Commissioners approve software contract change aimed at avoiding sales tax costs, vendor offers $50,000 in credits

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

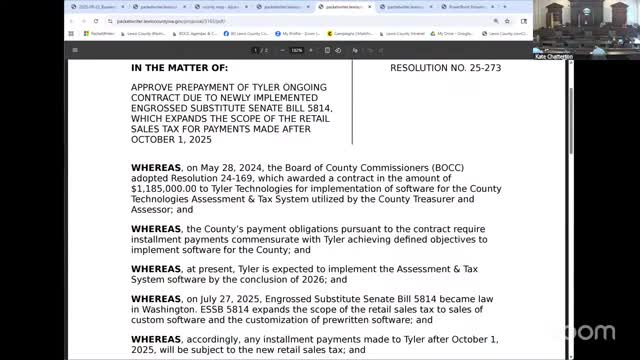

The Board approved Resolution 25-273 to proceed with an assessor-treasurer software update; staff said the county expects to avoid about $73,000 of unbudgeted state sales tax and the vendor offered about $50,000 of implementation hours or credits.

Lewis County commissioners on Sept. 23 approved Resolution 25-273, authorizing an assessor-treasurer software system update after staff reported potential savings on newly applied state sales tax and vendor concessions.

Treasurer/IT staff summarized the contract issue, saying the county was trying to avoid approximately $73,000 in unbudgeted new state sales tax tied to the software contract. Staff told the commission a vendor had offered concessions worth roughly $50,000—described as approximately 200 hours of project work or equivalent credits—intended to offset implementation costs and provide cushion for post-launch needs.

Commissioners asked whether a discount would be offered for prepayment; staff confirmed the vendor offered the $50,000 in upgrade/project hours as a concession but could not guarantee additional savings beyond that offer. Staff noted the county has some cushion in the contract if additional work is required during implementation.

The motion to approve the resolution passed 3-0.

Nut graf: The Board authorized the software procurement and accepted vendor concessions; staff will proceed with implementation and monitor project needs during deployment.

Ending: Staff did not specify contract dollar amounts in the hearing record; the county will proceed with procurement and report back if additional contract changes are required.