CUC presents IRP findings, seeks IPP bids and funding options as fuel costs stay volatile

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The Commonwealth Utilities Corporation presented an updated Integrated Resource Plan and power-project status to the CNMI Senate, showing utility-scale solar plus batteries narrows long‑term losses versus continuing diesel generation and prompting CUC to prepare RFPs and IFBs in coming months.

The Commonwealth Utilities Corporation presented an updated Integrated Resource Plan and power-project status to the CNMI Senate on a briefing that reviewed island-level financial modeling, near-term procurement steps and funding options.

The IRP consultant and CUC management told senators that, while large capital plans will be required, a program of utility-scale solar PV with battery energy storage would reduce long-term net losses compared with “business as usual” diesel generation and that staff will solicit private partners to build and operate projects.

The plan matters because diesel fuel has driven wide swings in the fuel adjustment charge and threatens reliability: the presentation showed the CNMI’s fuel adjustment charge ranged from about 8¢ per kilowatt-hour in June 2020 to roughly 43¢ in June 2022 and was about 23¢ as of February 2025. Senators repeatedly stressed the effect on ratepayers and asked how the IRP’s timeline and procurement would limit short-term bill impacts.

The consultant’s headline findings and island-level modeling

The IRP consultant summarized techno‑economic scenarios comparing large-scale solar plus batteries against continued reliance on diesel engines. Presenter Mister Tenorio, the IRP consultant from GHD, summarized projected net present values (NPV) in the slides: “the net present value, we’re looking at, negative 86,000,000 with the solar…if it was business as usual with…diesel generators, we’re looking at negative $202,000,000” for Saipan over the modeling horizon. For Tinian the slides showed an NPV of about negative $31,000,000 with solar versus negative $128,000,000 under business as usual; for Rota the NPV figures were about negative $46,000,000 with solar versus negative $80,000,000 for business as usual.

The consultant also presented system-size examples the IRP used for planning: Saipan modeled roughly 60 megawatts (MW) of solar and 48 MW of battery energy storage (BES), Tinian about 8 MW of solar and 3 MW of BES, and Rota about 3 MW of solar and 2 MW of BES (all by the IRP target year). Tenorio described those as an illustrative optimization rather than final project authorizations.

Grid operations, capacity and reliability concerns

Director Watson of CUC said the system’s derated (available) capacity is lower than nameplate because several diesel units need repair or replacement and that Saipan is at “critical status” for adequacy. Watson said a temporary leased generator (Greco) is currently supplying a minimum of 12 MW but that the Greco lease contract ends in May and “it can’t be renewed,” so CUC plans to issue an invitation for bids (IFB) to ensure replacement capacity is available by that time.

Procurement approach, short-term tasks and timelines

Both Tenorio and Director Watson told senators the short-term work plan includes issuing procurement documents and follow-up stakeholder steps: develop an RFP to engage independent power producers (IPPs) for renewable projects, issue an IFB for new diesel generation to replace aging engines, finalize the 20 MW solar design (the design was described as roughly 40% complete), hold additional stakeholder workshops, present a final IRP to the CUC board, and release the IRP for public comment. Watson said staff expect to put the RFP and IFB out “within the next few months.”

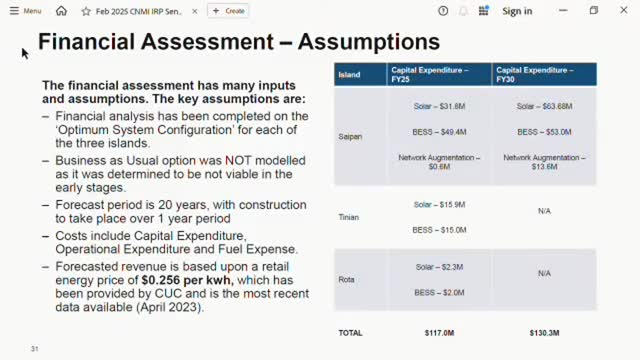

Funding, cost estimates and alternatives

Watson gave a program-level cost estimate and funding options. He summarized total estimated investment across the three islands at about $700 million and presented an alternative cost estimate to replace all diesel engines at about $432 million (to be phased). Because CUC does not have cash on hand for those sums, Watson discussed two main financing paths: public‑private partnerships (PPPs)/IPPs (where a private partner finances and constructs projects under a long-term energy purchase agreement) or borrowing through a U.S. Department of Energy (DOE) loan/line-of-credit program that would require legislative approval.

Watson said the DOE loan option could reduce near-term rate impacts because interest would be charged only on drawn amounts and because more efficient new engines could cut fuel use. He also described a $3,396,000 DOE grid-resiliency grant award (subject to final DOE guidance) that requires roughly one-third local matching funds and listed candidate projects for that award.

Regulatory and policy pieces

Watson and Tenorio noted procurement must follow CNMI law cited in the briefing: renewables will be procured via RFPs and new diesel generation via IFBs consistent with Public Law 17‑34 (which amends Public Law 16‑17) and other applicable requirements. CUC staff said they are coordinating with technical reviewers (including NREL) to refine bid documents and with the Public Utilities Commission and other stakeholders on reconciliation and net‑metering policy updates.

Senators’ questions and technical context from Guam

Several senators asked technical and implementation questions. Senator Castro suggested the plan should examine distributed options (rooftop solar and microgrids) in addition to centralized farms and raised aviation siting concerns near airports. Senator Frank Cruz pressed whether 2022 data used in modeling remains valid given population and commercial changes; Tenorio said updated data were received “actually yesterday” and will be reviewed. Senator Simon Sanchez described Guam’s experience with utility‑scale solar and battery storage, saying the Guam program achieved materially lower bids and that batteries allowed shifting cheaper solar energy to peak evening hours; he described the Guam results as the practical learning the CNMI should adapt.

Other operational and program notes

Watson outlined several concurrent CUC efforts: net‑metering policy revision (contracted to etronymus.com), a cost-of-service study and 10‑year budget inputs, a Department of Defense-funded energy/water/wastewater/telecommunications master plan, hazard‑mitigation pole and underground distribution projects, and an anaerobic‑digestion study for wastewater sludge that could produce methane for onsite generation.

What’s next

CUC management and the IRP consultant said they will (a) complete the 20 MW solar designs and finalize RFP/IFB documents, (b) present the final IRP to the CUC board and release it for public comment after board review, and (c) pursue parallel funding options including PPP bids, DOE loan programs and grant funding. Watson flagged that a DOE loan would require legislative authorization before CUC could draw funds.

Quotes from the hearing

“Mister Tenorio” (IRP consultant, GHD): “the net present value, we’re looking at, negative 86,000,000 with the solar…if it was business as usual with…diesel generators, we’re looking at negative $202,000,000.”

Director Watson (CUC): “Saipan power generation condition is at a critical status…Greco…providing 12 megawatt…their contract ends this May, and it can’t be renewed.”

Senator Simon Sanchez: “40% renewables would mean we would be able to get 1.2 megawatts of your 3 megawatts provided by a renewable source.”

Ending

CUC and its consultant portrayed the IRP as a road map not a final set of contracts; the next concrete public steps are additional stakeholder workshops, the final IRP to the board, public comment on the IRP, and the issuance of RFPs and IFBs in the coming months. The Greco lease expiry in May and the need to ensure replacement capacity before that date were emphasized as urgent near‑term tasks.