Senate passes Fair Access to Financial Services Act after hour-long debate over ‘debanking’ and litigation risks

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

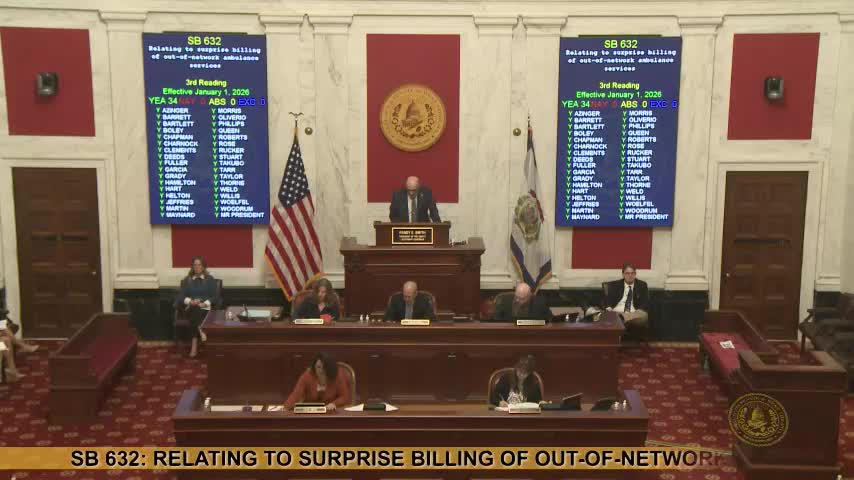

The West Virginia Senate passed Senate Bill 663, the Fair Access to Financial Services Act, on a 25-9 vote after extended floor debate over whether the law would invite lawsuits or protect residents from ‘‘debanking’’ by large financial institutions.

The West Virginia Senate on March 31 passed Senate Bill 663, the Fair Access to Financial Services Act, by a vote of 25 yays to 9 nays after more than an hour of floor debate over whether the measure would spur litigation against banks or provide necessary protections for customers who say they were closed out of accounts for political or reputational reasons.

The bill, described on the floor as designed to make it unlawful for an eligible financial institution to deny certain services on the basis of specified characteristics or views, creates a civil cause of action and authorizes recovery of damages, with statutory minimums discussed repeatedly in debate. “If the bank intended harm and that could be proven, it's 3 times actual harm,” said the senator from Wood in support, arguing the bill is a “freedom bill” to push back against what he called large banks’ reputational-risk policies. The senator from Jefferson recounted a constituent-level example and said, “We're not talking a Melania Trump... but a regular person. If it happened to you, it would be terrifying.”

Opponents warned the measure would invite “sue-and-settle” claims and place onerous burdens on financial institutions. The senior senator from the fourth said the bill would “significantly places an onerous cause of action on employers in our state, namely the banks,” and argued it risks reviving the kinds of private causes of action the Legislature removed in prior tort reform. The senator from Cabell pressed committee counsel and the bill’s sponsor on whether the law includes a fee‑shifting or “loser‑pays” mechanism; floor discussion clarified the bill permits recovery of attorney fees by prevailing plaintiffs and contains provisions allowing financial institutions to recover fees and costs where a claim is deemed frivolous.

Supporters repeatedly emphasized the bill targets only very large institutions. The junior senator from seventh noted, “this bill only affects financial institutions with total assets” at a high threshold — as discussed on the floor, institutions at roughly the $100 billion-asset level were the focus of the sponsors’ remarks. Supporters said that limitation reduces the bill’s scope to a small set of national banks.

The sponsor, identified on the floor as the junior senator from the fifteenth, closed debate urging passage and saying the bill “balances equities between the banks and the citizens of West Virginia.” The Senate approved the bill on a recorded vote, 25–9. The clerk was directed to communicate the action to the House.

Votes at a glance: SB 663 — Passed, 25 yays, 9 nays.

Why it matters: Supporters framed SB 663 as protecting individual West Virginians from sudden account closures and denials of financial services by major banks; opponents said it risks a wave of claims and litigation costs that could discourage investment or force higher insurance and banking costs. The bill sets up a new statutory remedy and will likely prompt litigation and questions about how courts will interpret standards such as “reasonable attorney fees” and what evidence meets the bill’s thresholds.

Next steps: The bill’s text as passed will be sent to the House for its consideration; if enacted, courts will be asked to interpret statutory damages, evidence standards, and fee‑shift provisions that were central to floor debate.