Credit union tax bill draws banking industry support and credit union opposition in House Finance hearing

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

House Bill 15 06 would remove the B&O tax exemption for state‑chartered credit unions that merge with or acquire a bank regulated by the Department of Financial Institutions, applying a 1.2% B&O rate to the credit union's gross income in those cases. Supporters (community and mutual banks) said the measure corrects a competitive advantage; credit

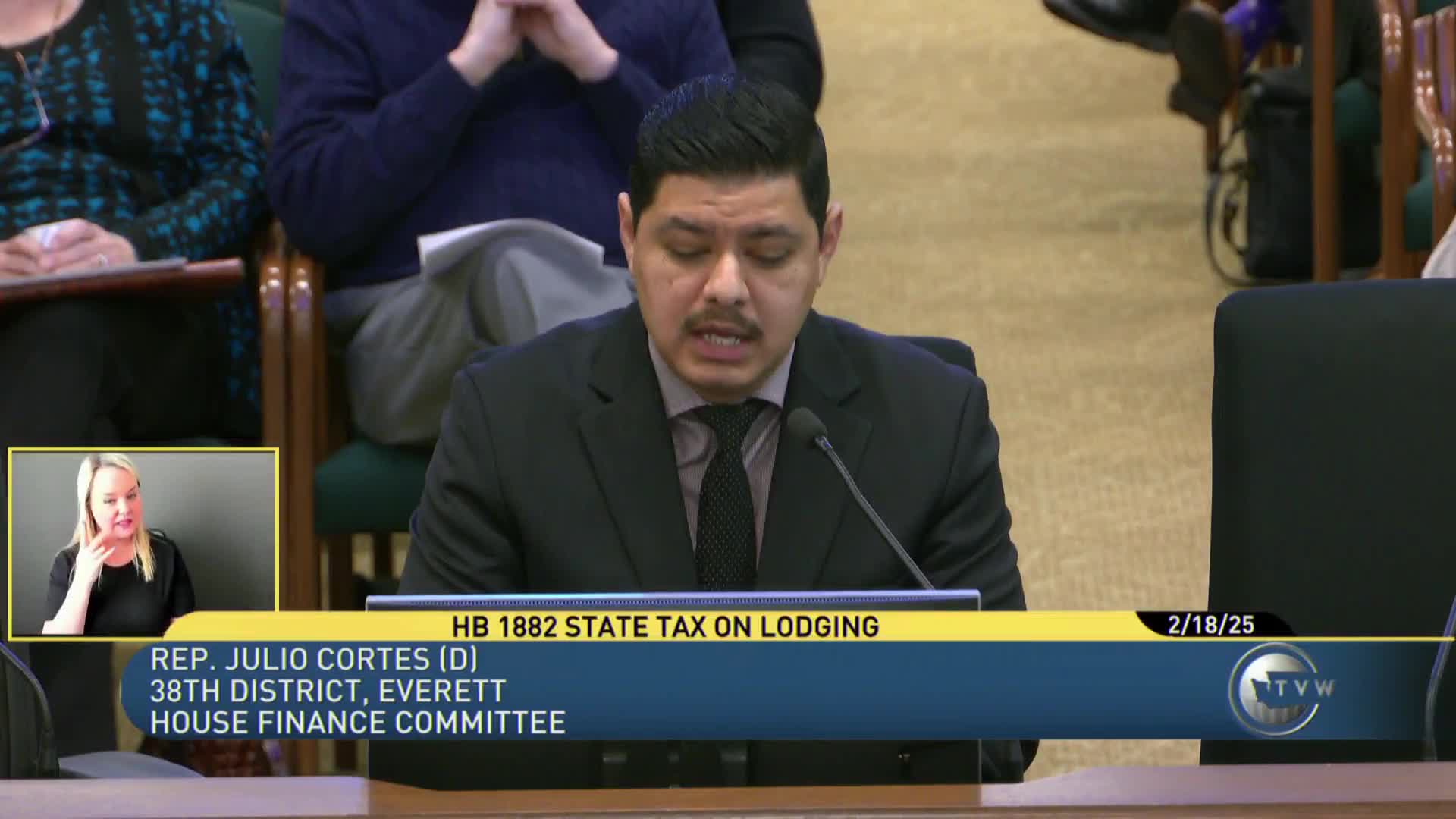

House Bill 15 06 prompted a contested hearing Feb. 18 with industry groups on both sides of the aisle. The bill would require a state‑chartered credit union that merges with or acquires a bank regulated by the Department of Financial Institutions to pay the business and occupation (B&O) tax at a 1.2% rate on gross income beginning Oct. 1, 2025.

Proponents — including the Community Bankers of Washington, Washington Bankers Association and several community bank CEOs — said recent bank acquisitions by credit unions removed taxable entities from the state’s tax base and that the exemption produces unfair competition. Supporters argued the proposal is a measured correction; one presenter estimated potential revenue lost from recent deals could have generated tens of millions in state receipts.

Credit unions including Sound Credit Union and Boeing Employees Credit Union (BECU) testified in opposition. They said acquisitions preserve community banking access in markets where national banks have retreated, that purchasers paid fair market (often premium) prices, and warned that subjecting credit unions to state B&O tax after such transactions would push them to seek federal charters. Credit unions also said taxing them would reduce capital available for lending and reduce member benefits.

Department of Revenue staff and bill proponents referenced a fiscal note estimating state revenue increases if certain credit unions become taxable; DOR estimated impacts in the millions over the first years and provided administrative cost estimates. The committee received extensive oral testimony and submitted written comments; no committee vote was taken.

Ending: Lawmakers said they will review fiscal and competitive analyses and consider the bill as the session proceeds.