Franchise and excise tax primer: what corporations and LLCs should know

Get AI-powered insights, summaries, and transcripts

Subscribe

Summary

Presenters summarized Tennessee's franchise and excise (F&E) tax basics for corporations and most LLCs, including who must register, how franchise tax is computed for tax years ending on/after Jan. 1, 2024, filing deadlines, extension rules and estimated payments.

Tennessee Department of Revenue staff gave a concise overview of the state's franchise and excise tax obligations aimed at corporations, LLCs and other entities subject to F&E tax.

Katie Julian explained the distinction between the two components: excise tax is imposed on net income (or loss) and franchise tax for tax years ending on or after Jan. 1, 2024, is computed on net worth (not the prior property measure). "The excise tax and the franchise tax are imposed on corporations and most LLCs for the privilege of doing business in Tennessee," Julian said.

Why it matters: corporations and many LLCs must register for F&E and file returns that generally align with federal filing periods. F&E rules affect a business's annual tax accounting, extension and estimated-payment obligations.

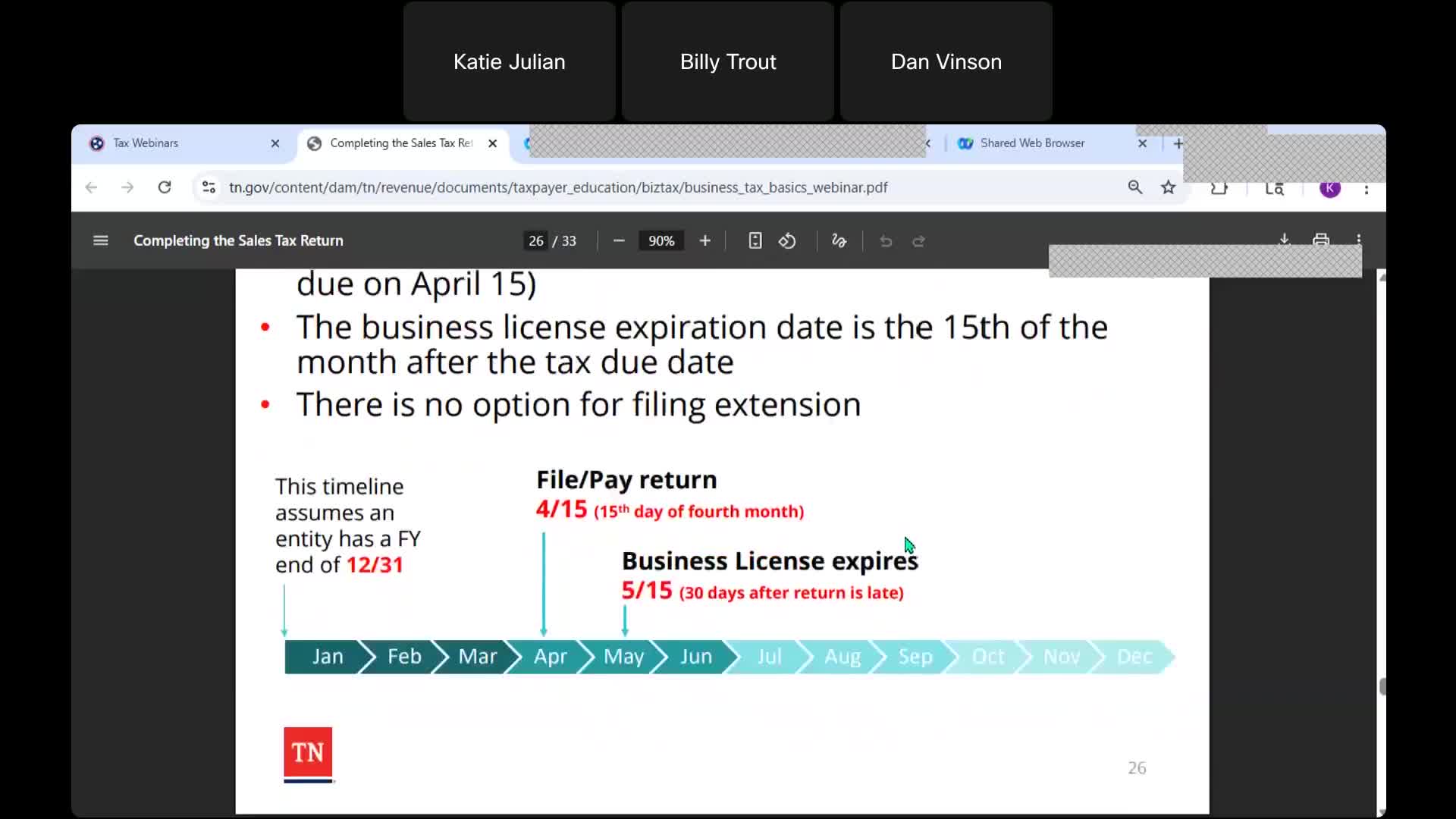

Key details presented: - Who files: corporations, most LLCs, limited partnerships and business trusts must register for F&E; sole proprietorships and general partnerships are generally not subject to F&E. - Franchise tax base change: for tax years ending on or after Jan. 1, 2024, franchise tax is computed using net worth; excise tax remains based on net income or loss. - Filing deadlines and extensions: the return is due on the 15th day of the fourth month after fiscal year end (April 15 for calendar-year filers). A timely extension is available that pushes the filing deadline seven months after the original due date (to Nov. 15 for calendar-year filers) if certain payments are made by the original due date (90% of current liability, 100% of prior liability, or a minimum payment). - Estimated payments and penalties: entities with combined F&E liability of $5,000 or more may owe four estimated payments during the year. Delinquency penalties are generally 5% per month up to 25% with a $15 minimum and interest accrues at the statutory rate.

Practical advice: presenters recommended using TenTap for filing or certified vendor MEF channels for F&E e-file, confirm registration with the Secretary of State does not automatically register for F&E, and follow Department guidance when claiming statutory exemptions that require annual renewal.

Ending: businesses forming in Tennessee should register promptly and consult their tax adviser about F&E computations; the Department's F&E manual and webinars provide further procedural guidance.