Finance Committee discusses debt capacity and surplus fund options for future projects

September 23, 2025 | Prince George County, Virginia

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

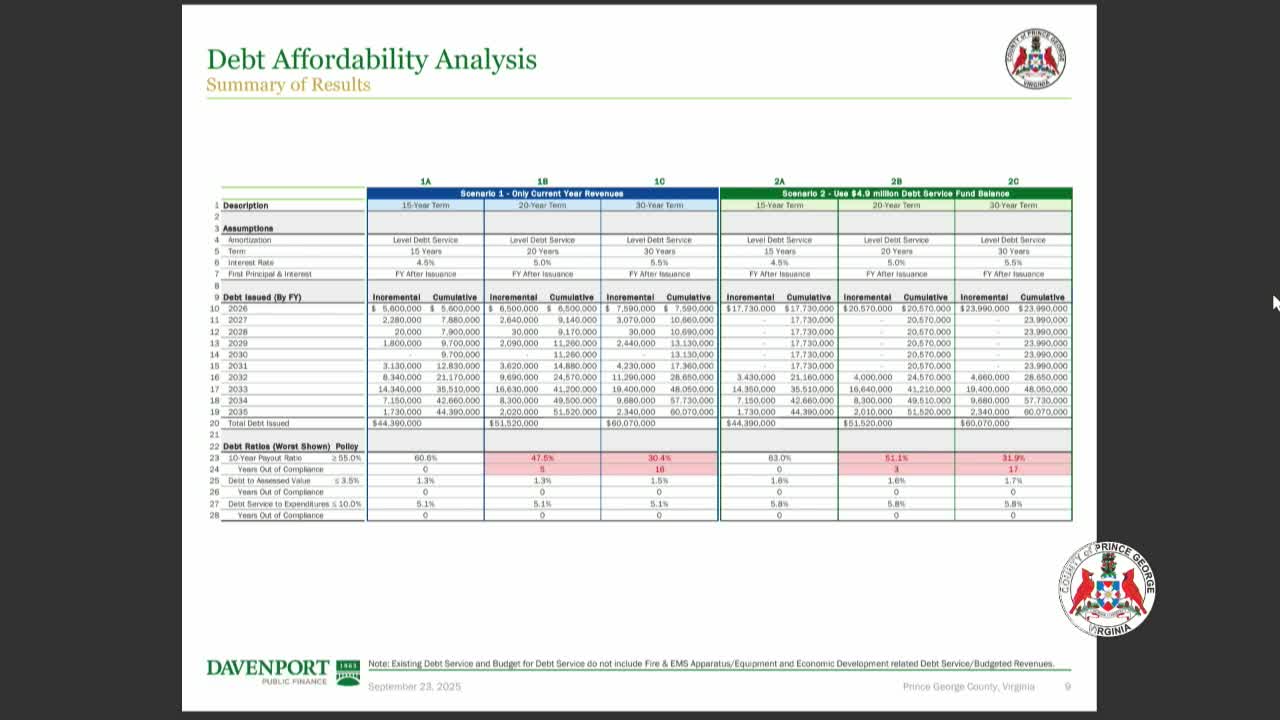

The Prince George County government meeting held on September 23, 2025, focused on financial strategies related to debt management and project funding. The discussion centered on the potential benefits of extending the term of debt issuance, which could yield an incremental benefit of approximately $7 to $8.5 million by extending the term to 20 or 25 years. However, this approach may temporarily affect the county's debt capacity, potentially dropping below the 50% policy limitation for a short period.

The meeting highlighted the importance of flexibility in debt issuance, noting that the county might not issue the full $44.4 million to $60 million of debt at the same term. Instead, varying terms could help maintain a healthier payout ratio. Additionally, the board discussed the option of making exceptions to policy for projects deemed particularly important.

A key point of discussion was the utilization of an existing fund balance of $4.9 million to expedite debt service. This strategy would allow the county to take on additional debt more quickly, enhancing cumulative capacity over the first five years from $9.7 million to $17.7 million without utilizing the existing reserve balance.

The financial analysis presented during the meeting indicated that without a tax increase, the county could manage projects within a range of $5.6 million to $7.6 million. However, should there be a desire to pursue projects beyond this range, a tax increase would be necessary.

The meeting concluded with an offer for hardbound copies of the financial analysis to board members, ensuring they had access to the detailed information discussed. Overall, the meeting underscored the county's strategic approach to managing its financial resources while considering the implications of debt issuance and project funding.

The meeting highlighted the importance of flexibility in debt issuance, noting that the county might not issue the full $44.4 million to $60 million of debt at the same term. Instead, varying terms could help maintain a healthier payout ratio. Additionally, the board discussed the option of making exceptions to policy for projects deemed particularly important.

A key point of discussion was the utilization of an existing fund balance of $4.9 million to expedite debt service. This strategy would allow the county to take on additional debt more quickly, enhancing cumulative capacity over the first five years from $9.7 million to $17.7 million without utilizing the existing reserve balance.

The financial analysis presented during the meeting indicated that without a tax increase, the county could manage projects within a range of $5.6 million to $7.6 million. However, should there be a desire to pursue projects beyond this range, a tax increase would be necessary.

The meeting concluded with an offer for hardbound copies of the financial analysis to board members, ensuring they had access to the detailed information discussed. Overall, the meeting underscored the county's strategic approach to managing its financial resources while considering the implications of debt issuance and project funding.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting