Legislature approves excise tax on nicotine pouches after full-day debate

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

The Nebraska Legislature passed LB9, creating a wholesale excise tax on alternative nicotine products including nicotine pouches, after several hours of debate over tax fairness and public health. The bill passed on final reading following a failed attempt to delay consideration.

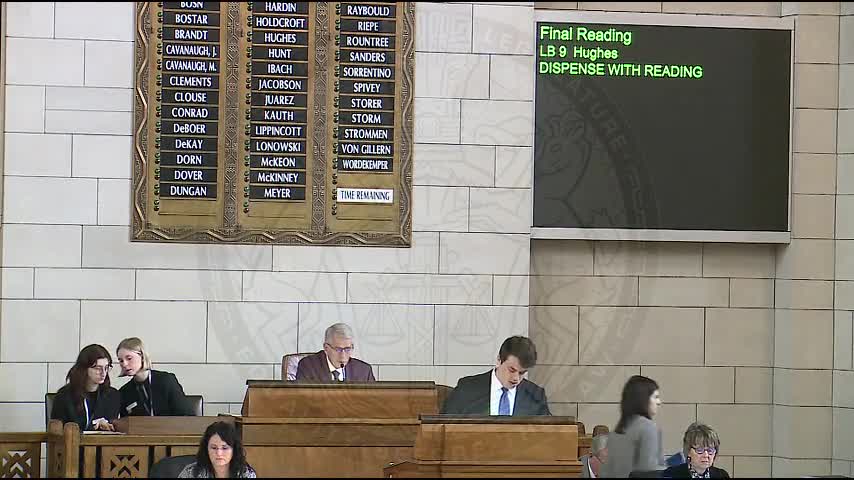

Nebraska lawmakers passed LB9 on final reading on April 24, 2025, creating an excise tax on alternative nicotine products such as nicotine pouches.

Supporters said the bill closes a tax gap between newer nicotine products and traditional tobacco products and uses a wholesale-percent approach to capture novel product forms; opponents called the measure a regressive tax that would disproportionately hit younger and working Nebraskans.

Senator Machaela Conrad, who led an unsuccessful motion to postpone consideration, argued the body should evaluate revenue and tax policy choices together as the Legislature addresses a larger budget shortfall. "It's a regressive tax increase and we can have legitimate points of view about how we should move forward," she said during floor debate. Senator Kathleen Hughes, sponsor of LB9, said the bill is meant to bring parity to nicotine products and to tax whatever new delivery systems industry develops: “The percent wholesale tax ... is the right way to go to tax these products and any new products in the future.”

Supporters including Senator John Kavanaugh said the bill put novel products on parity with taxed tobacco goods and noted other states levy wide-ranging excise rates on similar products. Opponents — including Senators Stroman, Grama and Ballard — said the increase would hit younger Nebraskans and working families and could push some buyers across state lines where those products may be untaxed. Senators in the debate also disputed whether the measure was primarily a revenue bill or a public-health parity bill.

The bill drew floor amendments and a failed motion (FA136) to return the bill to select file. After the at-large reading was dispensed with, the roll call on final passage recorded 34 ayes and 10 nays with five senators excused; the clerk announced, "LB 9 passes." The text as read by the clerk defines "alternative nicotine product" and revises multiple statutory sections to add excise-tax authority for those products.

As passed, LB9 imposes an excise tax at a specified percentage of wholesale on products the bill defines as containing nicotine but not being subject to existing tobacco excise rules; the measure also contains implementation language and conforming statutory changes. The bill was advanced and then passed on final reading; the Legislature’s Journal contains the full roll call and the enacted statutory cross-references.

Lawmakers said next steps include working with the Department of Revenue on implementation details and rate administration. The Legislature’s final roll-call record and the clerk’s journal entry supply the official vote and the bill text for the public record.

The clerk’s reading and roll-call record are the official action on LB9; the bill will proceed to the governor’s desk per constitutional process and implementation details will be handled by the Department of Revenue and affected retailers and wholesalers.