House roundup: bills on audits, radon disclosure, ethanol incentives and school oversight moved through floor

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

On April 3 the North Dakota House considered multiple Senate bills: it passed measures on auditor fees and exemptions, radon disclosure in real estate, a low-carbon fuels fund, several agency budgets, and pilot programs; it rejected a proposal to give the Department of Public Instruction new compliance enforcement powers for school districts.

The North Dakota House of Representatives completed a busy floor day on April 3, voting on a wide set of Senate bills that covered state auditing practices, real‑estate radon disclosure, ethanol incentives, agency budgets and school governance. Several bills passed with large majorities; measures that would expand DPI enforcement authority and a compact for school psychologists failed.

Why it matters: the bills collectively affect auditing procedures and fees, property transactions, ethanol industry funding and eligibility, state agency budgets, and services for people with disabilities. Some measures carry fiscal notes, appropriations or changes to how state funds are collected and distributed.

Votes at a glance (selected floor outcomes from the April 3 transcript):

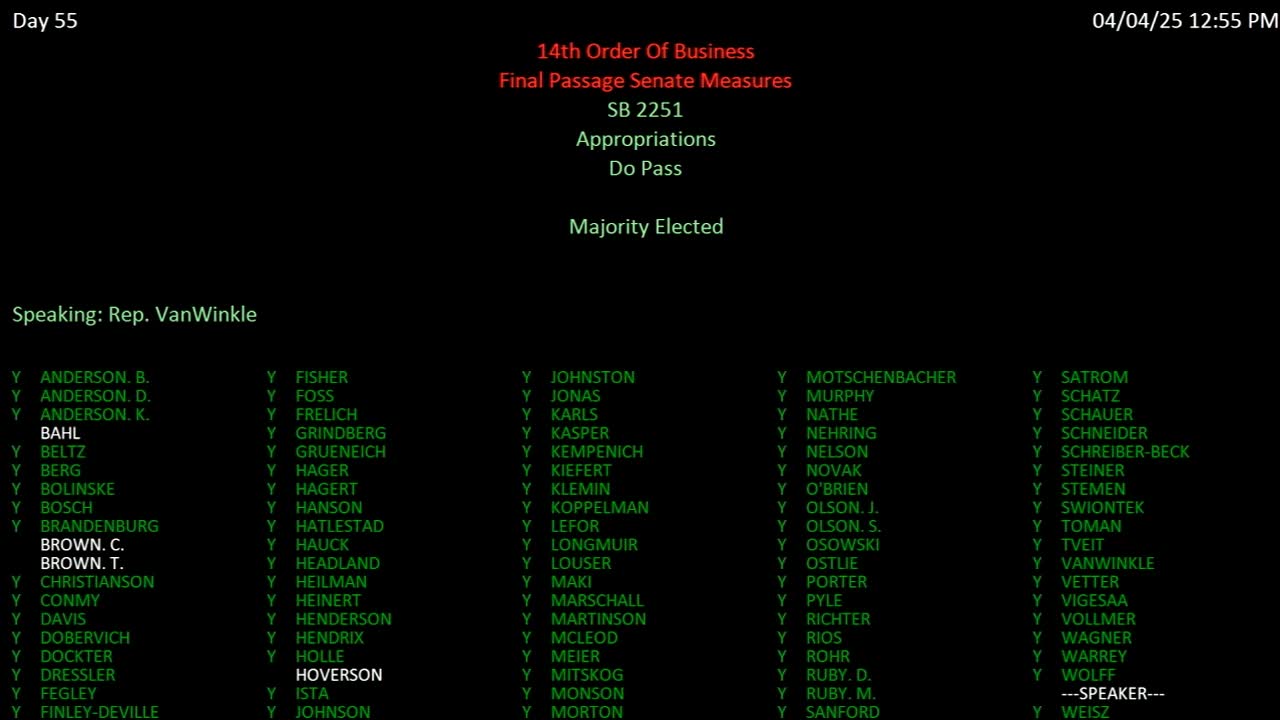

- Senate Bill 2251 (auditor audits and charges): Passed unanimously on final House consideration (90–0). The bill codified charging practices for certain federally required audits, reduced a local retention requirement from 20% to 5%, and adjusted thresholds for occupational and professional boards; the state auditor’s fiscal note estimated a $343,300 reduction in general fund revenues and matching reductions in other‑fund expenditures for the 2025–27 biennium.

- Senate Bill 2204 (required disclosure of radon hazards in property sales): Passed 87–3. The bill adds radon hazard disclosure language to the universal property condition statement used in transactions; the House Industry, Business and Labor Committee supported the measure.

- Senate Bill 2333 (low‑carbon fuels fund / ethanol incentives): Passed 65–25. The bill repurposes an ethanol incentive fund to create a capped low‑carbon fuels fund (cap cited at $30 million) and shifts oversight to the Agriculture Commissioner; a fiscal note estimated additional revenues of about $5.24 million (other funds) for 2023–25 and significant expenditures tied to incentives.

- Senate Bill 2051 (Private Investigative and Security Board fees and a performance audit): Passed 85–5 after amendments. The bill raised fee caps (the committee limited increases compared with the board request), moved fee‑setting authority from the board to the legislature for greater transparency, and added a performance audit to examine the board’s operations.

- Senate Bill 2022 (appropriation for the Commission on Legal Counsel for Indigence, staffing changes, study): Passed 81–9. The bill funds the commission’s operations, adds investigators as FTEs and includes legislative study language about agency classification and a proposed name change.

- Senate Bill 2009 (state fair appropriation / maintenance and campground projects): Passed 76–15; emergency clause carried. The measure contained multiple one‑time appropriations and cost‑share language to support campground and security improvements at the State Fair in Minot.

- Senate Bill 2007 (veterans home budget, Lisbon): Passed 88–3 with emergency clause. The budget provides operating funds and capital maintenance for the North Dakota Veterans Home, with the committee noting bed counts and staff levels.

- Senate Bill 2006 (Aeronautics Commission): Passed 82–8. The budget includes grant carryover authority and language for runway rehabilitation projects and other project carryover provisions.

- Senate Bill 2158 (distribution of unobligated cash balance for dissolved school districts): Passed (final recorded tally 59–31 after excusal of one member). The bill amends law to permit a dissolved school district to transfer unobligated cash balances to a political subdivision; supporters said it corrects a statutory gap affecting a specific community plan.

- Senate Bill 2016 (Job Service appropriations): Passed 84–7. The bill funds Job Service operations, includes an FTE for H‑2A housing inspections and IT/mainframe hosting costs, and addresses declining FTE counts over prior years.

- Senate Bill 2305 (family paid caregiver pilot appropriation and cross‑disability advisory work): Passed 84–6. The appropriation continues a paid family caregiver pilot program and funds work toward an eventual cross‑disability waiver design; testimony reported 50 approved applications, 17 pending and 182 on a waiting list.

Failed or referred measures:

- Senate Bill 2104 (authority for DPI to review school districts and impose sanctions): Failed 44–47. The bill would have added Century Code provisions to allow the Superintendent of Public Instruction to review alleged noncompliance, issue corrective actions and impose sanctions including a 2% withholding of state payments for noncompliance. Opponents said similar authority already exists in administrative code and warned of added enforcement cost and mission creep for DPI; supporters said the measure would provide an enforcement mechanism absent from current statute.

- Senate Bill 2341 (interstate compact for school psychologists): Failed 16–74. The House Industry, Business and Labor Committee recommended do not pass, citing concerns about conflicts with current state law and an ongoing study of interstate teacher mobility.

- Senate Bill 2387: Re‑referred to the Human Services Committee for additional consideration.

Floor posture and fiscal detail: Multiple bills carried fiscal notes prepared by agencies; the transcript contains fiscal estimates for several measures (examples: SB 2251 — $343,300 reduction; SB 2333 — $5,242,000 additional other‑funds revenue in 2023–25, with related expenditures). Where the transcript included a committee report or fiscal note, that figure is reported above.

What the transcript does not show: Text of final engrossed bills, enacted language, or gubernatorial actions beyond the governor’s earlier letter listing House bills signed on April 2 (that letter was read on the floor). Implementation steps, department assignment for follow‑up, or any effective dates are not always specified in the floor summary presented in the transcript.

For more detail: individual committee reports and the official engrossed bill texts (and fiscal notes) filed with the Legislative Council should be consulted for precise statutory language, appropriation language, and implementation conditions.