Economic development director briefs board on TIF basics; trustees back further study tied to comprehensive plan

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Director Janie Patch presented tax increment financing (TIF) basics from a recent IML seminar, advising alignment with the comprehensive plan and use of third-party consultants; trustees expressed interest in exploring TIF after organizational and comprehensive planning work.

The Village of Homer Glen’s economic development director, Janie Patch, briefed trustees on Tax Increment Financing (TIF) basics during the Sept. 25 meeting and recommended policy alignment with the village’s comprehensive plan before pursuing any TIF district.

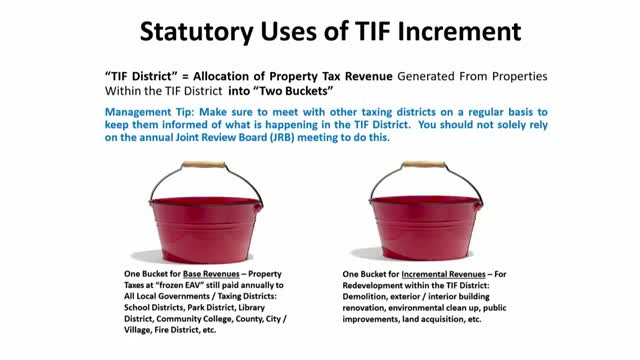

Patch said TIF is governed by the State Tax Increment Allocation Redevelopment Act and explained the mechanism used by municipalities: at the creation of a TIF district, the current equalized assessed value (EAV) is set as the base; as new development raises EAV, the incremental property-tax revenue becomes a fund to finance public improvements or incentives within the district. “The tax increment in the second bucket is used to stimulate desired new development,” Patch said, summarizing the seminar materials she provided to trustees.

Patch told trustees the initial maximum term for a TIF district is 23 years, that feasibility and set-up can take nine months or more, and that TIF incentives should meet a “but-for” test — a third-party pro forma is typically needed to confirm that private development would not proceed without the TIF incentive. She recommended using the comprehensive plan to identify community goals and potential TIF candidate areas and suggested hiring outside TIF consultants and counsel for technical review.

Trustee response and next steps

Trustees said the briefing was timely and should continue the board-level conversation. Trustee Schaller and Trustee LaPorte expressed support for studying TIF options as part of an overall development strategy that prioritizes sales-tax-generating uses and aligns with the comprehensive plan and the staffing/organizational study the board approved earlier in the meeting.

Why it matters: TIF is a long-term financing tool that re-directs only incremental property-tax revenue within a defined district to pay for public improvements or incentives intended to spur private investment. Decisions to create TIF districts can affect local taxing bodies and require careful legal and financial analysis.

Ending: Patch provided a printed packet of seminar slides and materials for trustees and recommended further study; trustees asked staff to consider next steps in a workshop or Committee-of-the-Whole format.