Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Sanitation fund: city argues low rates and twice-weekly service, but trucks and landfill equipment need replacement

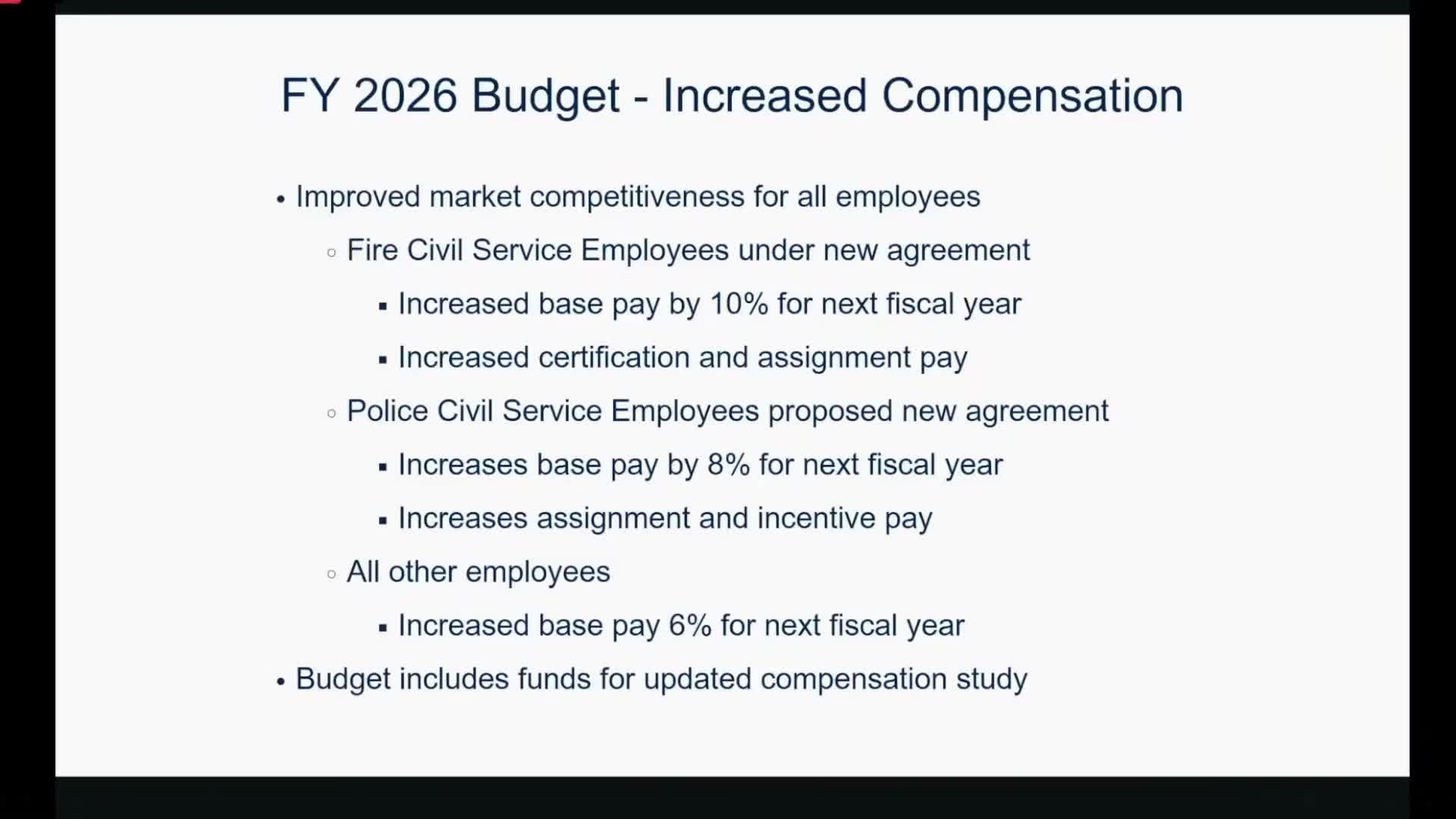

Draft budget raises pay across city workforce; council told changes improve recruitment but won't close market gap

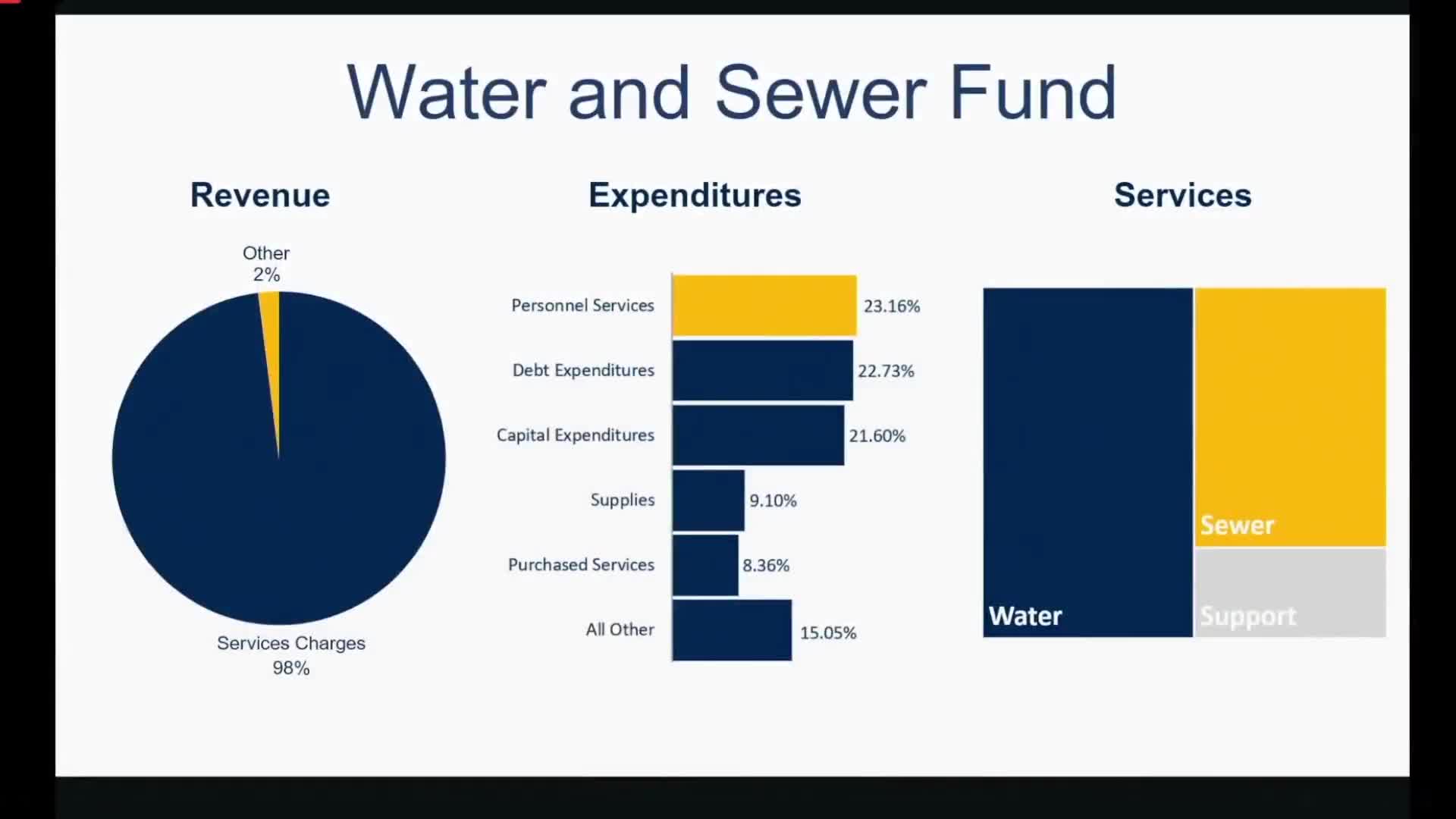

Council hears options on water-sewer rates as major plant work and debt roll-off create funding window