Committee hears experts urge tougher screens on outbound investment and stronger economic offers to counter China

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Witnesses and members debated how to strengthen U.S. economic engagement in East Asia and the Pacific, including market access limits of IPEF, bilateral trade options, critical-minerals partnerships, outbound investment screening (COINS/administrative orders) and measures to curb Chinese intellectual-property theft.

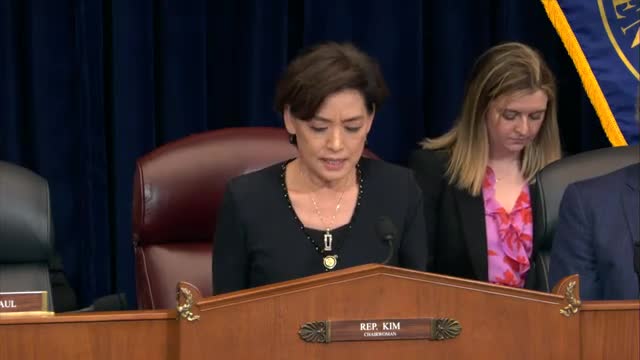

Chairwoman Sharon Kim opened the hearing asking whether U.S. economic engagement "has been aligned with the demands and needs of our partners." Members and witnesses answered with a mix of urgency about enforcement and proposals for positive economic initiatives.

Nut graf: Witnesses and lawmakers argued that the Indo‑Pacific Economic Framework lacks U.S. market access and that the United States needs both new economic offers (sectoral or bilateral deals) and stronger defensive tools — outbound investment screening, targeted export controls and enforcement actions — to deny China sensitive technology and reduce coercive dependency.

Craig Singleton criticized recent approaches that emphasized diplomacy over deterrence and argued for "robust outbound investment screening and bans accompanied with enhanced export controls and targeted sanctions" to deny Beijing access to U.S. capital and dual‑use technologies.

Members pressed witnesses on specific tools. Representative Andy Barr and others highlighted the COINS Act (outbound investment screening legislation) and President Trump's executive order on outbound investment screening. Barr asked whether Congress should codify those powers; Singleton endorsed statutory action, saying codification is "vital" even where executive action is in place.

Trade options were debated. Jack Cooper recommended sectoral or bilateral agreements—digital trade chapters or critical-minerals and Taiwan‑related security support—to give partners tangible U.S. economic benefits. Richard Fontaine said the Indo‑Pacific Economic Framework "lacked any market access in the United States" and suggested bilateral sectoral deals (digital trade, critical minerals) or eventual free-trade agreements with partners such as the Philippines or Taiwan.

Intellectual property and academic-security concerns were raised. Members cited an FBI estimate in hearing discussion that the Chinese Communist Party steals up to $600,000,000,000 in U.S. intellectual property annually. Witnesses recommended stronger academic partnership screening and enforcement; Singleton referenced the recently reintroduced Deterrent Act to require universities to report certain entanglements with Chinese entities.

On critical minerals and supply chains, members and witnesses recommended combining sourcing and processing, using DFC and aid tools to incentivize private investment, and working with allies (Japan, Korea, Australia, Indonesia) through the Mineral Security Partnership and related programs.

Ending: The committee heard bipartisan support for twin strategies: (1) offer partners clearer market access and targeted bilateral/sectoral agreements to make the U.S. the partner of choice; and (2) codify outbound-investment screening and strengthen export controls and sanctions to protect critical technologies and intellectual property.