Ogden City asks district to consider larger Adams CRA budget; board requests cash-flow projections

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

City economic development staff outlined a proposal to increase the Adams Community Reinvestment Area (CRA) investment pool and described potential redevelopment projects; the school board asked for a year-by-year cash-flow analysis before deciding whether to join the revised funding plan.

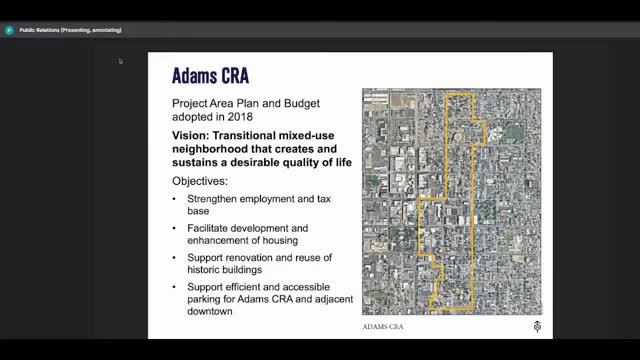

Ogden City officials told the Ogden City School District Board they want to increase the investment capacity of the Adams Community Reinvestment Area (CRA), citing recent private development interest and pending restoration projects in the downtown arts district.

David Sawyer, deputy executive director in Ogden City—ommunity and Economic Development, told the board the city is proposing to increase the CRA—udget from a previously projected $10,800,000 in increment to $30,500,000. "What we're proposing to do is amend the ADAM's CRA budget ... increase the budget from 10,800,000.0 to 30,500,000.0," Sawyer said.

Why it matters

The Adams CRA covers an area east of Washington Boulevard within the 9 Rails Arts District and has already supported projects city officials described as successful, including the Monarch development, Perry Lofts, Stonehill Homes and recent for-sale townhomes. The proposed change would give the redevelopment agency more money to offer incentives, finance infrastructure or help restore historic buildings. Because school districts share the property-tax base with municipalities and counties, changes to CRA arrangements affect future property tax revenue available to the district.

What the city presented

City staff said completed projects in the CRA already include new housing and public improvements in an area the city calls a mixed-use, arts-focused neighborhood. City presenters highlighted a set of projects in planning or early stages: the historically significant Forest Service Building (recently purchased by the city with the intent to restore and return it to productive private use), work needed to stabilize the old First Security Bank/Cache Valley Bank landmark, and conceptual restoration of the former Bigelow Hotel into hospitality use. City staff said some proposed new housing in the area has already sold quickly and that certain pipeline projects depend on additional CRA support.

Proposed participation changes and projected returns

Sawyer described a proposed structure in which taxing entities (the city, county and school district) would maintain their current participation rates through year 10 of the district plan (2028), then reduce the county and school district participation to 75% in later years. He said the change is intended to bring incremental valuation increases to taxing entities sooner rather than later and to increase the total pooled increment the RDA can use now.

Board response and requests

Board members asked for more precise, year-by-year forecasts and clear explanations of what the extra money would be used for. One board member asked that the city provide a literal cash-flow analysis showing projected annual tax increment and the district's projected share under the current agreement and under the proposed revision. "Could you simplify that too perhaps? ... just show us the cash flow that you project based on that throughout that period," a board member said.

City staff agreed to provide those projections and said they had run preliminary calculations; they also said partners outside the district (the county and Ogden City Council) had already discussed the proposal.

No formal board vote

The board did not take formal action on the CRA amendment at the meeting. City staff said they planned to return with a formal amendment and requested that the district let them know whether the board would like additional work sessions or a consent-calendar review before an eventual vote.

Ending

Board members asked the city to provide detailed cash-flow charts, prior CRA outcomes and specific project-level uses for the increment funds before the board considers approving the proposed budget increase.