Multiple carbon dioxide pipeline and storage bills fail after extended House debate

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

A package of bills addressing carbon dioxide pipeline status, tax incentives, pore-space use and related taxes drew extensive floor debate and ultimately failed in the House on Feb. 14; sponsors and opponents disagreed over economic benefits, property rights and risk.

Bismarck — Lawmakers spent a large portion of the Feb. 14 House session debating a series of bills that would have altered how carbon dioxide pipelines, sequestration projects and related tax incentives are treated under state law. Several measures were considered, amended or read on the floor; floor debate included producers, agriculture advocates and lawmakers urging both caution and economic opportunity. The House ultimately recorded failures on multiple CO2-related measures during the session.

Representative Dee Anderson, speaking for the Energy and Natural Resources Committee at multiple points, described the industry’s history in North Dakota and the role CO2 storage and pipelines can play for ethanol plants, enhanced oil recovery and continuing operations at some coal plants. “Without CO2 storage and sequestration, it'd be very difficult for the coal plants to stay in business,” Anderson said on the floor while describing committee testimony and the state's existing storage projects. Other members emphasized economic opportunity for agriculture and energy if CO2 infrastructure is available, while others stressed landowner property rights and the risks of allowing out-of-state companies to exercise eminent-domain authority.

Key themes: Supporters of retaining tax treatment and common-carrier status argued pipelines and storage create jobs, tax revenue and value for agriculture and energy. Opponents argued special exemptions allow out-of-state interests to profit at the expense of property owners and that the state should apply general tax rules to pore-space use and pipeline property. Representative Jay Olson and others called for taxation or compensation tied to use of state “pore space,” while Representative Porter and committee members cautioned that the state already has a carbon-dioxide trust fund and existing financial-responsibility and insurance requirements.

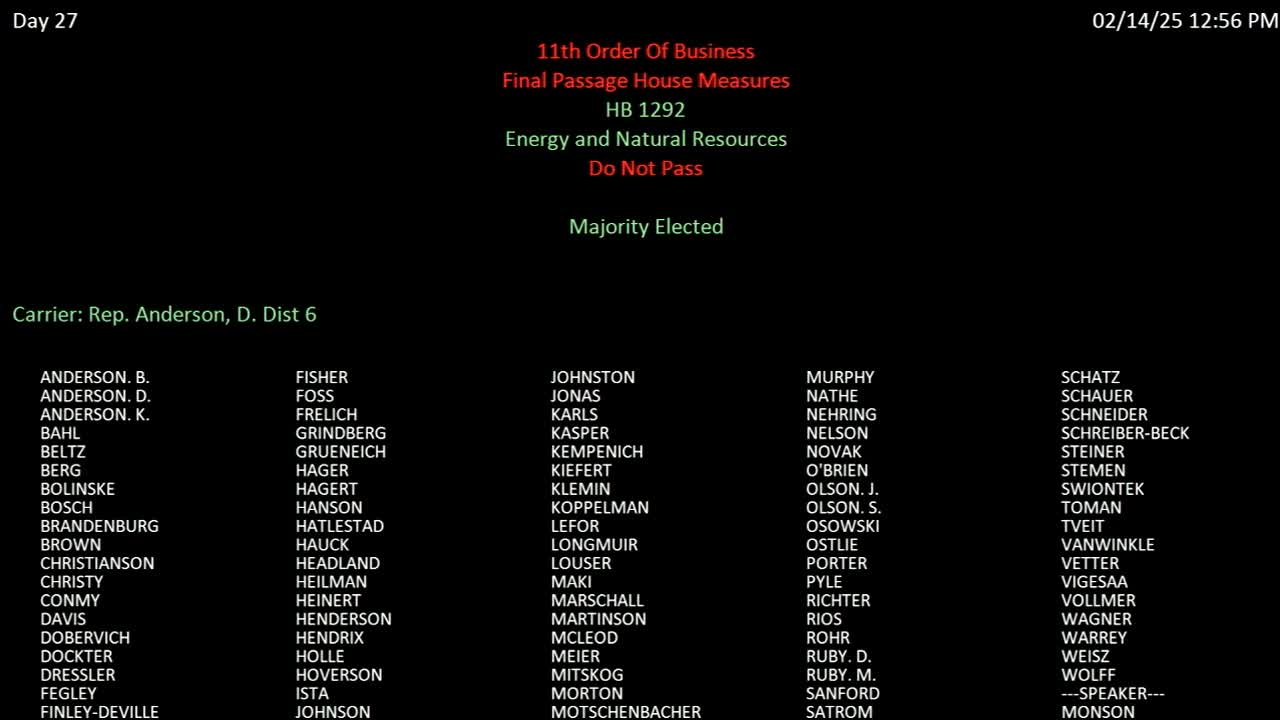

Bills considered and floor outcomes (as recorded in the transcript provided): - House Bill 12-92 (revise common-carrier status for CO2 pipelines): final floor notation: “The final vote shows 15 17 House bill number 12 92 is declared failed.” - House Bill 12-95 (tax and exemption changes for CO2 capture/equipment and pipeline PILOTs): final roll call recorded as “Final vote shows 24 yea, 60 nay, House Bill number 12 95 is declared failed.” - House Bill 14-14 (revocation of common-carrier status language): the clerk recorded that HB14-14 “is declared, failed.” - House Bill 15-74 (prohibit direct-air carbon-capture projects): the clerk recorded the final tally as “20 a, 64 nay” and declared the bill failed. - House Bill 15-73 (pore-space/utilization fee to create a disaster fund / impose fee on substances injected into pore space): the clerk recorded the final tally as “23 a 61 nay” and declared the bill failed. - House Bill 12-10 (carbon dioxide pipeline damages and lien rights proposal): the bill was debated on the floor with extended testimony and a range of safety and financial-responsibility arguments; the transcript does not record a completed roll call on final disposition in the excerpt provided.

What speakers said: Representative Van Winkle, a sponsor on at least one pipeline status bill, argued the common-carrier designation in statute wrongly permitted condemnation and that the designation should be removed for CO2 lines. Representative Porter, chairman of the Energy and Natural Resources Committee, repeatedly highlighted committee recommendations and technical details of the existing statutory trust fund and insurance and said the committee had recommended “do not pass” for several measures. Representative S. Olson argued that pore-space use should be monetized and that companies using finite pore space should pay a fee; Representative DeE Anderson and others described project economic impacts and the role of enhanced oil recovery.

Safety and liability topics: Floor speakers referenced pipeline incidents elsewhere and described dispersion analyses in hearings. Representative Essa Wilson and others flagged that CO2 can expand when released and travels low to the ground; proponents responded that modern pipelines include automatic shutoffs, leak detection and high insurance requirements placed by the Public Service Commission.

Why it matters: The measures would have altered the tax and regulatory framework for carbon management, affected potential enhanced-oil-recovery operations and pore-space uses, and touched on eminent-domain and property-rights questions. Committee reports and floor debate repeatedly connected the bills to broader questions about North Dakota’s energy economy, the fiscal role of fossil-fuel tax receipts, and county and landowner protections.

Next steps: Multiple bills were declared failed on the House floor in the transcript excerpt provided. Sponsors noted differing priorities—some sought to target only sequestration projects, others wanted to preserve incentives for enhanced-oil-recovery—and indicated further work could continue in committee or the Senate if members pursue amendments.