House passes bill raising Idaho food tax credit, allows optional itemized refunds

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

On Feb. 14, 2025, the Idaho House approved House Bill 231 to raise the statewide food tax credit to $155 and let taxpayers optionally claim refunds for actual sales tax paid on food by submitting receipts; the bill passed 61-6 and includes an emergency clause retroactive to Jan. 1, 2025.

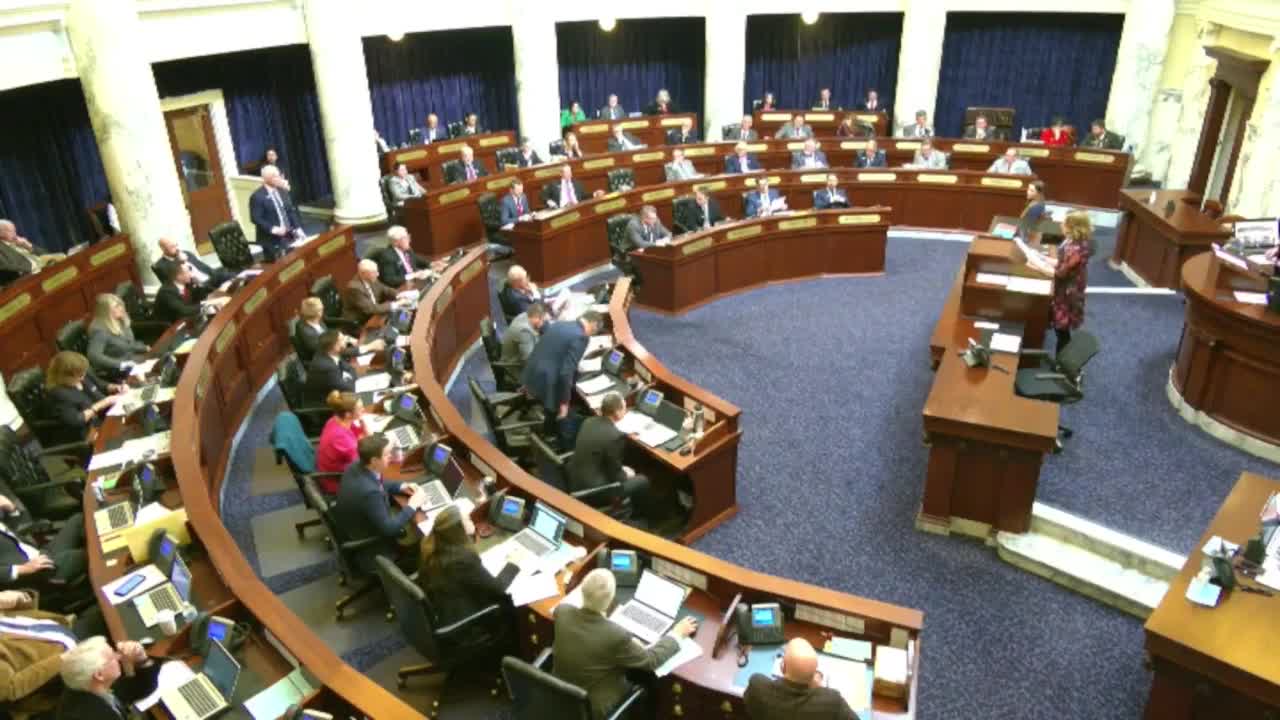

BOISE — The Idaho House of Representatives on Feb. 14 passed House Bill 231, a measure that raises the state food tax credit and creates an optional refund based on taxpayers' documented sales-tax payments on food. The chamber approved the bill 61-6, with three members absent or excused; the bill includes an emergency clause making much of it retroactive to Jan. 1, 2025.

Supporters said the bill increases direct relief to Idaho taxpayers while preserving some tax revenues from visitors and nonresidents. “All we're trying to do here is give more money back,” said Representative, District 22 (sponsor). The measure raises the flat credit and allows residents who choose to document purchases to claim refunds equal to actual sales taxes paid on qualifying food purchases, up to a statutory per-person cap.

Under the bill as passed, the flat food tax credit will be $155 for tax year 2025 and each year thereafter (it had been $100 for 2022 and $120 for 2023–24). In lieu of the flat credit, a resident taxpayer may elect to claim the actual amount of sales tax paid on qualifying food purchases during the taxable year, up to a maximum of $250 per person; to do so, the taxpayer must indicate the choice on the return or application and submit scanned copies of sales-tax receipts as prescribed by the State Tax Commission. The tax code language adopted in the bill ties the definition of "food" to the federal definition in 7 U.S.C. 2012 as it existed on Jan. 1, 2025, and excludes candy, soda, meals sold ready-to-eat by restaurants and other enumerated items.

The bill preserves proportional limits where other benefits apply: credits or refunds must be prorated if an individual received Supplemental Nutrition Assistance Program benefits or was incarcerated for part of the tax year; refunds are not allowed for individuals residing illegally in the United States. The bill authorizes the State Tax Commission to determine application procedures and requires that refunds be paid from the state refund fund. It also authorizes taxpayers to irrevocably donate credited funds to the cooperative welfare fund for assistance with home energy costs; donations must be remitted from the refund fund as provided in the bill.

HB 231 also directs the State Tax Commission to enter information-exchange agreements with the Idaho Department of Correction (for incarceration status) and the Idaho Department of Health and Welfare (for SNAP participation) to determine eligibility and to detect erroneous claims; the bill states such disclosures are confidential and limits the scope of information to name, date of birth, Social Security number and whether the food tax credit was claimed. The bill imposes penalties and recovery procedures for misrepresentations on applications or returns, as provided in the Idaho tax code.

The House debated both policy and administrative concerns. Opponents warned the optional, itemized refund option could impose burdens on taxpayers who must keep and scan receipts and might increase audit exposure. “It’s bookkeeping for bread crumbs,” Representative, District 11 said during debate, arguing the itemizing requirement would be onerous for many families and low-income filers. Supporters said free tax-preparation services and a simple one-page application for nonfilers would reduce that burden and stressed that the flat credit alone should return money to most households without itemizing.

Lawmakers also debated the policy trade-offs of keeping a grocery sales tax while returning a portion via credit. Proponents noted that the credit preserves some revenue from out-of-state visitors and nonresidents who purchase groceries in Idaho, and that sales tax supports programs including property-tax relief and other state priorities. Critics argued full repeal would be simpler and more equitable, and some members unsuccessfully moved to send the bill to general orders for amendment to repeal the grocery tax entirely.

Key formal actions on HB 231 in the House included a successful motion to suspend rules to take up the bill (suspension vote recorded at 62 ayes, 6 nays, with absences/abstentions noted in the record), a failed motion to send the bill to general orders for amendment (6 ayes, 61 nays, 3 absent/excused), a failed motion to end debate early (previous question: 35 ayes, 32 nays, 3 absent/excused), and final passage (61 ayes, 6 nays, 3 absent/excused). The House adopted a correction to the bill title before approving it for transmission to the Senate.

Officials who will implement the new provisions include the State Tax Commission, the Idaho Department of Health and Welfare and the Idaho Department of Correction, which the bill authorizes to enter narrowly tailored confidentiality agreements to verify eligibility. The bill directs the Tax Commission to prescribe application and refund procedures and to administer the documentation-based refund option.

The bill text contains an emergency clause declaring an emergency exists; the bill as passed takes effect on enactment and is retroactive to Jan. 1, 2025, as enacted.

Votes at a glance: - Motion to suspend rules for immediate consideration — Passed (62 ayes, 6 nays, absences/abstentions recorded in House roll). Mover: Representative, District 22 (sponsor); Second: Representative, District 18. - Motion to send HB 231 to general orders for amendment (to pursue full repeal) — Failed (6 ayes, 61 nays, 3 absent/excused). - Motion to end debate (previous question) — Failed (35 ayes, 32 nays, 3 absent/excused). - Final passage of HB 231 — Passed (61 ayes, 6 nays, 3 absent/excused). The bill was approved with a correction to title and will be transmitted to the Senate.

What remains unclear from the floor record: the bill’s final enacted appropriation or administrative fiscal notes, if any, and detailed procedures the State Tax Commission will adopt to accept scanned receipts and process itemized refund claims; those specifics will appear in agency rulemaking or administrative guidance following enactment.

The House debate on HB 231 occupied a major portion of the Feb. 14 session and reflected a substantive policy divide within the chamber over whether targeted credits or wholesale repeal of the grocery sales tax is the preferable path for tax relief in Idaho.