Michigan land‑bank official tells Vermont committee statewide or state‑supported model can help rural communities

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

James Tishler, who runs Michigan's state land bank, told the Vermont Senate committee that a state‑level land bank can provide capacity, funding tools and technical assistance to help towns repurpose blighted and tax‑foreclosed properties; he described Michigan’s funding model and recommended the department return legislative options.

The Senate Economic Development, Housing & General Affairs Committee heard testimony on April 18 about land banks and options for Vermont, led by James (Jim) Tishler, who runs Michigan’s state land bank.

Tishler told the committee that land banks are public or quasi‑public entities that acquire, clear title to, and rehabilitate or transfer blighted, contaminated or abandoned properties to productive uses. He described Michigan’s experience: a state‑level land bank created by statute in 2003, an initial funding mechanism generated by sale of transferred state parcels producing about $2 million, an inventory of roughly 2,600 properties statewide, and a funding tool where half of property taxes on sold properties are diverted to the land bank for five years (a “5‑year, 50%” tax capture mechanism). Michigan pairs land banking with project‑based tax increment financing (TIF) to underwrite predevelopment and due‑diligence costs.

“Land banking is excellent,” Tishler said, but its effectiveness depends on capacity: rural areas often need state involvement to support local projects. He said typical timelines vary: properties ready for development can move in two to three years; redevelopment and brownfield remediation can take five years or longer. Tishler estimated Michigan had moved roughly 500 properties to productive reuse and generated multiyear, multi‑million‑dollar valuation increases, and said job creation from those projects runs into the hundreds.

Committee members asked implementation questions: how properties enter a land bank (tax foreclosure, environmental enforcement or transfers), whether eminent domain is used (Michigan’s constitution prohibits taking property via eminent domain for this purpose), and how initial funding was sourced. Tishler summarized Michigan’s approach: a combination of property transfers, foreclosure inventories and sale proceeds; legislative authorization for tax capture on subsequent sales; and project‑based TIF as a complementary funding source.

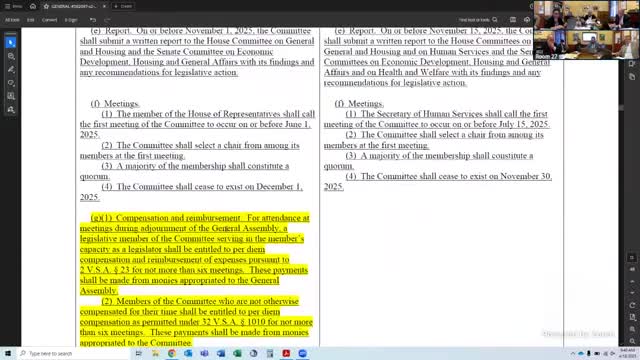

The bill text the committee reviewed asks the Department of Housing and Community Development to produce a report by November 1 that would propose legislative language for a statewide land bank, options for regional or municipal land banks and funding proposals for each model. Committee members said the department’s earlier studies had described the benefits of land banks but did not include specific legislative proposals. The committee asked Tishler and department staff to continue the conversation and for staff to summarize options and draft legislative language in the requested report.

Why it matters: land banks can help towns remedy title problems, consolidate and rehabilitate blighted properties, and generate housing and economic development—particularly in regions where local capacity or funding is limited. The committee signaled it wants a formal analysis comparing statewide and regional models and potential funding tools before deciding whether to proceed with authorizing legislation.