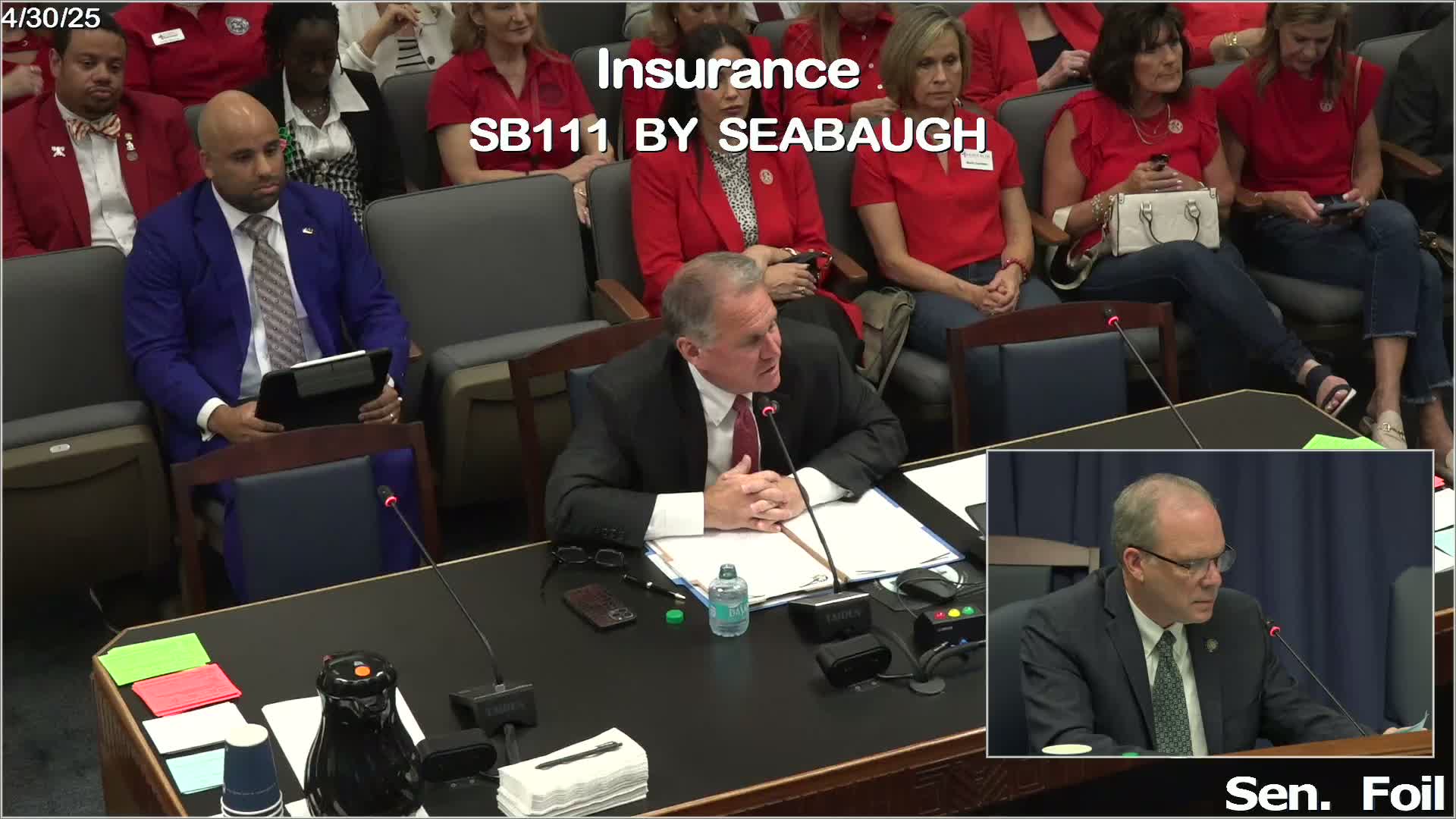

Committee backs bill to broaden insurance department authority to act against unlicensed fraud

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Senate Bill 199, offering expanded enforcement authority to the Louisiana Department of Insurance to address unlicensed insurance actors and online scams, passed the Senate Insurance Committee as amended.

Senate Bill 199, which would broaden the Louisiana Department of Insurance's authority to act against unlicensed individuals and deceptive insurance activity, was moved favorably as amended by the Senate Insurance Committee after testimony and amendments addressing due‑process and practice‑of‑law concerns.

Senator Michael Myers, the bill sponsor, told the committee the measure "seeks to enhance Louisiana Department of Insurance Authority to more effectively combat insurance fraud, thereby protecting and ensuring a fair competitive marketplace." Myers said the bill would amend multiple provisions in Title 22 to expand the definition of the business of insurance to include advertisements, claims resolution and other consumer‑facing interactions.

Representatives from the Department of Insurance described recent adverse rulings from the Division of Administrative Law that narrowed the department's ability to issue cease‑and‑desist orders, including rulings that limited authority to licensed entities and constrained investigations when a crime might be involved. Nathan Strubach, deputy commissioner for insurance fraud, described two cases the department challenged in which administrative rulings limited its enforcement; he told the committee, "Approximately 43 consumers testified that they had no intent to hire an attorney" in one matter and described seized documents, demands and checks the department identified during its investigation.

The committee adopted a staff‑drafted amendment (amendment set 775) intended to preserve due process, modernize electronic notice language, and exclude lawful legal practice from the bill's reach. Senator DuPlessis pressed for clearer limits to ensure the department could not substitute its judgment for the disciplinary authority of the state bar; department witnesses said investigations would remain focused on insurance fraud and that disciplinary matters for attorneys would be referred to the disciplinary board and Supreme Court as appropriate.

Senator Bass raised questions about artificial‑intelligence‑driven prior‑authorization denials and whether those systems could amount to fraud; Department of Insurance officials said the department has consumer‑services and market‑conduct mechanisms to investigate algorithmic or systemic denials and would pursue cases if misrepresentation, intent to defraud and materiality were present.

After the amendment and clarifying exchanges, the chair announced there were no objections and that Senate Bill 199 was "moved favorably as amended." The committee did not record a roll‑call vote in the transcript.

Votes at a glance: The committee adopted amendment set 775 and moved Senate Bill 199 favorably as amended by unanimous voice action recorded in the transcript.