County raises fire‑protection assessment $10; RV park owner disputes square‑footage basis used in notices

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Columbia County approved a $10 per‑household increase to the fire protection assessment to $303.98. An RV‑park representative challenged the assessment method and reported notices sent using a 1,200‑square‑foot assumption will be reduced to 382.5 square feet on the final roll, per the consultant.

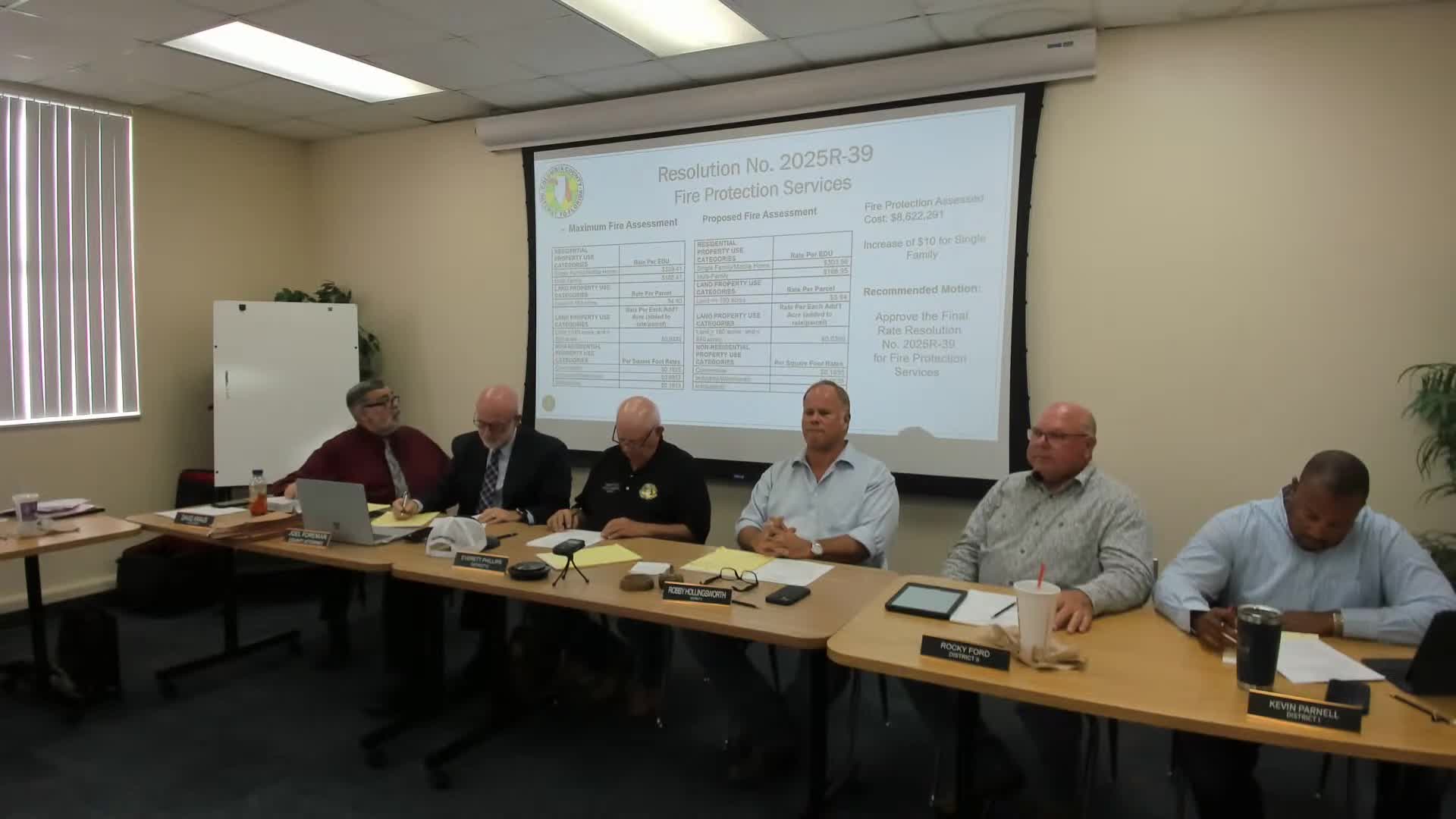

Columbia County commissioners approved a $10 increase in the fire‑protection assessment for a single‑family residence, moving the charge from $293.98 to $303.98 per dwelling unit for the coming year.

Staff presentation County staff said the advertised maximum based on the study could have reached a higher figure ($339.41 was cited as a possible maximum), but the board chose a modest annual increase of $10 this year to ease the burden on taxpayers while maintaining revenue for fire services. Staff opened a public hearing and took comment.

Public comment from RV park and consultant Representatives from an RV park raised concerns about how their spaces were categorized and calculated in the assessment notices. One speaker said the county’s assessment consultant historically used 1,200 square feet per RV space but the assessment this year switched to 382.5 square feet per space; notices and tax data may still reflect the older 1,200‑square‑foot figure. Jeff Rackley of Stan Tech, who said he assisted the county with the study, told the board that the final roll would reflect the reduced 382.5‑square‑foot figure and that notices that showed 1,200 square feet would be corrected on the final roll.

Board action After closing the hearing, the board adopted the fire‑protection assessment resolution (2025R‑39) with the $303.98 per‑residence figure. Staff said the county will correct assessment rolls to reflect the consultant’s revised square‑footage assumptions where applicable.

What residents should know If property owners in RV parks or other nonstandard housing believe their parcel was incorrectly categorized in mailed notices, staff advised contacting the property appraiser’s office or the county assessment staff; the county indicated adjustments could be made before the final roll is certified.