Committee advances House bill exempting counties from certain motor-fuel taxes

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The committee referred House Bill 1109 (in lieu of Senate Bill 935) to the full Senate with a recommendation to pass; the bill would exempt county government vehicles from certain motor-fuel taxes or provide a credit authority, as presented by the sponsor.

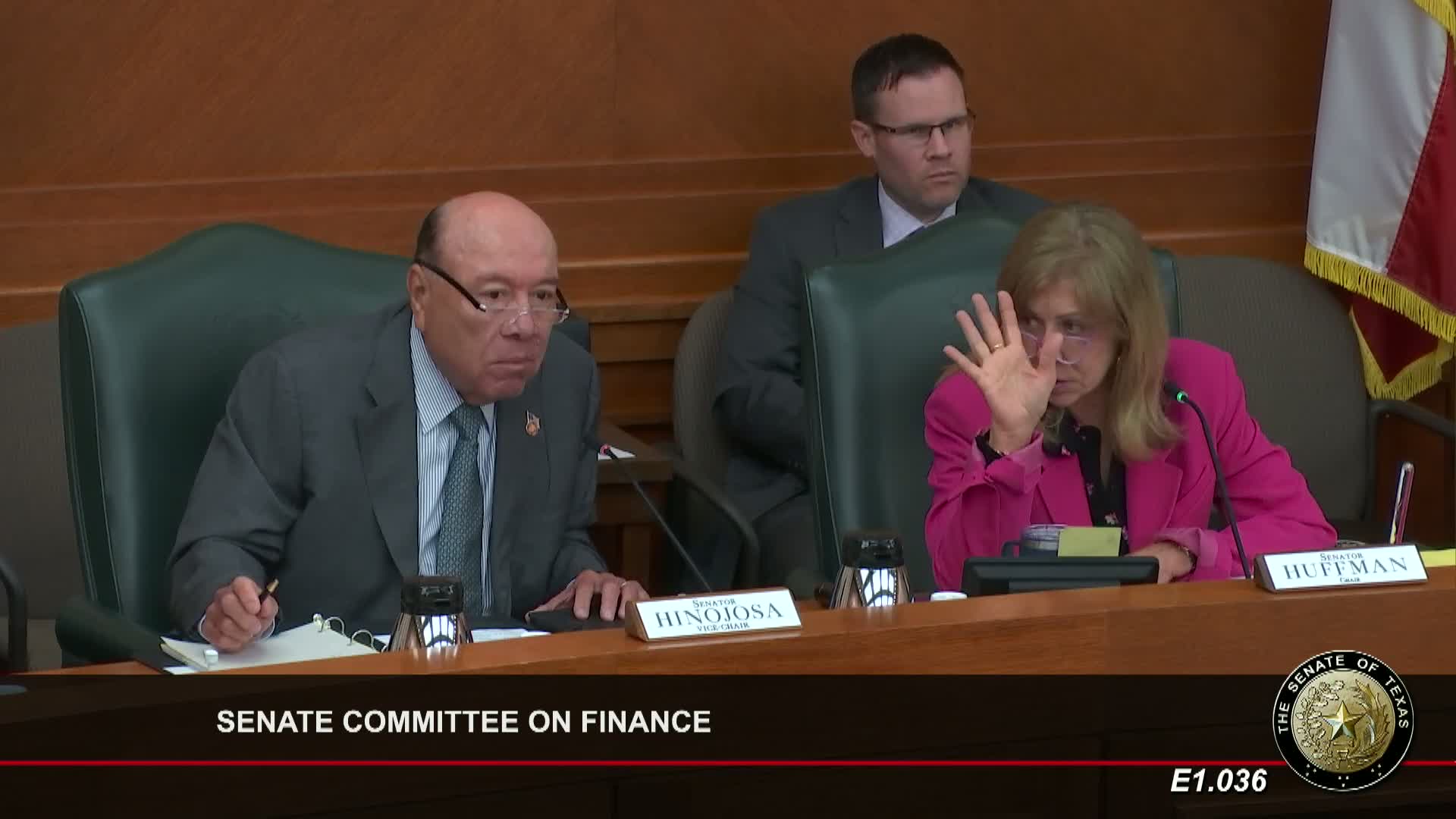

The Senate Committee on Finance on Oct. 12 referred House Bill 1109 (the House companion to Senate Bill 935) to the full Senate with a recommendation that it pass. Sponsor remarks described the measure as providing an exemption or credit so counties would not have to pay motor-fuel taxes on vehicles used in county government operations.

Senator Hall explained the bill as creating an exemption for government agencies—counties and, in some descriptions, cities—so they would not be charged motor-fuel taxes for fuel used in county-owned vehicles. Committee members discussed procedure and timing; no public testimony was recorded during the segment of the transcript covering this item.

The clerk recorded a roll-call vote of 11 ayes and no nays, and the chair ordered the bill reported favorably to the full Senate.