Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

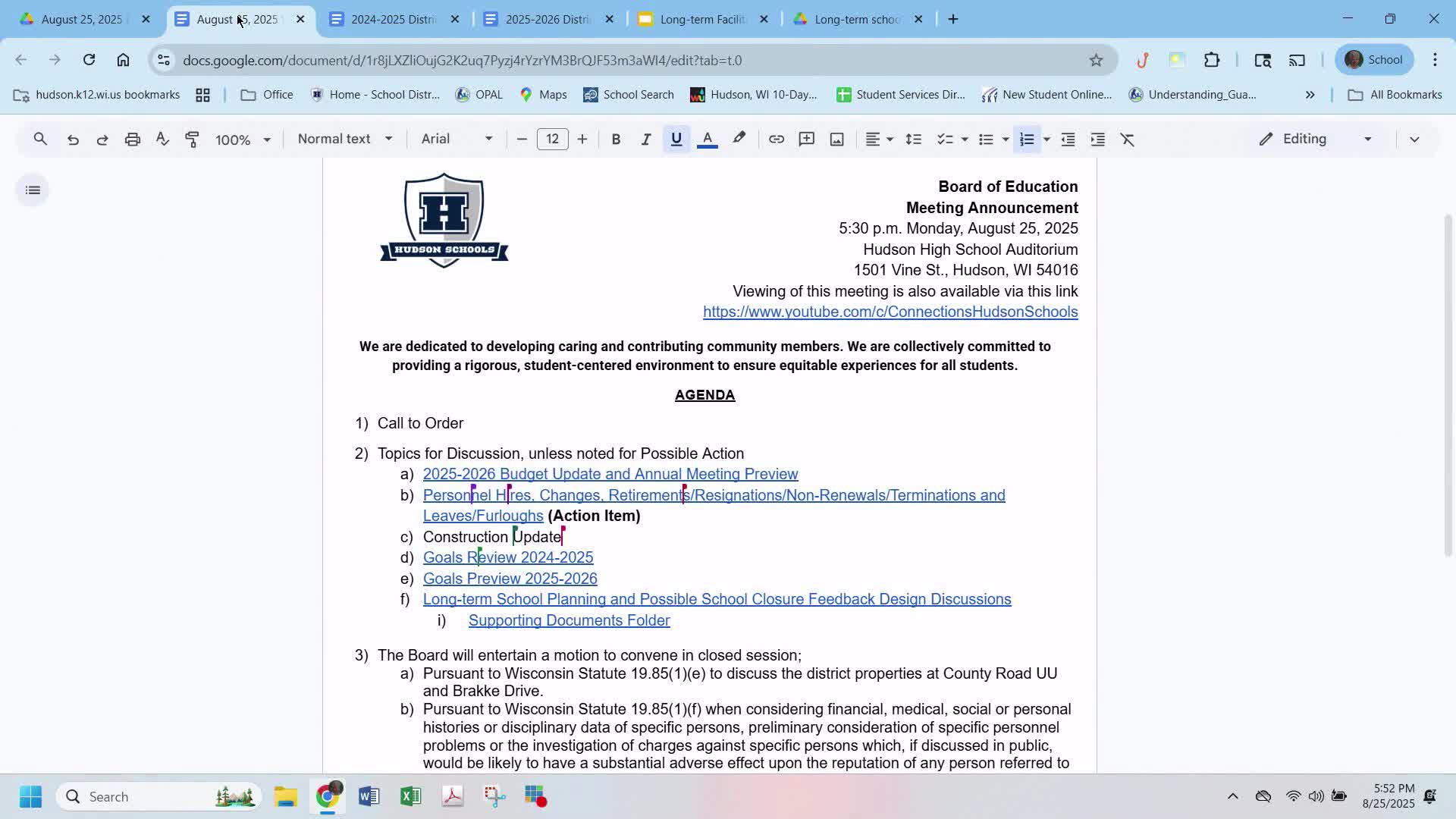

Hudson Board reviews demographic projections, facility options and schedules community feedback meeting

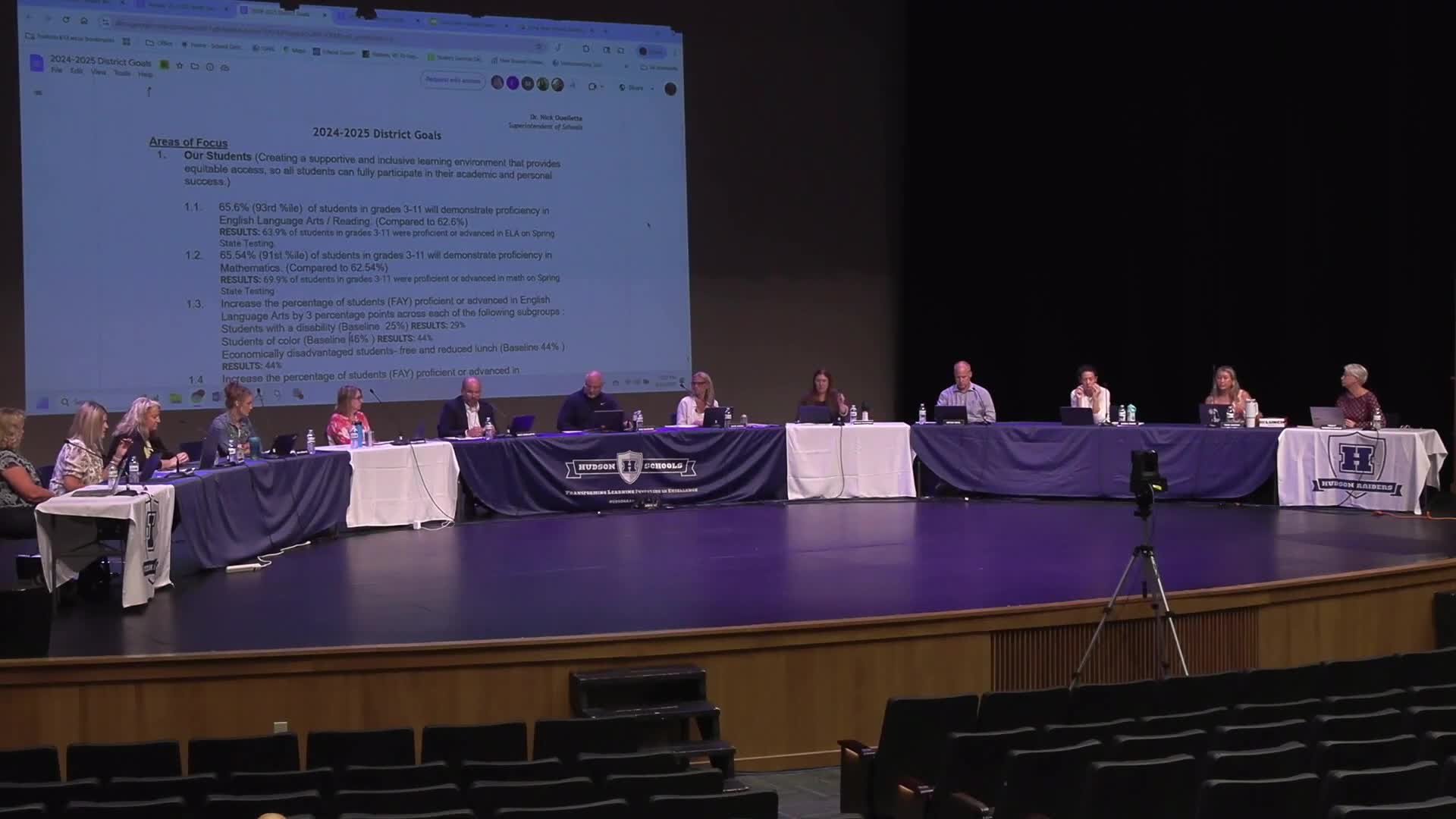

Hudson Board reviews academic results, sets short‑term proficiency goals for 2025–26

District reports middle‑school and other referendum buildings ready for start of school; finishing work to continue into fall

Hudson board approves consent hiring packet during work session