DHSS outlines $5.27 billion FY2026 request, highlights Medicaid growth and targeted door-openers

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Delaware Department of Health and Social Services presented the governor's recommended FY2026 budget—totaling $5.27 billion—calling out Medicaid growth, hospital tax authority, and several ‘‘door opener’’ program requests across public health, developmental disability services and social services.

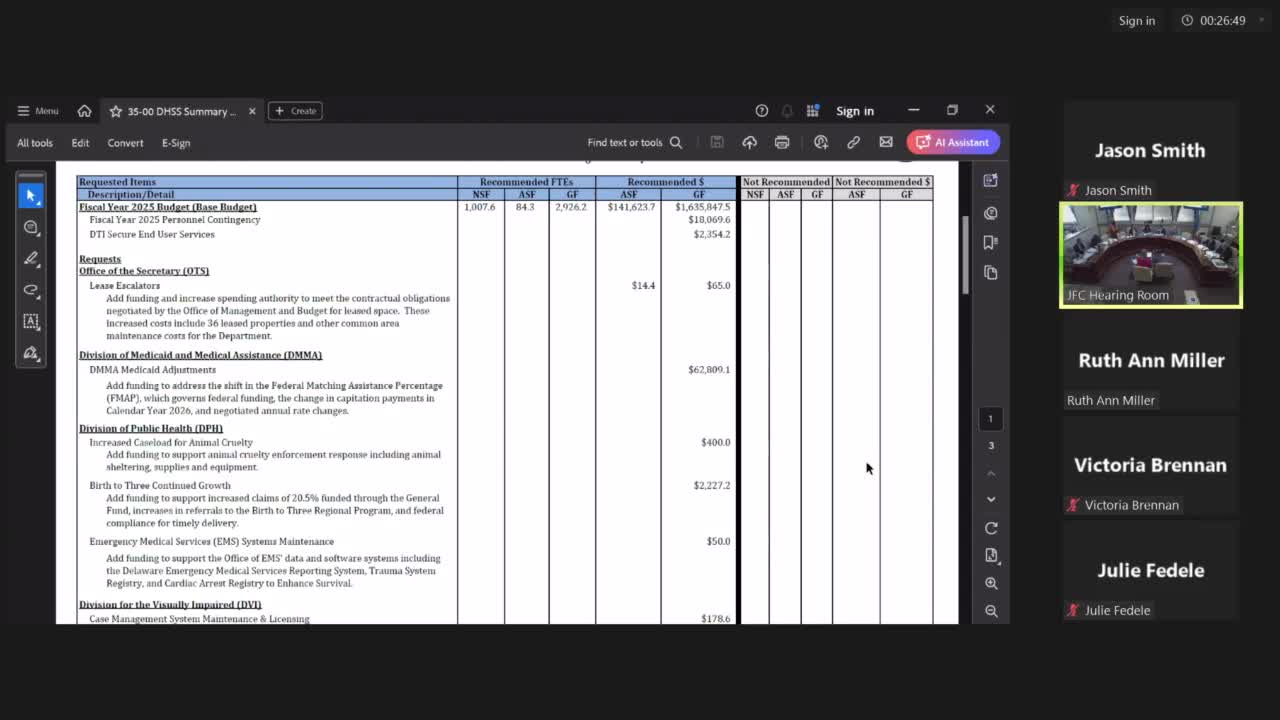

The Delaware Department of Health and Social Services told the Joint Finance Committee on May 20 that its FY2026 governor's recommended budget totals $5,265,038,800 across general, appropriated special and non‑appropriated special funds.

The most visible line items are $1,756,255,400 in general funds and $175,837,500 in appropriated special funds for the department's FY2026 general revenue budget, Secretary Josette Manning said during the agency presentation. She highlighted large Medicaid-related increases and a set of departmentwide contingencies intended to support hospitals and long‑term care.

Why it matters: DHSS is the state's largest human‑services agency; changes to its budget affect hospital payments, long‑term care and community services for thousands of Delawareans. Several funding requests are aimed at responding to rising use and cost pressures in Medicaid and community‑based programs.

What the recommended budget includes - Medicaid growth: The governor's recommendation reflects substantial Medicaid increases and other program growth; the Division of Medicaid and Medical Assistance (DMMA) shows an FY2026 request for additional state dollars to cover federal match changes, managed‑care pricing and caseload growth. DMMA estimated an $85.5 million state request to address inflation, volume, and new benefits. - Hospital provider contingency and tax: The recommendation assumes collection authority tied to Senate Bill 13 (a hospital quality/tax measure) that would create a hospital provider assessment. The draft GRB includes $40 million in anticipated hospital provider assessment revenue to be used in accordance with that statute. The department said statutory constraints and pending federal guidance affect how those dollars could be reinvested. - Door openers and one‑time items: Noted additions include $1.5 million in one‑time hospital provider contingency funds, $1,131,300 for Direct Support Professional rate adjustments in developmental disability services, and allocations for community placements and other program annualizations.

Context and limits: Manning and agency directors repeatedly warned of federal uncertainty. DMMA noted several possible federal policy proposals — from changes to FMAP to new caps or restrictions — that could materially change state costs. The department asked the committee to proceed cautiously on program commitments that depend on federal policy or tax collections.

What lawmakers asked: Committee members pressed for greater detail on FMAP exposure, the expected timing and uses of hospital assessment dollars, and on the agency's plans if federal policy changes reduce the federal match. Manning and division directors agreed to provide follow‑up analyses and clarifying line‑item detail on request.

Next steps: Agency directors will return to answer program‑level questions during subsequent hearings and will provide requested line‑item detail and impact estimates on the hospital assessment, federal match scenarios and the department's door‑openers.