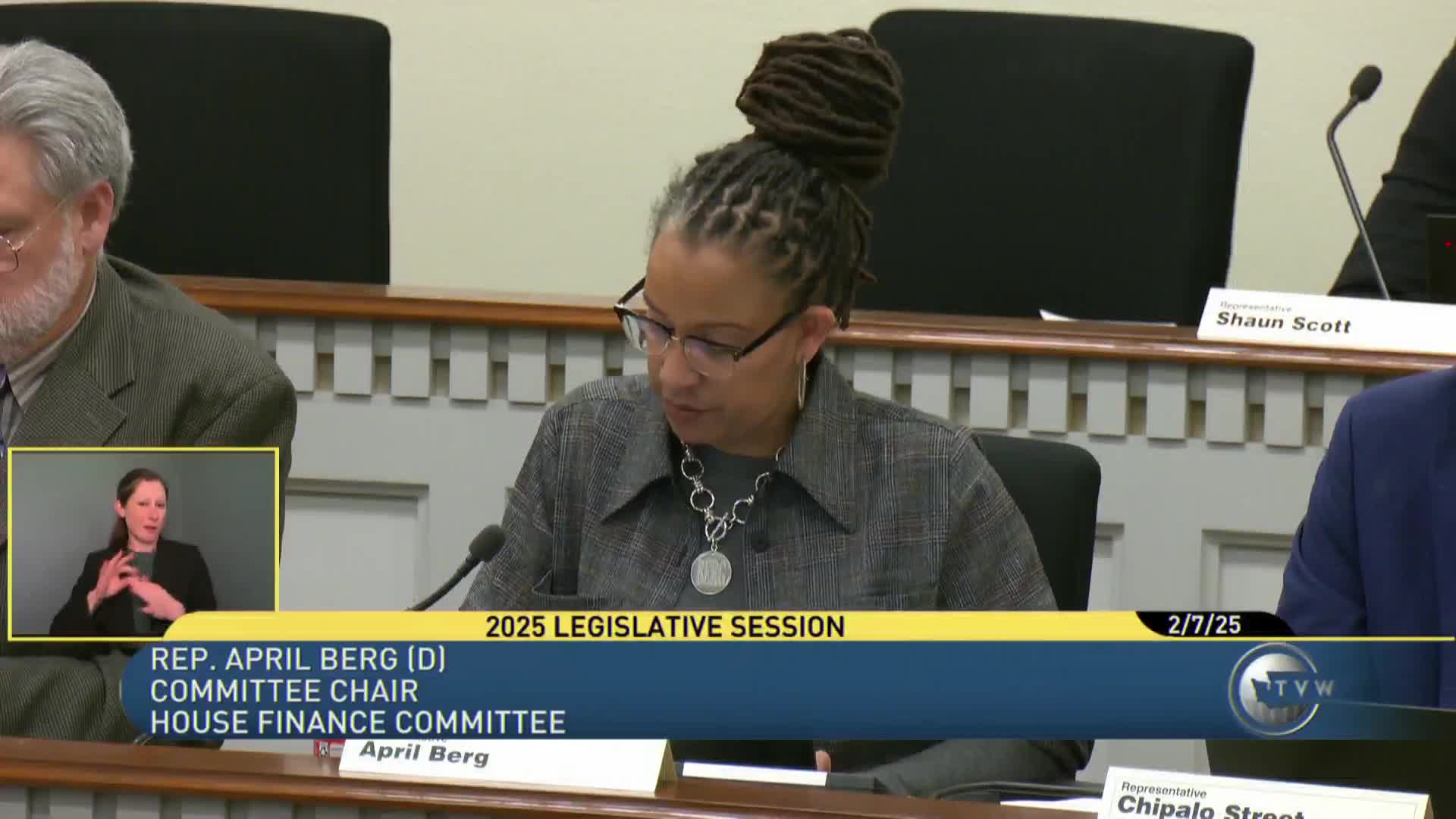

House Finance held a public hearing Feb. 7 on House Bill 1307, which would create a sales-and-use tax exemption for child and adult diapers and a range of "essential childcare products" starting Jan. 1, 2026.

Christina King, staff to the committee, summarized the bill’s scope: the exemption would cover child and adult diapers and items designed for infants and children under 5, including cribs, strollers, baby wipes, car and booster seats, child safety cabinet locks and certain clothing. The Department of Revenue must adopt rules to implement the exemption and publish a public list of qualifying products. King presented DOR preliminary fiscal estimates: about $34.7 million state general-fund reduction in fiscal 2026 (five months of collections) and $86.7 million in fiscal 2027 for a biennial reduction of roughly $121.3 million; ongoing and one-time implementation costs were also noted.

Representative Michelle Caldier, prime sponsor, described the bill as wider in scope than a diapers-only measure: "If you liked her bill, you're gonna like mine even better," Caldier said, adding that the draft contains wording she planned to refine with DOR. Committee members asked about specific product lists; Caldier and staff said the department would publish qualifying items under the rulemaking authority in the bill.

Several advocates and providers later testified (in a separate public-testimony panel) in favor of diaper and childcare-product exemptions, describing the cost pressures on families and the health and hygiene importance of diapers and breast pumps. Staff flagged tribal revenue-sharing discussions and the need to update administrative rules and forms.

Why it matters: HB 1307 would broaden the exemption beyond diapers to many commonly purchased infant items, increasing the fiscal effect and requiring a clearer product-qualification process. The DOR estimate shows substantially larger budget impacts than the narrower diapers-only bill.

Next steps: public hearing concluded; DOR rulemaking details and fiscal estimates were recorded on the bill’s electronic binder. No committee vote occurred at the Feb. 7 hearing.