Pampa sets proposed tax rate at 0.703304 per $100; public hearing scheduled

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

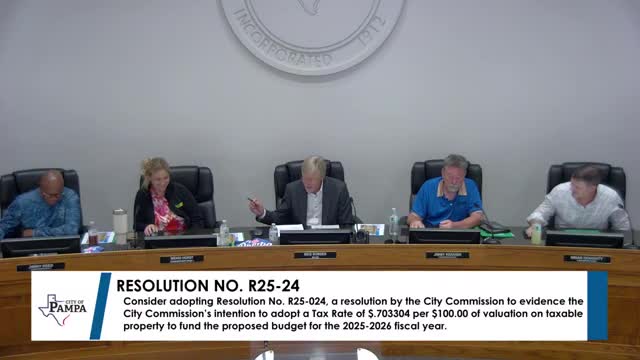

The commission approved Resolution R25-024 to propose a tax rate of 0.703304 per $100 valuation for fiscal 2025–26 and set a public hearing; city staff explained how that compares with no-new-revenue and de minimis rates.

The Pampa City Commission voted to set a proposed tax rate of 0.703304 per $100 valuation for the 2025–26 fiscal year and scheduled a public hearing by adopting Resolution R25‑024.

During the discussion Theresa Daniels, identified in the meeting as city staff, explained the rates the commission considered: the no‑new‑revenue (NNR) rate of 0.644015, the voter‑approval rate adopted in the proposed budget at 0.703304, and the de minimis rate of 0.745371. "The no new revenue tax rate was 0.644015," Daniels said, "and the voter approval is 0.703304, which is in the budget. The de minimis rate is 0.745371." She reminded commissioners that adopting a proposed rate above the NNR can require additional public‑notice language and, if higher than certain thresholds, could trigger an election under state law.

Daniels also noted the practical effect under state notice rules: because the proposed rate is above the NNR it will be reported as a tax rate increase in public notices even though the proposed rate is 4% lower than the city’s current rate. "To reiterate, it is a decrease for everybody watching. This is a decrease," a commissioner said during the discussion. Daniels said the published comparison will show a percentage increase relative to the NNR.

The commission moved and seconded adoption of Resolution R25‑024 to set the proposed rate at 0.703304 per $100 valuation and to set the date, time and place for the required public hearing. The motion carried by voice vote.

Daniels also briefed commissioners on an emerging state proposal that would require mailed notices to property owners whenever a rate above the NNR is proposed; she said that if passed, the city would redouble direct notifications.

The resolution does not finalize the tax rate; it schedules the required public hearing on the proposed rate. Commissioners may revise the rate before final adoption subject to state law and notice requirements.