Committee advances bill to recognize gold and silver bullion as legal tender in Oklahoma

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

House Bill 1199, companion to the depository bill, would recognize gold and silver bullion as legal tender for transactions in Oklahoma; lawmakers debated tax and contract implications and a possible AG staffing cost estimate.

A House committee advanced House Bill 1199 on March 1, a proposal to recognize gold and silver bullion as legal tender in Oklahoma while noting the measure would not compel private parties to accept it.

Sponsor Representative Cody Maynard said the bill ‘‘recognize[s] gold and silver bullion as legal tender in Oklahoma, but it does not compel anyone to accept it as a form of payment.’’ He told members the change would clarify that bullion — not only government-minted coins — could be used in contracts and transactions and be treated consistently under state law.

Members pressed how the change would interact with taxes, courts and contract enforcement. Representative Bennett framed the measure as removing a tax consequence for people who buy and later sell bullion; Maynard responded that current capital-gains treatment can penalize holders who later sell bullion and that the bill seeks legal clarity for privately executed gold contracts.

Representative Lappack and others asked about litigation and enforcement; Maynard said the Attorney General’s office had included a projected $300,000 cost ‘‘in case they have to enforce contracts in gold’’ and that the bill would give the attorney general and courts clearer statutory standards for adjudicating gold-denominated contracts.

Committee members also asked whether the law would prevent private parties from accepting gold today; Maynard said ‘‘there’s nothing that stops somebody from doing it’’ now and that the bill ‘‘provides clarity for how it can be done’’ and extends that clarity to bullion outside of U.S.-minted coins.

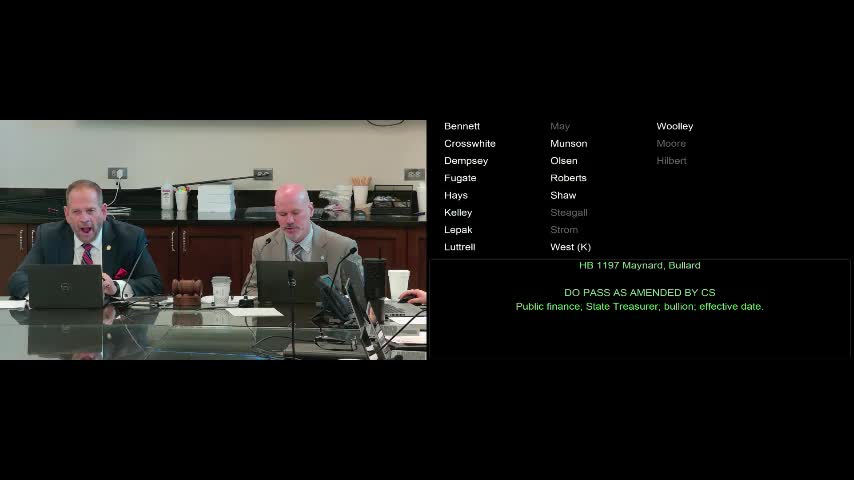

The committee voted to report the bill out do pass by a 12-4 margin.