Shelton council debates adding police positions, public safety grant and sales‑tax options

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Council members and staff discussed funding for new police positions and other public safety costs at the Sept. 23 study session, including an 8‑month training timeline, a potential public safety grant under HB 2015 that covers 75% of a salary for up to $125,000, and the option to place a 0.1% public safety sales tax on the ballot.

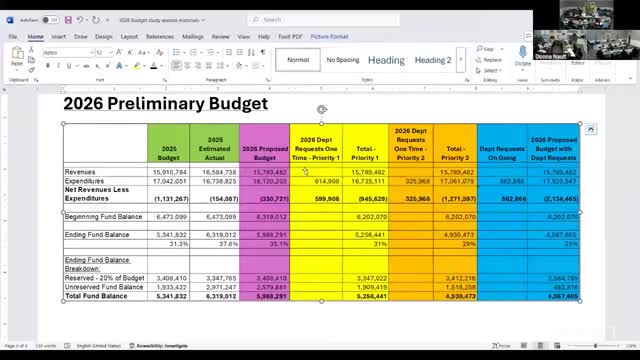

Shelton city staff and council members spent significant time at a Sept. 23 study session discussing whether to add police positions in the 2026 budget and how to pay for them. The council discussed short‑term use of unreserved fund balance, a state grant program and a possible local public safety sales tax as potential revenue sources.

City Manager Mark Ziegler and police leadership told the council that adding officers has a multimonth cost and training timeline; a newly hired officer typically requires academy training and field training that can extend eight months before the hire is fully operational. Ziegler warned against hiring officers in the budget if revenue will not sustain the positions over time, saying the city should avoid hiring and then reversing course mid‑training.

Staff described a state grant program created under House Bill 2015 that would subsidize public safety positions: the grant can pay 75% of an employee’s salary (up to $125,000) but requires the municipality to commit to maintaining the position for three years beyond the grant period. Ziegler said that grant funding and a 0.1% public safety sales tax (also enabled by HB 2015) were both possible avenues to support officers, co‑responder programs, municipal court services or mental‑health responder programs.

Council discussion focused on community engagement and timing. Several council members said they support public safety investments but want to consult residents before pursuing a sales tax. One council member suggested a town hall or public hearing if the council pursues a sales tax measure; others urged pursuing the state grant application now because grants are competitive and not guaranteed.

The council also weighed operational alternatives: staff proposed using unreserved fund balance to start the year with one or two additional officer slots, then adjust later if revenues differ from projections. Ziegler recommended starting 2026 with conservative commitments and refining requests as incoming revenue and grants materialize.

On equipment and programs, council heard requests for ongoing costs tied to public safety: body and patrol cameras, online reporting platforms, license‑plate readers, taser payments on a multi‑year schedule, and continued funding for a regional dispatch partner (MACECOM). The police chief reported benefits from video, noting several investigations and recoveries tied to the body/camera program.

No formal staffing or revenue measure decision was made. Council asked staff to prepare detailed grant application guidance, revenue‑measure options (public safety sales tax and transportation benefit district options), and a public engagement plan for any sales‑tax proposal.