Addison council reviews proposed FY2026 budget with reserves above policy

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

City staff presented a proposed fiscal 2026 budget that keeps core service levels, maintains reserves above the council's policy, and includes targeted decision packages for public safety, utilities and events; council discussion focused on festival funding and steps to reduce ongoing subsidies.

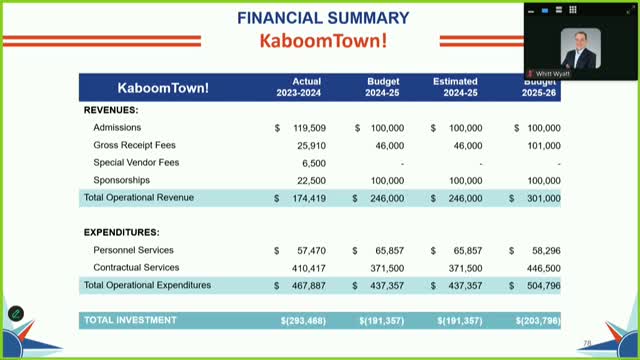

The Addison City Council on Aug. 6 reviewed a proposed fiscal year 2026 budget that keeps the town's operating reserves above adopted policy while funding several one-time and recurring requests. City staff presented the plan that projects general fund revenues of about $52.5 million and proposes expenditures that leave an estimated fund balance equal to roughly 40% of operating expenses. Steve Glickman, the town's chief financial officer, said the budget maintains a fund balance above the council's 25% policy and the 30% goal. The budget presentation grouped expenditures by fund and department and summarized both recurring requests and one-time decision packages. Glickman said the recommended FY2026 proposals include targeted increases for public safety, utility capital and special events programming while keeping the town's tax rate and long-term reserve posture intact. Why it matters: the budget directs resources for operations and capital projects that affect town services, utility reliability and the town's event-driven tourism strategy. Council and staff framed the FY2026 proposal as a balancing act: preserving reserves while funding aging infrastructure and continued investment in events that drive hotel stays. Council discussion covered three themes: whether to adopt specific event funding and revenue-sharing changes for Taste Addison (the town's largest festival); how to fund water/wastewater asset assessments and planned upgrades; and how to pace capital improvements to the Addison Performing Arts Center. Glickman said sales-tax receipts are the largest variable revenue source for the general fund and are projected at $17.1 million in the proposed budget. He described the FY2026 personnel package as including a 4% compensation adjustment and a budgeted 7% increase in health insurance costs in 2026, while longer-term projections use more conservative inflation assumptions. Directives and next steps: staff will return to the council during the remaining budget work sessions with updated line-item backup and revised fund summaries reflecting council direction. Several councilmembers asked that staff prepare alternative policy options on special-event subsidies and possible revenue-sharing models; staff said those options can be included in the next work session packet.