Assembly holds work session on options to refill Local Education Fund; PILT and sales-tax cap among ideas

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

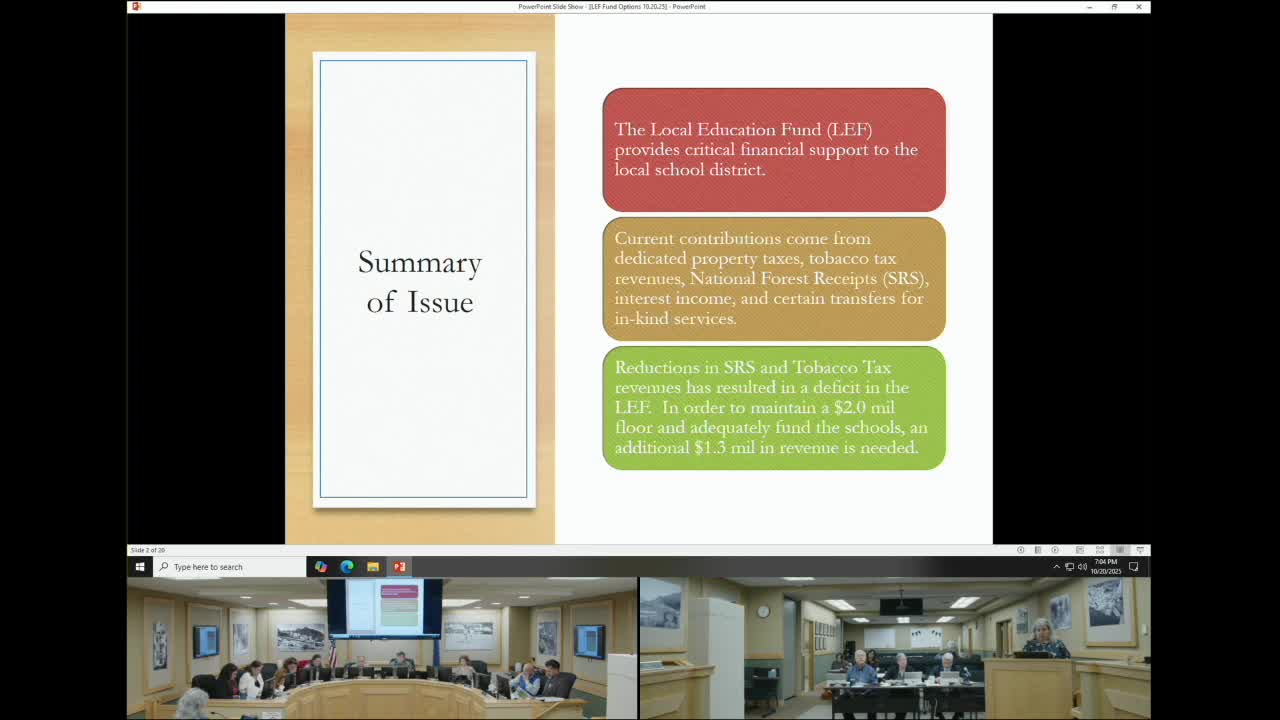

Finance staff and assembly members discussed shifting revenue sources, indexing a sales-tax single-item cap, and other options to close an estimated $1.3 million gap in the Local Education Fund for FY26.

The Ketchikan Gateway Borough Assembly held a work session on Oct. 20 to consider options for restoring the Local Education Fund (LEF) after a shortfall tied to lower-than-expected secure-rural-schools and other revenue changes.

Context: Finance Director Charlene Thomas told the assembly the LEF dipped below the borough’s $2 million floor in FY25 after secure rural schools funding proved far lower than budgeted and the district applied large health-care accruals to its accounts. The assembly’s staff briefing estimated a near-term need of roughly $1.3 million to preserve the floor and cover the school district’s anticipated supplemental requests for FY26.

Revenue options discussed: The staff presented a menu of possibilities, including redirecting existing revenues (federal and local PILT, transient-occupancy tax, marijuana tax, remote-seller sales tax or a fixed percentage of borough sales tax), increasing the property-tax mill levy (an additional 0.5 mills was estimated to raise roughly $1.0 million), and raising the single-unit sales-tax exemption from $2,000 to higher amounts (estimates given for $4,000 and scenarios that would keep contractor exemptions at $2,000). Shifting PILT into the LEF would produce an estimated $1.5 million; dedicating the new transient-occupancy tax revenue was projected to yield roughly $300,000 in FY26.

Debate and considerations: Members repeatedly stressed trade-offs: moving PILT or sales tax revenue into the LEF would reduce general-fund resources that support parks, transit, animal protection and other services unless the general fund is backfilled. Several members favored a combination approach — for example, dedicating transient-occupancy tax receipts to the LEF while raising the single-unit cap to shift more visitor spending into borough coffers — to minimize new burdens on residents. Indexing any new cap to CPI was suggested to avoid repeated reauthorizations.

Follow-up actions: Assembly members asked staff to prepare additional analyses: (1) estimates for raising the single-unit exemption to $5,000 and $6,000; (2) a calculation showing what a 4% assessment increase would contribute to revenue; (3) a memo describing the fiscal impact to the general fund if PILT were redirected; and (4) outreach materials so the assembly can frame any forthcoming ordinance to the public.

Why it matters: The assembly emphasized urgency because the LEF funds school operations and because secure-rural-schools and other federal sources remain uncertain. Members signaled preference for measures that concentrate tourist- and visitor-related revenue (transient-occupancy and higher sales-tax caps) and avoid disproportionately increasing property taxes for residents.