Nueces County adopts FY25–26 budget and raises voter-approved property tax rate to 0.289789

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

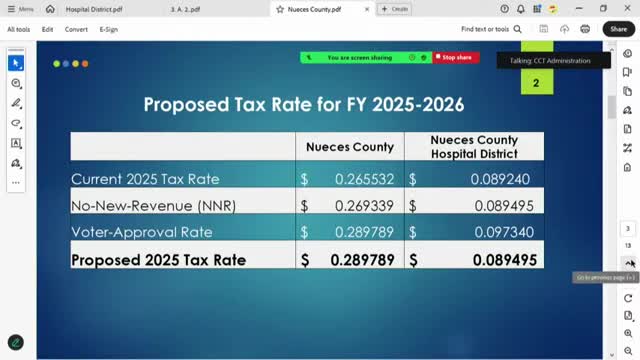

After public hearings and debate, the Commissioners Court voted to adopt a $133 million fiscal 2025–26 county budget and set the county tax rate at 0.289789 per $100 valuation (voter‑approval rate). The vote followed public comment on taxes, employee raises and law‑enforcement funding.

Nueces County Commissioners voted Sept. 10 to adopt the county’s fiscal year 2025–26 budget and to set a voter-approved property tax rate of 0.289789 per $100 valuation. The commissioners said the proposed budget includes a 10% cost-of-living increase for most county employees, statutory judicial pay adjustments and changes the court made to department head pay and staffing. County staff told the court the budget would raise more property taxes than the prior year by $12,160,605, about 10.68% in total, and that roughly $2.86 million of that is expected from new property on the tax roll. Why it matters: The tax-rate decision affects local homeowners’ bills and the county’s ability to fund salaries, public safety and services. The county’s presented figures were flagged as unaudited and the auditor cautioned that fund balances may change after external audits are completed. Debate focused on employee pay, law-enforcement recruitment and retention, and how much contingency to hold while final audit figures remain pending. The court added budget amendments that partly reallocated positions, funded a grants effort and preserved vector-control funding pending further legal clarity. The fiscal package passed after roll-call votes: the tax-rate motion passed 3–2 (Commissioners Pusley, Matos and the judge voted yes; Commissioners Gonzales and Chesney voted no). The final budget adoption also passed, with one abstention noted in the record. Commissioners and staff said they will refine figures after audit results and may allocate parcel-sale proceeds to contingency if closing proceeds arrive as expected.