Senate bill would restrict use of I&S tax revenues to debt servicing, sponsor says

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Sen. Hinojosa introduced SB 16 36 to prohibit using interest and sinking (I&S) tax revenues for deferred maintenance, aiming to protect bond-funded debt service; Frisco ISD finance chief cautioned the bill’s current wording could force districts to shift maintenance costs into operating budgets. The bill was left pending.

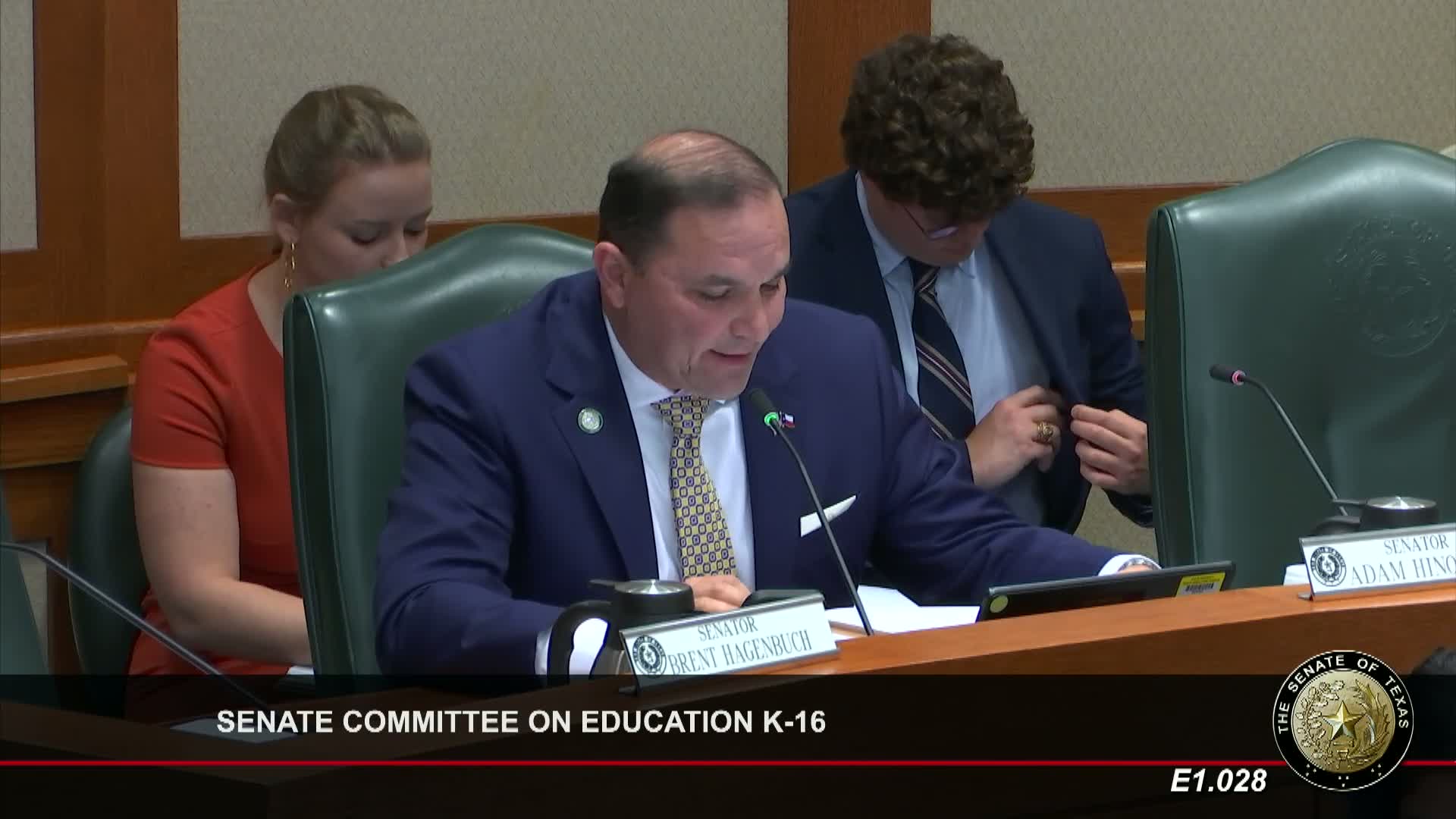

Senator Adam Hinojosa presented Senate Bill 16 36 to clarify that interest and sinking (I&S) tax revenues — the portion of local property taxes dedicated to debt service — should be used exclusively for servicing bond debt and not for deferred maintenance or other operational costs.

Hinojosa told the committee I&S revenues are intended to service debt for voter-approved capital projects and that allowing those dollars to be repurposed for deferred maintenance or operational items can undermine long-term fiscal integrity for capital projects. “SB 16 36 aims to ensure that I&S tax revenues are used exclusively for their intended purpose, servicing debt associated with capital projects,” he said.

Witnesses representing school districts raised concerns about the bill’s current drafting. Kimberly Smith, chief finance and strategy officer for Frisco ISD, testified as a resource witness and warned the bill’s wording could prevent districts from using bond proceeds to pay for necessary deferred maintenance projects. Smith described a recent high-school maintenance project that would have cost about $12 million and said shifting such work into operating budgets would reduce funds for salaries and classroom positions. “Preventing school districts from using bond money to pay for these projects would be detrimental to our operating budgets,” she told the committee.

Senators on the committee urged Hinojosa to work with district officials, consultants and fellow senators on a workable definition of “deferred maintenance” and to refine the bill’s language. The committee took public testimony and left SB 16 36 pending for further drafting and stakeholder work.