Committee reports K–12 property-tax and revenue growth bill after heated debate; several voter-protection amendments rejected

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Proposed substitute House Bill 2,049, which would change the revenue-growth limit for property taxes to incorporate inflation and population and alter several K–12 funding calculations, was reported out of the Finance Committee with a due pass recommendation after contested debate; staff announced a 9-6 vote in committee.

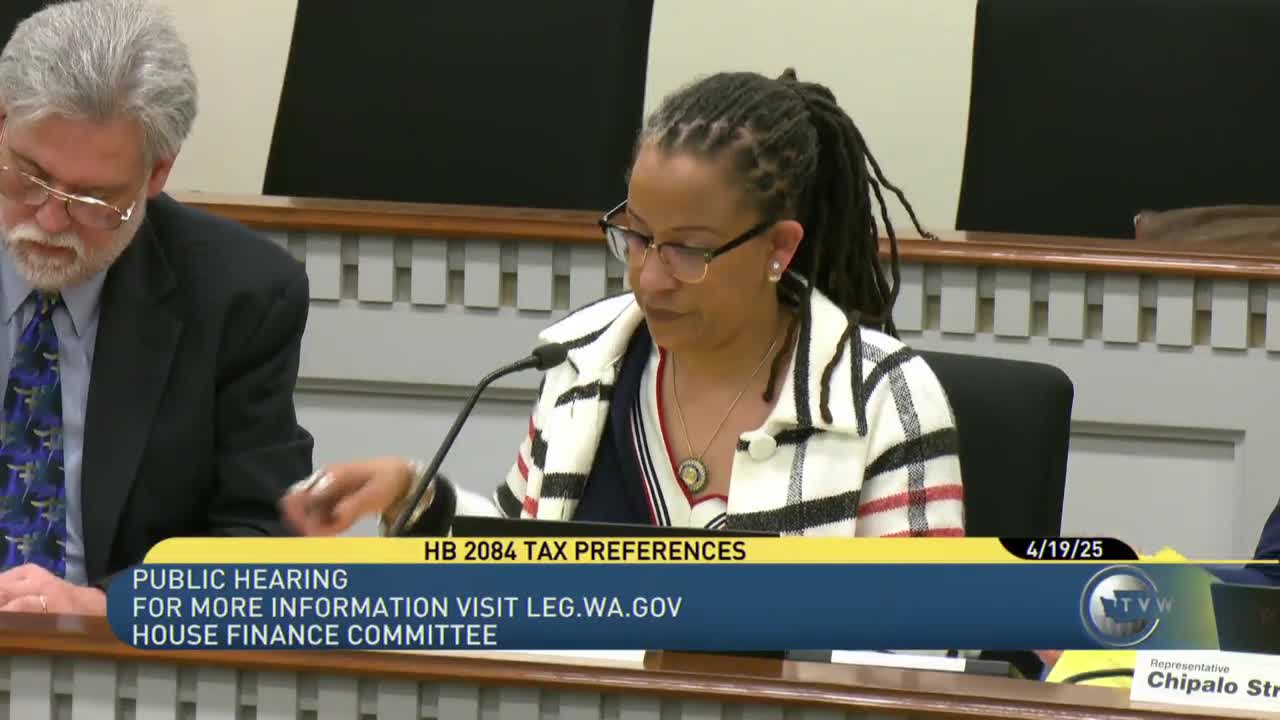

The House Finance Committee on Saturday voted to report proposed substitute House Bill 2,049, a multipart measure addressing K–12 education funding and adjustments to property tax limit calculations, after extensive debate and several rejected amendments. The substitute would change how the revenue growth limit is calculated for taxing districts by replacing a flat 1% factor with a formula that includes population change and inflation, subject to a 3% cap, and would adjust certain components of education funding calculations.

As briefed by committee staff, the substitute modifies the definition of inflation for the revenue growth limit to the Consumer Price Index change, excludes state population in some district population-change calculations, changes the county road fund levy population calculation to full-county population, and adjusts the revenue growth limit formula to 101% plus population change and inflation (retaining an overall 103% cap). The substitute also removed special-education adjustments and lowered some inflation enhancements to local effort assistance per-pupil thresholds.

Amendments included proposals to require that increased revenues supplement rather than supplant existing school funding, to remove population change from the limit factor, to eliminate adding new construction as an add-on value when calculating levies, to require voter approval before districts levy more than the new limit factor for the first time, and to send the bill as a statewide voter measure. Several of those amendments were considered and not adopted. Representatives debating the bill split over whether raising the limit factor would address school funding shortfalls or would shift more burden onto local taxpayers; opponents warned of double-counting population growth and of the impact on homeowners, expressing concern for elderly and fixed-income households.

On the roll call, staff read individual member votes; the final tally announced by staff was 9 ayes, 6 nays, 0 excused. The committee reported the substitute with a due pass recommendation and will forward it for further floor consideration. Debate indicated some members want voter referral on the question of changing long-standing local revenue-growth limits; others argued local governments need the flexibility to fund public-school capacity and that the change improves equity in state–local funding for education.