House Finance hears bill to exempt prepared food from sales tax

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

House Bill 1340 would exempt prepared food from sales-and-use tax. Committee staff presented definitions and a large preliminary fiscal note; restaurant and grocery industry groups and small-business owners testified in support, citing affordability and support for local businesses.

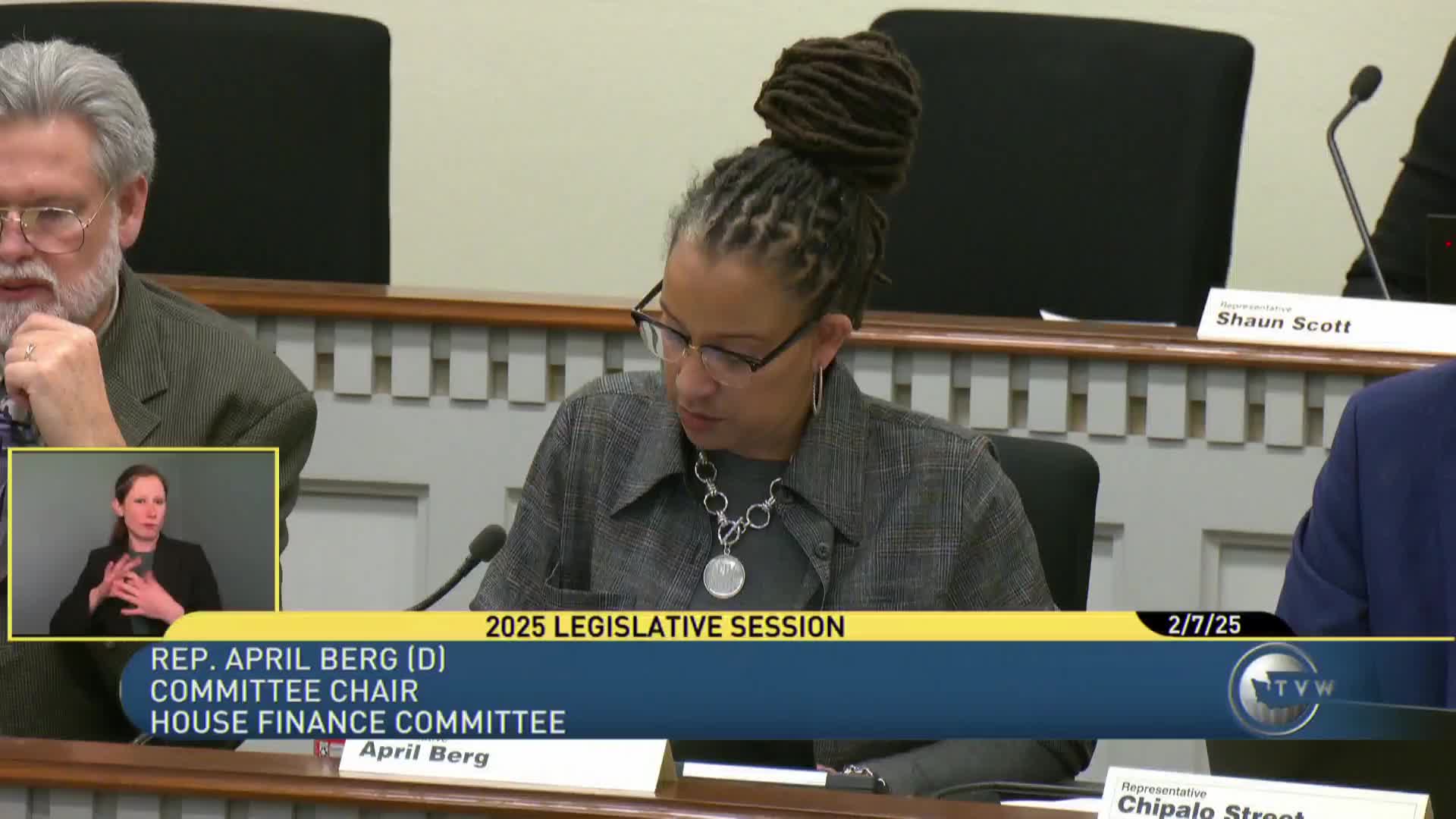

House Finance on Feb. 7 took testimony on House Bill 1340, which would remove sales tax from prepared food statewide.

Christina King, staff to the committee, explained that current law exempts most food and food ingredients but treats prepared food as taxable. She read the draft definition of prepared food (food sold heated or served with utensils, or products with two or more ingredients combined by the seller) and said the bill would add an exemption for prepared food while including a tax-preference statement, JLARC review and a 10-year expiration. King presented the preliminary fiscal estimate: a projected general-fund decrease of about $8.0 million in fiscal 2026 (10 months of collections) and an estimated $996.0 million in fiscal 2027, yielding a biennial total of roughly $1.8 billion; local-tax impacts were also large, and DOR identified one-time implementation costs for rule and form changes.

The bill’s prime sponsor (identified at the hearing as Representative Manjaras) described prepared food as restaurant and fast-food sales that would touch many Washington households. "This bill will affect almost everybody in the state of Washington," the sponsor said, and argued the exemption would provide immediate relief to taxpayers, while acknowledging the committee’s difficult budget year and that the fiscal note may need adjustment.

Industry groups and small-business owners testified in support. The Washington Food Industry Association (independent grocers and convenience stores) said prepared food purchases are common and stores lack the distribution economies of large chains. The Washington Hospitality Association said prepared food is often a necessity, not a luxury, and noted increased reliance on prepared meals in modern life. Small-café owners said eliminating the tax would help competitiveness and allow reinvestment in employees and services.

Why it matters: staff presented a very large preliminary fiscal estimate; if enacted, the exemption would substantially reduce state and local sales-tax revenues and require major DOR administrative changes and tribal revenue-sharing discussions.

Next steps: the public hearing closed and the bill remains pending. Staff and members flagged that the fiscal note and scope may be revised if the measure advances.