Committee clears technical changes to tax‑sale overhaul; lawmakers debate long‑term impact on local revenue

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Senate Bill 55, a technical cleanup to the recent tax‑sale reform that converts a certificate system to a lien system, was reported as amended after supporters said the changes clarify implementation; some senators expressed concerns about local revenue and market participation.

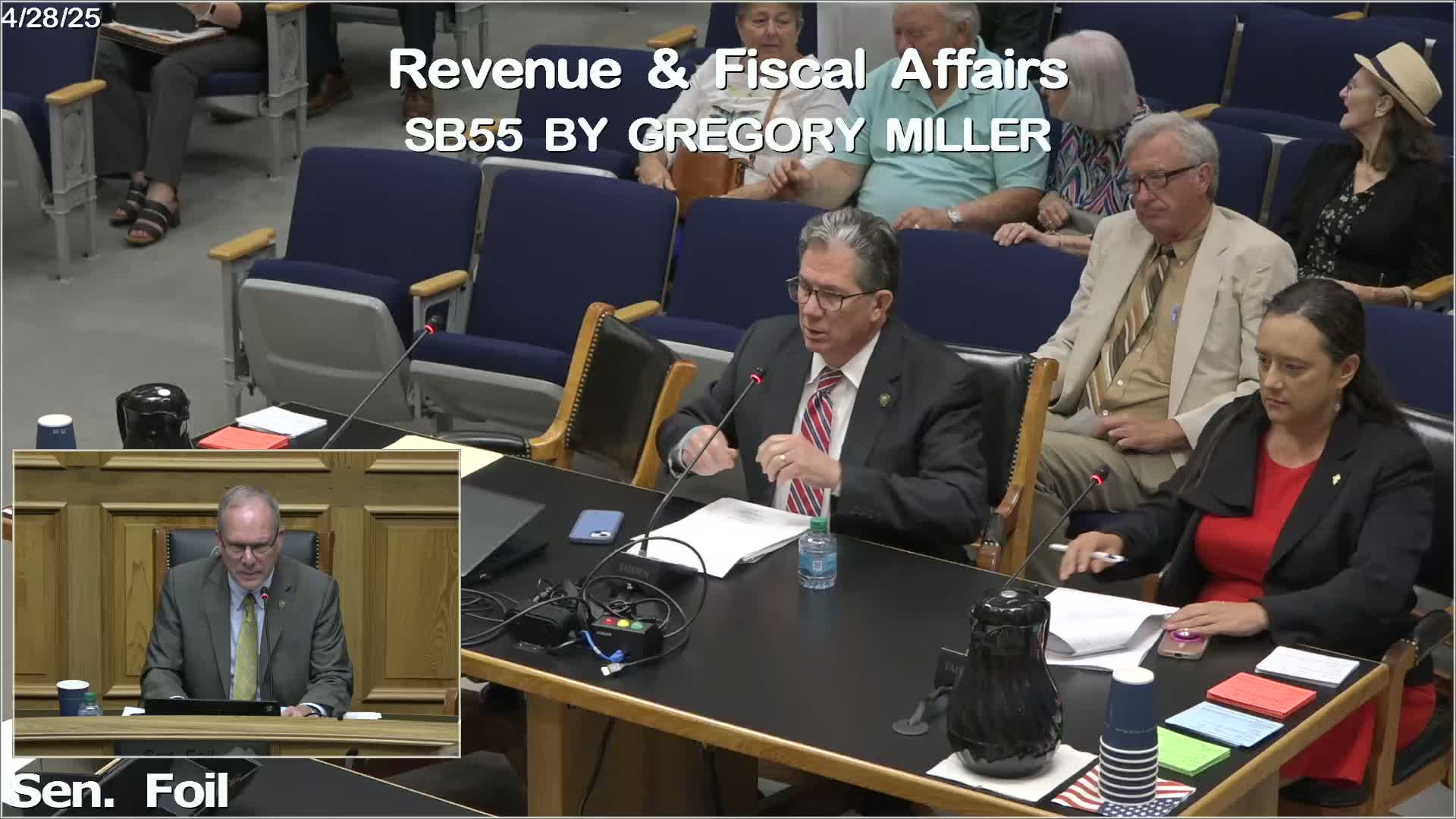

Senate Bill 55, a cleanup of last year's large tax‑sale reform, was reported as amended by the City Senate Committee on Revenue and Fiscal Affairs on April 28 after sponsors described technical changes intended to align statutory language with the constitutional amendment voters approved last year.

Senator Miller, sponsor of SB55, said the bill incorporates recommendations from the Louisiana Law Institute to "clarify, modify, or eliminate antiquated provisions of law consistent with the provisions of the act" and is intended not to change the substance of the reform but to fix inconsistencies, references and typos. He noted the bill is shorter than the version previously enacted because it focuses on clarifications.

The legislation follows the voter‑approved constitutional change that converted the state's tax sale process from one that issued certificates convertible to ownership to a lien‑based system. Under the revised law discussed in committee, tax lien holders may have up to seven years to convert a lien into a judgment; if no bidders appear at a sale, the municipality or parish can become the lien holder and pursue nonjudicial foreclosure or sell the lien. Sponsor counsel and industry witnesses told the committee the bill preserves protections for property owners, including existing redemption or extinguishment periods, while giving local authorities options to recover unpaid taxes.

Senator Lambert pressed whether the change could reduce local revenue because individual bidders might not participate if expected returns were lower; Miller and supporters said many of the procedural burdens that previously produced title problems are addressed by the reform and local governments retain several tools to return properties to commerce, including nonjudicial foreclosure, sale, or negotiation with lienholders. Robert Theriault of Lafourche Parish cautioned that some prior statutory simplifications had limited access to data he relied on for appeals and said litigation over valuation remained ongoing in his case.

Several proponents and stakeholders, including representatives from the Louisiana Land Title Association and private firms that participate in tax‑sale markets, said the amendments are largely technical. The committee adopted an amendment set labeled 515 and, without objection, reported SB55 as amended.

The sponsor said the state will monitor collections and market participation when the new system goes into effect; senators asked the fiscal and tax collection offices to track any measurable changes in revenue and property adjudication patterns next year.

The committee's action was procedural: the bill will proceed with the technical amendments for further legislative steps.