Ferndale budget draft frames May millage question as part of a balanced strategy to close funding gap

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

City officials say a proposed voter millage on the May 6 ballot would help close a structural shortfall driven by Headlee/Proposal A limits and rising labor costs; draft budget keeps services but anticipates further changes before April readings.

Ferndale leaders presented a draft fiscal-2026 budget at a Saturday workshop that relies on a combination of cost savings, targeted capital deferrals and a proposed voter-approved millage to close an operating gap created by state tax limits and rising labor costs.

City managers told the council the draft budget is intended for conversation and will change before two scheduled readings — a first reading April 14 and final adoption April 28 — and that the millage proposal would appear on the May 6 ballot for voters to consider.

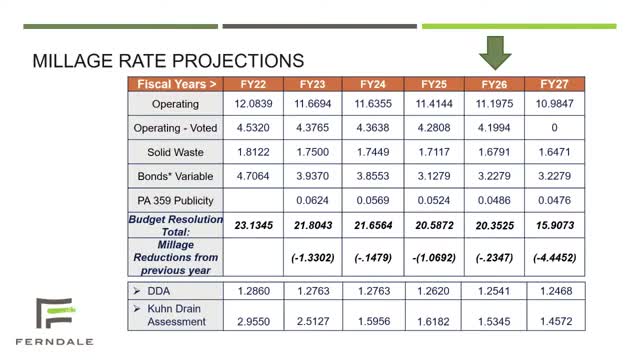

Why it matters: property taxes and the city’s voted millage together account for roughly half of general fund revenue, the presentation said. The city has experienced recurring downward pressure on levy capacity from Michigan’s Headlee rollback mechanism and the tax-limiting effects of Proposal A, which officials said together reduce municipal revenue growth even as local home prices have climbed. Council members and staff said the May question is meant to be a “balanced” approach — a limited override combined with internal savings and selective service changes — rather than a single, full replacement strategy.

Key details from the presentation: - The city’s general fund is forecast at roughly $30.9 million in revenues for the coming fiscal year, with property taxes and the voted millage providing the largest single share. - Staff described Headlee rollback as an automatic reduction in maximum millage when assessed value growth outpaces inflation; Proposal A further constrains local revenue growth by limiting taxable-value increases on properties to sales/transfers and capping allowable revenue growth. - Presenters showed comparative regional millage data and explained that a mill means different revenue in each community because of differing tax bases. - Officials cautioned that the initial appearance of a millage vote will “feel like an increase” to taxpayers in the first year because the voter-approved rate would reset higher than the rolled-back rate, but that future years would again be subject to rollbacks and other variables. Staff estimated illustrative household effects in the presentation (about $75–$175 per year, depending on taxable value) but emphasized the number depends on how rollbacks and taxable-value changes play out.

What’s next: staff said the budget will be revised after additional department-level discussion and before the April readings. If council finalizes a millage proposal for the May 6 ballot, the earliest the additional voted levies could be collected is the next tax year cycle described in the presentation (effective fiscal-year timing described at the workshop). Council members asked staff to make the postcard and voter materials clearer about the difference between rolled-back and voted rates.

Speakers quoted or cited in the workshop included City Manager Colleen (presenter of the draft budget and revenue context), finance staff Phil (budget and revenue details), and staff member James (millage and policy context). Council members who asked follow-up questions included Polica and Johnson.

Ending: staff urged the council to use the April meetings to provide policy direction on the balance between an override request, service adjustments, and other local revenue or savings options. The presentation framed May as a decision point intended to reset the city’s revenue trajectory while seeking to limit immediate service cuts.