Neighborhood Partnerships and partners urge larger tax credit for Individual Development Accounts to avoid program cutbacks

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Advocates told the Senate committee that Oregon's tax credit that funds Individual Development Accounts (IDA) is capped at $7.5 million and has not kept pace with inflation; they asked lawmakers to raise or supplement the cap to avoid a 50% program reduction and to preserve statewide reach.

Staff presented an overview and multiple witnesses testified April 23 in an informational meeting about Oregon's Individual Development Account (IDA) initiative, which matches participant savings and is funded in part by a state tax credit for donors.

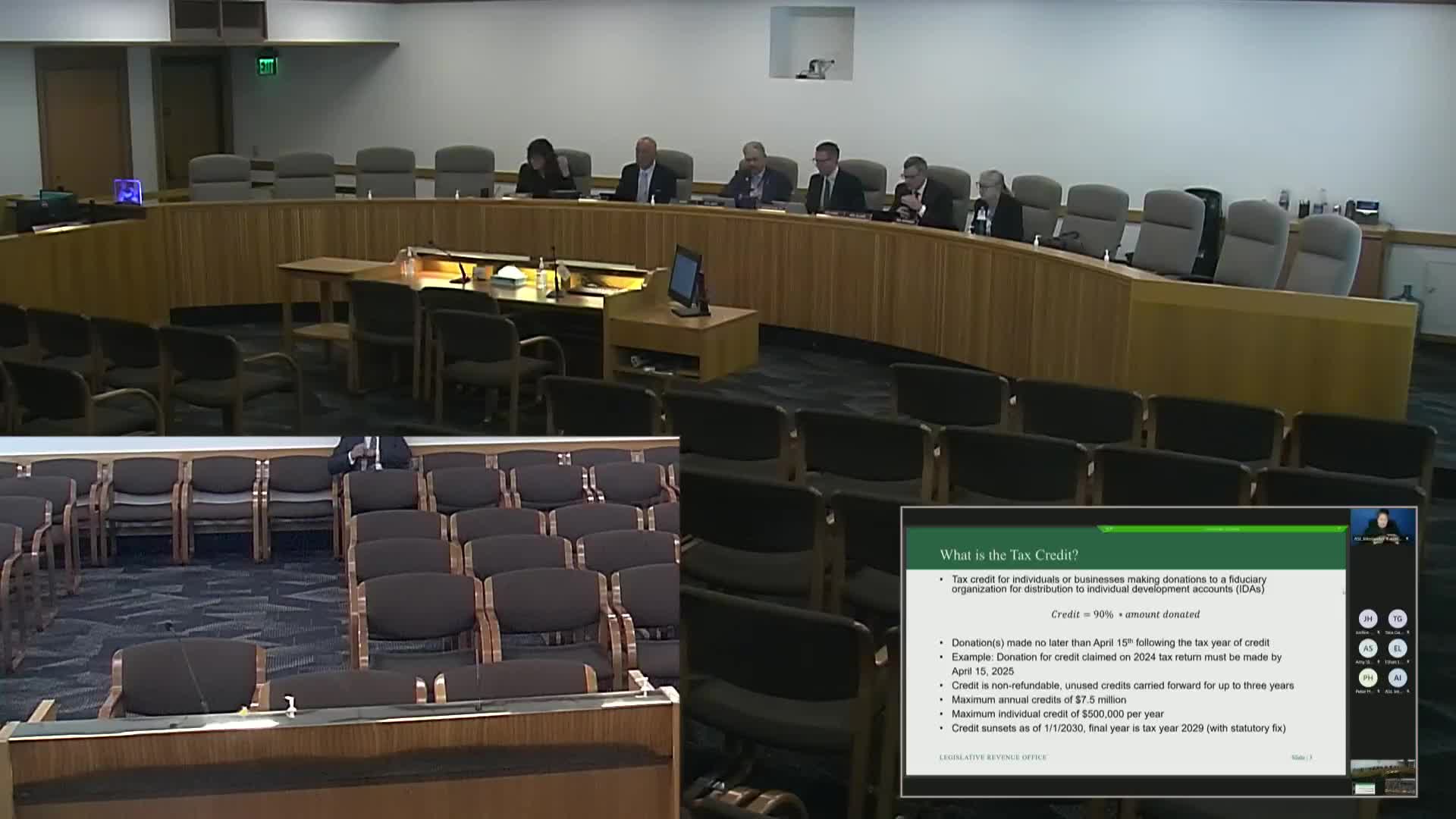

A staff presenter explained the current tax credit: donors receive a credit equal to 90% of the amount donated; the credit is nonrefundable, can be carried forward three years and currently has an annual cap on credits of $7,500,000 (allowing roughly $8.3 million in qualifying donations per year). The presenter noted the credit sunsets in 2030 as currently scheduled.

Ethan Livermore, economic justice organizer with Neighborhood Partnerships, said the IDA program has helped more than 19,000 Oregonians over 25 years but the $7.5 million cap has not changed since 2009. "If the legislature does not act this year, the program will shrink by 50% and will only enroll fewer than 500 people each year," Livermore said. He asked the Legislature to either dedicate lottery revenue (House Bill 3809, referenced in testimony) or raise the tax credit cap (House Bill 2735, referenced in testimony) to stabilize funding.

Justice Alexander Hager, Development and Communications Manager for Neighborhood Partnerships, described the program mechanics: IDAs match participant savings (commonly up to 5:1) for goals such as homeownership, starting a business, postsecondary education, vehicle purchase and retirement savings. He said Neighborhood Partnerships has administered the program under contract with Oregon Housing and Community Services since 2003 and that donors and CPAs are important referral sources and proponents.

Amy Stuczynski, Neighborhood Partnerships' manager of data and evaluation, provided program outcomes and stewardship details: the organization oversees an investment policy reviewed by OHCS, runs performance and fiscal reviews of fiduciary organizations, and supports a network of more than 60 IDA providers statewide. She said $29,000,000 saved by IDA participants has been matched by $72,000,000 from the state over the last decade and that savers show improved financial stability and outcomes relative to national averages.

Peter Haney of CASA of Oregon and Tara Garkow, an IDA participant and employee of Homes for Good Housing Agency, offered brief testimonials about program reach and individual impact; Haney said CASA has delivered about 6,700 IDAs and that 30% of his work is rural; Garkow said using an IDA enabled her to become a homeowner.

Witnesses and staff referenced pending bills. Testimony named House Bill 3809 (dedicate lottery revenue) and House Bill 2735 (raise the cap); a committee member also cited a bill referenced in the hearing materials that would increase the cap from $7,000,000 to $16,500,000 and noted that the measure had passed a committee and was at House Revenue at the time of the hearing.

No committee action was taken; the session was informational. Supporters asked lawmakers to act in 2025 to avoid program contraction and to stabilize long‑term funding.